Bitcoin tanked sharply today as the market appears to be swiftly shifting to Bitcoin Cash in recent hours. To be more precise, the BTC/BCH exchange rate has spiked over 35% higher over the past 24 hours. BTC's market share of the cryptocurrency market slid from 67.5% on the 8th of December to 48.5% as of writing. These patterns look vaguely similar to the first days of November and the Segwit2x debacle. But this time it's different: Bitcoin is trading off its highs above $19,000, but is still above $17,000 as of writing.

Discover credible partners and premium clients in China's leading event!

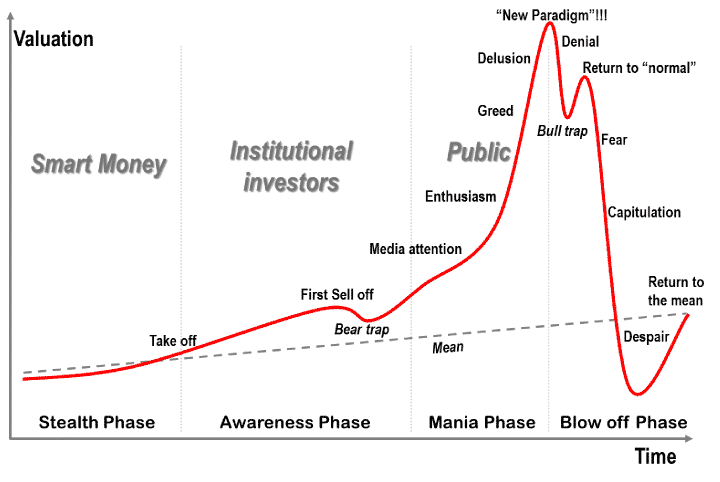

I was looking at the charts and the setup I am currently seeing flashed back to a classic bubble chart that I showed my friends a couple of weeks ago. I was explaining them my theory on why they should be extremely cautious with their BTC holdings. They just told me that “this time it's different”, and reaffirmed my belief in this classic bubble theory. But let’s get back to Wall Street.

Classic Bubble Price Action. Source: Dr. Jean-Paul Rodrigue Dept. of Global Studies and Geography, Hofstra University

What is ‘Buy the Rumour, Sell the Fact’?

Experienced traders have an age-old adage in their minds - when you start hearing rumors about something big happening in a given market, start taking action based on those. The assumption here is that more frequently than not, the rumor mill knows something that you don't.

So after seeing the classic bubble chart, I thought, hey this looks quite familiar, and I don’t think my friends trading Bitcoin have seen something like it in their careers yet. (While it probably happened at least once in 2013-2014 already, they most likely weren't aware of Bitcoin at the time.)

The classic bubble scenario is to play the market so that you get the best possible entry price and the best possible exit price. If there are people in this world that know how to do this, they are either physically roaming the streets of New York, and Chicago, or nowadays are just digitally present all over the globe.

Wall Street Plays This Game Best

So how do you manage to enter at the right time and exit at the right time? Let’s see how it might be happening with Bitcoin. Suppose that the price of an asset class has doubled in three months. This is something that happened to Bitcoin at the start of the year, as confidence levels in digital currencies started briskly rising. Welcome to the ‘stealth phase’, the time when the so-called ‘smart money’ got into the market.

Roll forward another three months, and you start hearing some more noise. August comes, Bitcoin is getting forked, there is now another Bitcoin, you feel confused - what is going on? The fork passes, the price keeps rising, and adventurous institutional investors are starting to get interested. So they devise a plan (or it's all just coincidence): “It would be great if we had futures to trade this asset class,” they tell their favorite exchanges.

The exchanges start thinking about the commissions they could make if such a volatile asset class was offered for trading. Rumours that futures contracts become imminent.. but let’s pause for a bit. Here comes Jamie Dimon who point blank tells the nerds: “You are idiots if you think you can make money on Bitcoin.” And you get angry: “How dare you, Jamie Dimon, you evil CEO of a major Wall Street bank!”

So you start buying more.. and the price continues rising. By now many institutional investors have realized that futures contracts are imminent and the media noise is playing to their advantage as more and more small players are getting interested in divesting their savings.

Bitcoin weekly chart since August 2016. Source: Tradingview

A Brief Pause for a Breath of Fresh Air

Come November institutional investors have loaded up on Bitcoin. BTC millionaires are left and right on TV, shouting that BTC is undervalued at $10,000...

The financial media plays the game and keeps paying more and more attention to a once-obscure asset class. Before you know it, more than half of the shows on financial TV are giving Bitcoin 90% of their airtime.

But let’s roll back again: it’s the beginning of November, and the SegWit2x fork is upon us. We’ve been here before, not a big deal - we saw how it happened in August. But wait, there is a massive dip that lasts 24-36 hours. Bitcoin Cash is king.. for a day! That was close; Bitcoin survived it, this is it, it's time to buy again.

Media keeps getting more enthusiastic and smaller and smaller investors are getting in. Your Youtube is full of ads about Cryptocurrencies and how, why and where to trade them. Google Ads is swamping you with ICOs and Bitcoin tips (alongside the occasional binary options ad). CFDs brokers are offering the product en masse before they realized that it might not be such a good idea after all.

The Conclusion is Yet to Come

Here we are in December. Everybody knows that two Chicago-based exchanges are going to start offering Bitcoin. And both contracts begin trading at a premium. There are way more buyers of cash-settled index contracts than sellers. But this doesn’t matter to the price of Bitcoin which is set on crypto exchanges.

While the deals on those are affecting the price on the CBOT and the CME, no amount of money changing hands in these contracts will influence the price on Coinbase, Bitstamp or Kraken. That's because the owners of the futures contracts are never forced to do any business on the crypto exchange and settle their debt by paying a Bitcoin. They simply pay the difference in cash.

There is one significant and new aspect of the market though. You can now short Bitcoin. After months of one-sided moves, no sane person would do that, right? Except if you are an institutional investor that has been buying physical Bitcoin and is now willing to hedge the position to manage some of the risks… or all of them. What happens to the futures market if those institutional investors start unloading BTC on crypto exchanges? You guessed it right; they could make double the profits by taking a roundtrip on the roller coaster train.

And here we are today again. Bitcoin tanked 10 percent for a brief period and here come the Asian buyers to save the day. Will they manage to prop it up to $20,000 again? I don’t know. I just wanted to share my thoughts with you about the recent price action and hear your opinion if the above makes any sense to you.