"The demand for credit is growing, and consumers are looking for more credit solutions," emphasized Meidad Sharon, the Founder and CEO at ChargeAfter, while talking to Finance Magnates recently from his New York office. "However, the approvals are decreasing. This is happening because the cost of capital is increasing as the balance sheet requirements on the bank side are becoming higher because of crises like SVB that happened in the industry."

"Point-of-sale financing is addressing this pain point," Sharon stressed adding that "it is a big market [and] is evolving and just growing."

ChargeAfter has become a recognizable name in the embedded lending platform and is now expanding its technology-side offering. Emerging from Citi's Accelerator program, ChargeAfter and the Wall Street giant recently expanded their partnership. Citi Retail Services selected ChargeAfter as a technology provider for its Citi Pay products, which include Citi Pay Credit and Citi Pay Installment Loan.

“A Double-Digit Growth in 2023”

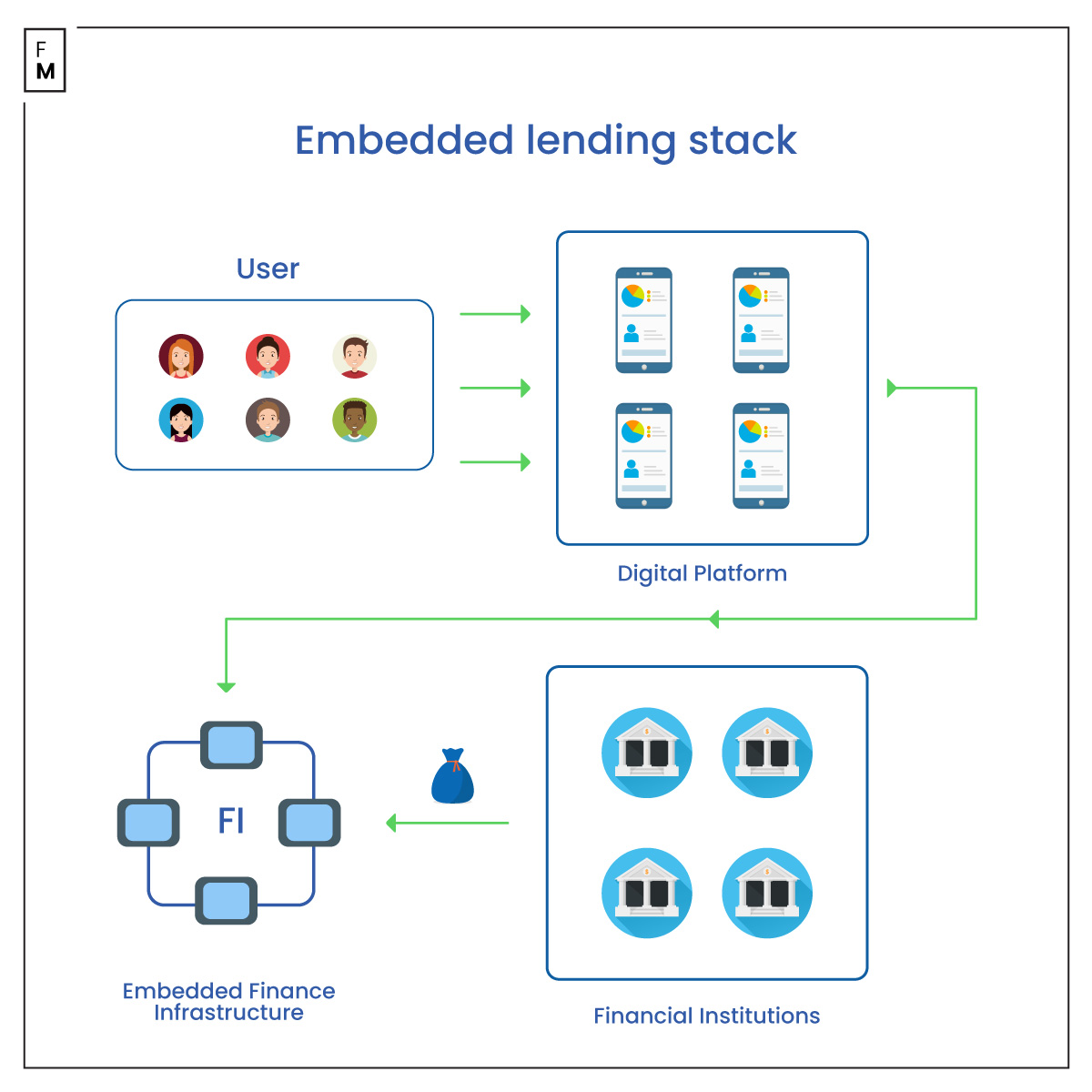

As Sharon highlighted, ChargeAfter acts like a marketplace. On one side, it works with merchants and big banks; on the other, it acts as a connectivity layer. Operational in the United States, Canada, and Australia, his company has partnered with over 40 banks.

"Point-of-sale financing is a payment option that is allowing the consumer to take unexpected high average order value transactions and split them into longer times," Sharon said. "Whether it's a revolving line of credit in a way, private label credit card, long-term installments up to five years, or leasing, ChargeAfter is facilitating all types of financing."

"We have a network of lenders that enables the merchants to offer financing on any product. If you renovate the house with a store, they will provide you with a five-year loan with 60 monthly installments at 0% APR. If you buy a new computer, instead of paying $2,000, you will pay $25 a month."

Explaining the revenue stream of ChargeAfter, Sharon said: “Our business model is very similar to the business model of VISA and MasterCard. We take a small fee from the successful transactions. When you buy something, typically the lenders will pay us, similar to the fees charged by Visa and Mastercard.”

“ChargeAfter witnessed a double-digit growth in 2023. We doubled our revenues and tripled it between three and four weeks. In terms of volumes, we processed billions of dollars in loans. So, we are growing very fast.”

.@ChargeAfter's Meidad Sharon shares that the success of your #startup depends on your ability to adapt and grow your company’s capabilities.

— Google Cloud Israel (@GoogleCloud_IL) August 9, 2023

Find out why partnering with us was the right choice for them, then register to the next #FoundersStory event >> https://t.co/WkIZ32GRCM pic.twitter.com/HS8EHC8b6L

“A Very Strategic Partnership”

Although charging a commission from lenders is its primary source of revenue, it is not the only one. “We also provide our technology as an enablement layer to the banks,” ChargeAfter's CEO added.

“Banks are great at lending to consumers, but they are not so good at connecting and embedding the lending products to the merchants’ platforms. So, they use ChargeAfter as a lending hub.”

Although ChargeAfter has ties with multiple banks, Citi is the one using the company's technology, which is its second source of revenue.

“Even if the merchant is not on ChargeAfter, and Citi is selling its services to a merchant, we will be the technology provider,” Sharon said. “Citi is using our technology as part of their technology stack. That's a technology deal for ChargeAfter and is a very strategic partnership.”

Other banks can opt for such technology-centric deals as ChargeAfter, which is now offering this service as a white-label solution, branded as The Lending Hub. It is meant for lenders and is an extension of its already available white label for merchants.

“This layer is bringing banks’ loans into the merchants,” Sharon said.

Shoppers today enjoy a personalized customer experience, however, many retailers struggle to provide the same personalization with consumer financing.

— ChargeAfter (@ChargeAfter) September 21, 2023

Our VP of Lender Relations shares how embedded lending is transforming customer journeys.

Learn more>https://t.co/lIQrSGpV9y pic.twitter.com/N7JL2q20Ul

"BNPL Offers Only Short-Term Installments"

“The use of BNPL (buy now, pay later) and the need for it will only increase,” Sharon said on the growing demand for BNPL products.

His reactions came when the regulators keenly looked at the spending traits of retail consumers using BNPL. “Regulators are looking at it as they should,” added Sharon. “It's a lending product, and they should highly regulate lenders that are offering lending products.”

When it comes to ChargeAfter, BNPL is only one of its offerings. Established in 2016, the company made its name in the embedded lending space.

“We support installments, long-term and short-term. BNPL actually offers only short-term installments. It's a very specific product with three or four installments over six weeks,” Sharon said. “BNPL is one financial product out of the portfolio of products on ChargeAfter.” Similar to its other services, ChargeAfter offers white-lable BNPL solutions.

He highlighted that “in terms of volumes, BNPL is not [a] major one” for his company.

Interestingly, the embedded lending space, the largest market for ChargeAfter, is already regulated. Unlike pure BNPL companies like Kalrna and AfterPay, regulated-big banks operate in this space. However, as a technology provider, regulation is not necessary for ChargeAfter.

“Banks want to take the lending market share bank BNPL companies,” said Sharon, adding that his company is “facilitating this trend.”

BNPL is definitely a life saver for communities that are stuck with 29% APR. https://t.co/jq2ZgyteoD

— Simon Khalaf (@Simonkhalaf) March 21, 2024

"AI Helps in Increasing Conversion"

As ChargeAfter operates in the consumer lending space, it has handled “crazy amounts of data on the consumers,” and artificial intelligence (AI) which can help to make sense of such massive datasets.

“AI is helping us to be more effective in helping merchants and banks,” said Sharon. “It helps to increase conversion and fight fraud. It's just a multiplier in terms of the capabilities of fraud prevention and conversion improvements.”

Fraud is a major issue when it comes to payments. According to Juniper Research, merchant losses from online payment fraud will exceed $362 billion globally between 2023 and 2028. The estimation of losses is at $91 billion alone in 2028.

“We are not liable for fraud, but we are helping both the merchants and the lenders in terms of fraud prevention,” ChargeAfter’s CEO emphasized. “We are helping them by integrating fraud prevention platforms into the platforms. They become available to the lenders, so they can use it as part of their underwriting.”