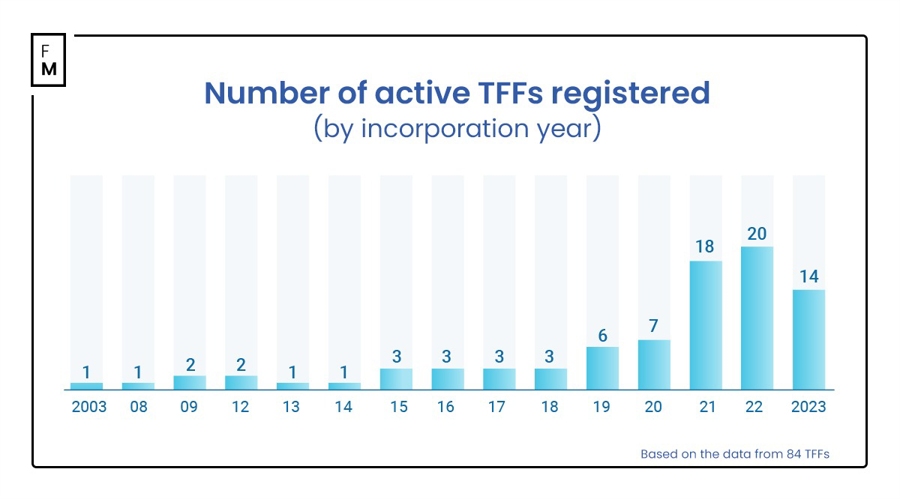

The concept of a trader-funded firms (TFFs), otherwise known as prop trading firms, is not new. Although these firms have existed for years, their popularity exploded in 2022.

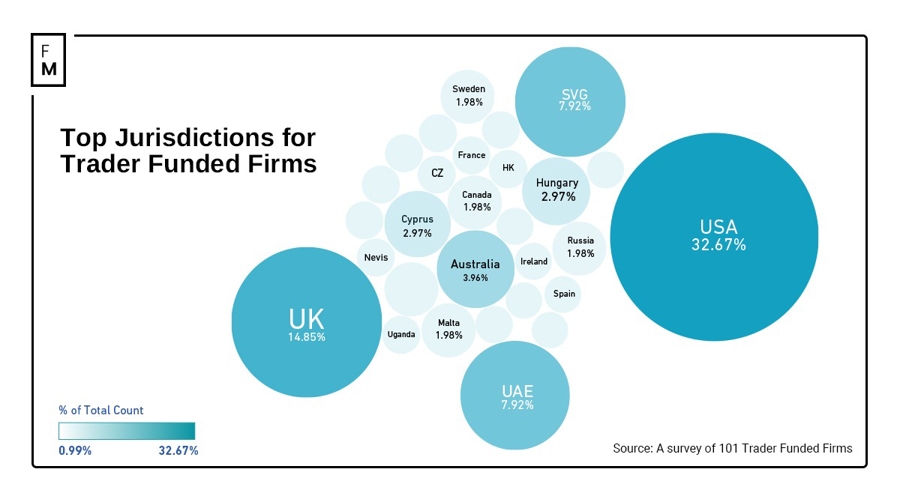

The key reason for the sudden rise of these TFFs is that they emerged as a loophole and a low-cost alternative to the traditional retail forex and contracts for differences (CFDs) brokerage. Many regulatory and non-regulatory crackdowns in the FX and CFDs industry in 2021 and 2022 have increased the barrier to operate a regular brokerage.

Regulators to Tech Providers: Tightening of Rules

Regulatory scrutiny over FX and CFDs brokers has increased across most of the jurisdictions, including for offshore regulators that now need physical offices and higher capital reserves. Further restrictions from banking and licensed payment providers unwilling to work with unlicensed FX businesses, for instance, the challenges of opening a bank account for an offshore forex broker starting in 2021.

Other non-regulatory barriers, include restrictions on advertising and increasing costs across almost every marketing channel. To name a few: TikTok banned promotions of crypto and forex in 2021; Google Ads required an FX license to show ads in countries without FX regulation, coupled with a general lack of understanding about FX licensing; and the cost for FX-related keywords/price per click skyrocketed.

Additionally, MetaQuotes, the developer of two MetaTrader trading platforms, also imposed many restrictions on offshore brokers. The company has tightened its licensing process, making it difficult for unlicensed brokers to get white labels.

At the same time, the COVID and post-COVID bloom of interest in financial markets persisted. On one hand, there was demand, and on the other, restrictions for retail FX. TFFs were a quite logical result of both dynamics.

A Fertile Ground for TFFs

While regular FX and CFDs brokers were facing difficulties, the situation is the opposite for TFFs because of their sheer structure.

The typical TFF structure in 2023:

- A license is not required.

- White labeling is not needed.

- Marketing is not restricted.

- Banking and Payment Service Providers are available.

This setup is truly a dream for many.

Also, the number of startup retail forex brokerages declined significantly. It was a trend I observed first-hand from the diminishing number of leads and inquiries received as a Vice President of Sales from 2010 to 2022, with each year experiencing a progressively larger drop.

One important factor for the TFF explosion was the predictability of TFF revenue, in contrast to retail FX brokerage, as well as the low entry barriers. These factors made investors more likely to invest, and as it often happens, early adopters made the most profit.

Now, regarding profits: Since a license is not required to run a trader funding program, it is nearly impossible to collect any public data on these technology companies, as most TFFs don’t report to any jurisdictions. However, there are still ways to gauge this:

- A lawsuit against My Forex Funds: $310 million in fees (Nov 2021 – August 2023), with a net income of approximately $172 million. With 135,000 clients, "Program Fees" range from $200-$4,900 (max funding of $2 million).

- Rare reports by regulators or public tax filings: A European-based TFF paid about $10 million in taxes in 2021 and about $23 million in taxes in 2022. Considering the country has a corporate tax rate of 19%, the revenue can be estimated.

- Public/Twitter/Instagram posts by TFF owners: a UAE-based TFF paid about $130,000 in taxes in 2022.

- Reverse engineering using prices/posted numbers of new clients (not very accurate but worth considering): Firm #A (via Instagram/LinkedIn public posts) has about 1,100 to 1,400 new clients per month, with an average evaluation fee of $165. Firm #B (via Instagram) has about 250 clients a month, with an average evaluation fee of $280.

Furthermore, I also have access to some unpublished data of TFFs, obtained through my personal network.

- Firm #1: It has about 100 to 140 new clients monthly, with an average evaluation fee of $200 and $90,000 in net yearly income. The company was established in 2023.

- Firm #2: It has about 400 to 700 clients monthly, with 20% of traders returning and offering other products (courses for a fee). The TFF was established in 2022 and was netting $460,000 annually.

- Firm #3: It has about $14 million gross yearly, with about $7 million in net income. It was established in 2019, but didn't grow much in the first 2 years.

It would be interesting (and priceless) to analyze all the data TFFs have collected over the years. I hope they are conducting this analysis internally.

Many are in search of a new prop firm to get funded again and looking for a UAE or a EU based firm to feel "safe".

— BF Fx (@BrightFuture_Fx) September 2, 2023

It's not just the jurisdiction that matters. It's important to know if you are trading a demo account in the name of funded account.

The Source of Revenue

The business of running TFFs is lucrative. These companies have multiple sources of revenue. However, their main source of revenue is from traders' evaluation or audition fees, including one-time challenge fees and ongoing subscription fees (mostly for Futures TFF). They also generate revenue from add-on fees (pay extra to get a lower profit target or increase allowable drawdown).

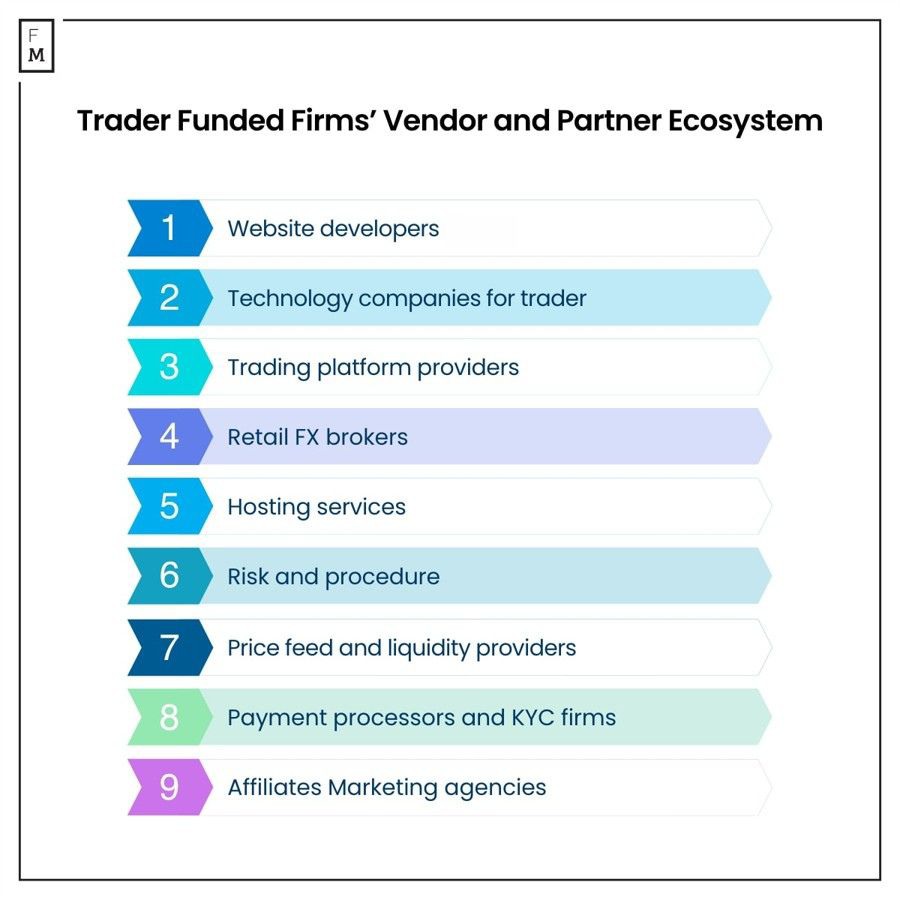

Another supplemental income source of the TFFs are mentorship program fees (some firms offer these complimentary), introducing broker partnerships with retail FX brokers, data reselling, and markup for data-related fees.

Although the TFFs take a small part of the profit from the traders, its is rather an optional and rare source of revenue. Other optional revenue sources for TFFs are reselling of trading data, which may occur sometimes without proper disclosures.

Income from proprietary trading activities is rare, primarily because the business model operates under the assumption that evaluation fees will cover the rare instances of profit withdrawals. Setting up the proprietary aspect of a TFF involves technology, capital, and crucial industry knowledge. Some well-established TFFs with decent Annual Recurring Revenue still don't have a proprietary trading desk setup, though they may have connections with Liquidity Providers and engage in occasional hedging.

If you would like to read more about technology and risk management for TFFs, leave your email on the waiting list to receive a 50-page long business plan.