With nineteen days still left to go, the DAO has just made crypto-history by becoming the second highest funded crowdfunding project ever. As of the time of writing, more than 2.78 million ethers have been raised for the DAO which at the current price of $9.26 per ether comes to over $25.7 million. This also means the DAO now controls over 42% of all ethers in all Ethereum contracts combined.

Until the launch of the DAO, Ethereum was the only Blockchain -project in the top ten list of the highest funded crowdfunding projects with $18.4 million (and with “Ethereum alternative” Lisk at number twenty with $6 million). The previous second highest funded crowdfunding project until today was Elio Motors with $25.6.

The DAO is of course expected to raise more funds until its sale is done but the rate is slowing down considering it raised $12 million in its first two days and about the same amount for the remaining week. However, in five days the price of a DAO token will rise and that could lead to a new rush of investors that stayed on the fence so far but will want to go in before the rate changes.

Stephan Tual, the founder of Slock.it, commented about the implications for the apparent success of the crowdsale, writing: "The cat is out of the bag: a provably fair, 100% decentralized governance model is now publicly available for anyone to copy, improve on and reproduce...While I’m sure many will continue to try deceiving their users by imposing artificial centralization rules to ‘pseudo-DAOs’, The DAO has educated the public in the importance of checking the source code and validating the bytecode of such projects."

He added: "It’s official: ‘coins’ for the sake of ‘coins’, ‘ICOs’ and featureless ‘altcoins’ are now dead, buried and cremated. DAO Tokens on the other hand hold intrinsic value in the form of rewards generated by the products and services the DAO backs."

What is the DAO?

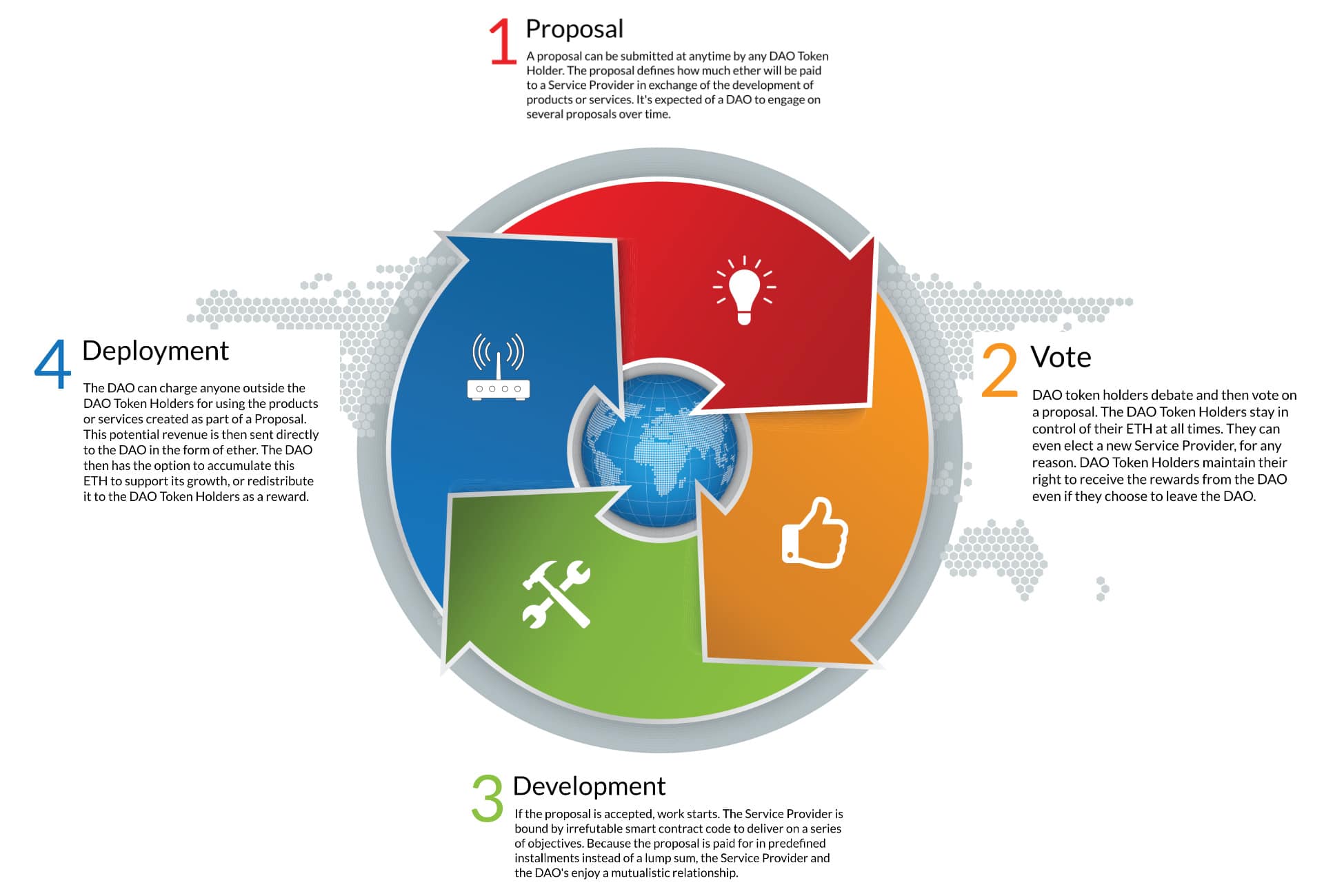

DAO stands for Decentralized Autonomous Organization equivalent. It can be understood as an entity that exists only in the blockchain – the same way a corporation exists only by law – just with programming code instead of articles of incorporation. It is controlled by its owners directly without central management.

Slock.it created the DAO platform but the investors that breathe life into it with their funds will stay in control of its coffers, vote on its future actions and be rewarded from its revenues. It is considered the first serious application on the Ethereum blockchain on its way to fulfilling the vision of the ‘planetary scale computer’ that can handle everything from secure communication to digital governance and so much more.

The DAO’s Curator signatories include Vitalik Buterin, the inventor of Ethereum, Gavin Wood, the co-founder of Ethereum, Christian Reitwießner, who implemented Solidity, the Ethereum smart contract language and others.

Investment projects

While its owners can vote to invest in anything they want, the idea seems to be that the DAO will serve as an investment fund for early stage Ethereum ventures. The hope of its creators is that the DAO would be used to support the development of the Ethereum protocol itself eventually, as a for-profit ‘Ethereum Foundation 2.0′.

Slock.it has already submitted its proposal for the creation of the Universal Sharing Framework and the Ethereum Computer to the DAO. It is also believed that more startups, such as the electric vehicle designers Mobotiq that have already revealed their DAO proposal (Ethereum integration to enable fully autonomous, self-renting vehicles), are planning to try and tap into this new source of venture funds.