Michael Pearl, the Chief Operating Officer of the blockchain firm KiroboFlow, has moved to Cyvers as the VP for GTM Strategy. Cyvers is a blockchain security company using machine learning to detect cryptocurrency attacks.

Pearl served as the Director of Content at Finance Magnates from 2019 to 2020. Before that, he held the role of Head of Intelligence for two years and three months, followed by a role as the Head of Content and Intelligence. Prior to joining KiroboFlow, he was the Head of Content for the Fintech Unit at Natural Intelligence.

Past Career Highlights

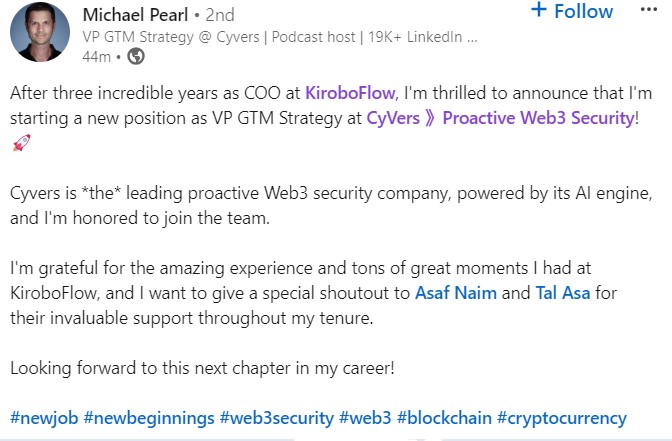

In a post on LinkedIn, Pearl mentioned: "After three incredible years as COO at KiroboFlow, I'm thrilled to announce that I'm starting a new position as VP GTM Strategy at Cyvers. I'm grateful for the amazing experience and tons of great moments I had at KiroboFlow, and I want to give a special shoutout to Asaf Naim and Tal Asa for their invaluable support throughout my tenure."

Web 3 Security

Security in blockchain technology is gaining traction. For instance, the banking sector is experiencing a shift with the adoption of smart contracts, a technology that is streamlining traditional financial processes while enhancing security.

As blockchain technology expands, smart contracts, which operate as self-executing contracts with terms coded into the blockchain, are reshaping banking transactions. The technology offers unprecedented efficiency and reliability, Finance Magnates recently reported.

Smart contracts are digital contracts that self-execute based on predefined conditions, leveraging blockchain technology. Unlike traditional contracts, they eliminate the need for intermediaries and execute actions automatically when specific conditions are met. This speeds up transactions and ensures accuracy.

Smart contracts reduce the time and resources needed for settlements and loan approvals for banking operations. Besides that, they minimize human error, leading to increased accuracy without the need for intermediaries. This benefits both banks and customers. However, some of the challenges banks face in the adoption of smart contracts include legal recognition and standardization.