Hong Kong's financial regulator has warned the public about an unlicensed virtual asset trading platform that is suspected of marketing services to investors without proper authorization. The Securities and Futures Commission (SFC) cautioned investors against trading on Sure X, highlighting the risks of potential losses due to platform failure, hacking, or misappropriation of assets.

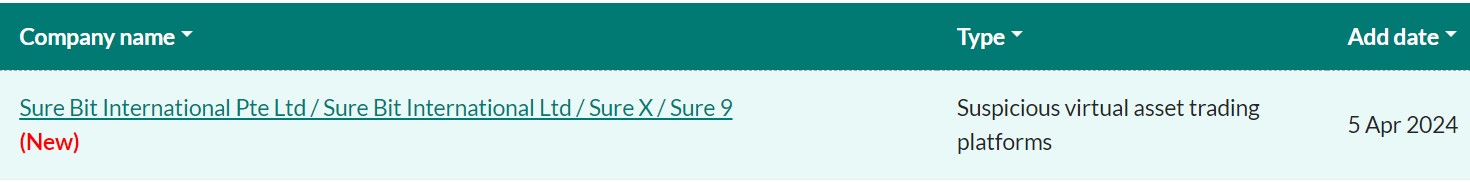

Sure X Added to SFC's Alert List

Sure X is a virtual asset trading platform operating under various names, such as "Sure Bit International Pte Ltd" or "Sure Bit International Ltd." The SFC warned that investors might still find ways to access Sure X's websites and trading platform despite appearing to be inaccessible.

The regulator wrote: "While Sure X's platform websites appear to be inaccessible, the SFC notes that Hong Kong investors, through other means via the internet, may still be able to access the websites and/or the purported trading platform and register as new users."

Last month, the SFC raised concerns about two other cryptocurrency trading platforms, HKCEXP and EDY, due to suspected fraudulent activities. According to a report by Finance Magnates, the regulator's investigation revealed that EDY falsely claimed affiliation with a financial institution in Hong Kong and a digital token system.

Moreover, investors reported difficulties withdrawing funds from the platform, indicating potential malpractice. Similarly, HKCEXP is suspected of operating with a fake Hong Kong address and falsely presenting itself as an "SFC-registered company." Thus, the securities watchdog warned investors against paying hefty fees to the platform to facilitate withdrawals.

Hong Kong Tightens Crypto Regulations

Additionally, the SFC warned about Bybit, a cryptocurrency exchange purportedly operating without the necessary licensing in Hong Kong. The regulator mentioned that Bybit's suspected unauthorized products, including futures contracts and leveraged tokens, pose significant financial risks to investors.

In the aftermath of the scandal involving JPEX, the SFC is taking decisive action to safeguard investors. The regulator has rolled out a comprehensive set of measures aimed at enhancing transparency, bolstering public awareness, and tightening regulations surrounding crypto trading platforms.

Hong Kong's foray into retail cryptocurrency trading in June 2023 brought with it a surge in opportunities for investors. However, it exposed vulnerabilities in the regulatory framework, particularly regarding unlicensed trading platforms.

To address this, the SFC published a detailed list of licensed Virtual Asset Trading Platforms on its website. Besides that, the watchdog is conducting a public awareness campaign to educate individuals about protecting themselves from potential fraud.