Coinbase is entering the prediction markets business through a partnership with specialist exchange Kalshi. The move marks another step away from a crypto-only model toward a broader, multi-asset ecosystem, reflecting a wider industry shift toward all-in-one financial platforms.

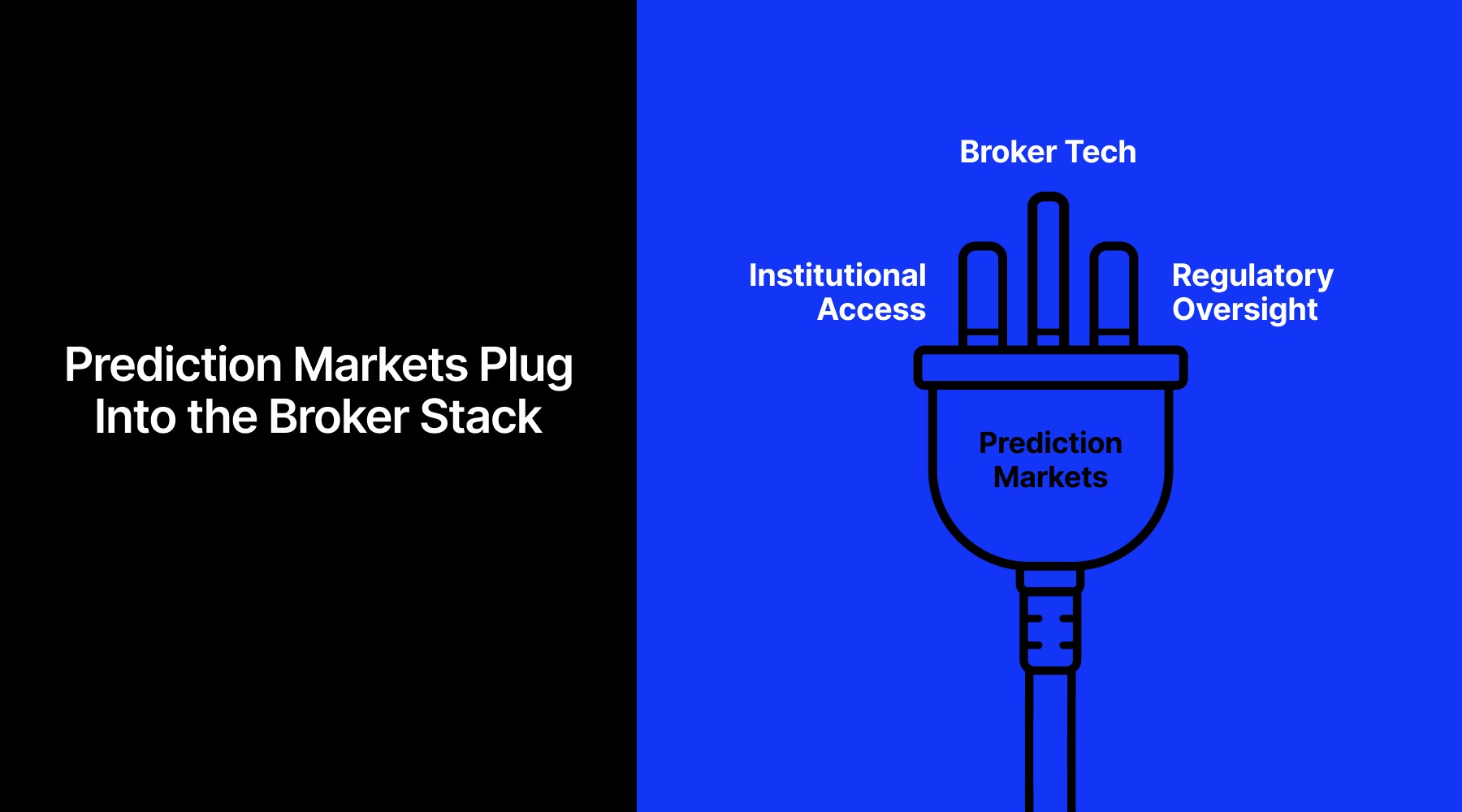

Platforms built around a single asset class are evolving into multi-asset environments designed to increase engagement and capture a larger share of users’ trading activity. Prediction markets have emerged as one of the latest areas of expansion in this race.

From Single-Asset Platforms to Multi-Asset Ecosystems

Coinbase’s strategy mirrors changes already visible across retail trading. Recent research by Coinbase and Ipsos shows that younger investors are allocating a growing share of their portfolios to non-traditional instruments, including crypto, derivatives, and event-based products.

Against this backdrop, prediction markets reflect changing investor demand rather than a niche experiment. They align with the preferences of a more self-directed retail audience seeking alternative exposure and continuous market access.

“The everything exchange is our vision where users will be able to trade every asset, 24/7, from anywhere in the world on one trusted platform that starts with crypto,” said Max Branzburg, Coinbase’s vice president of product.

- CFTC Spares Polymarket, Gemini, Aristotle and MIAXdx From Swap Reporting Rules

- Robinhood, Kalshi and Crypto.com Face Prediction Markets Crackdown as State Regulators Call it Illegal Gambling

- Prediction Markets Boom Draws CZ-Owned Trust Wallet, Joining MetaMask and Polymarket Integration

Prediction Markets Move Into the Mainstream

Coinbase is not alone in targeting this segment. Robinhood has already built a fast-growing prediction markets business through its partnership with Kalshi. Gemini, meanwhile, has taken a more formal route, securing approval from the Commodity Futures Trading Commission to operate prediction markets under a designated contract market licence.

These developments point to growing adoption of event-based contracts across retail platforms, supported by rising investor demand. Kalshi has raised $1 billion at an $11 billion valuation, while rival Polymarket has entered a strategic partnership with Intercontinental Exchange, underscoring expectations that the sector can scale.

The push toward “everything stores” reflects a structural shift in how platforms compete for relevance in an increasingly diversified retail market. Just as Amazon expanded from a single product category into a marketplace for almost everything, financial platforms are moving toward one-stop destinations for trading across asset classes, with prediction markets forming an important part of that strategy.