With the broker set to release a new version of its social Trading Platform , OpenBook, later this year, Forex Magnates got a chance for a sneak peak of the product. Currently, the platform is set to be released to private invite only beta users later this month, with a planned public launch targeted for the latter part of Q2.

So why is eToro launching a new version of its OpenBook platform? The answer resides in how eToro made its way to become a social trading broker.

In its early days, eToro entered the market as a standard forex and CFD broker. What they brought to the market at the time of their public launch in 2008 was a gamified version of trading. Using graphics such as barrels of oil and country flags of the US and Japan, eToro offered a much more interactive version of trading to the forex and CFD market that was simpler for beginners.

For the casual viewer unfamiliar with the financial markets, eToro’s earliest platforms didn’t look much different than the binary options offerings of today. As the broker matured and attracted customers desiring a more professional trading environment, it led eToro to make MetaTrader 4 available to its clients.

Simultaneously, eToro pivoted its proprietary platform from a gamified version of trading to social trading. This move culminated with the 2010 launch of the social trading network OpenBook platform. Social trading eventually became the product that defined eToro, with the broker adding copy trading in 2011. Since the launch of OpenBook, it has triggered other brokers to create 'copy' cat offerings as well as add features to increase real-time customer engagement on their platforms.

However, despite their emergence as a social broker, eToro continued to provide tools for more experienced traders that required higher end charts and analysis that weren’t available on OpenBook. As a result, there are two main results that eToro plans to accomplish with the release.

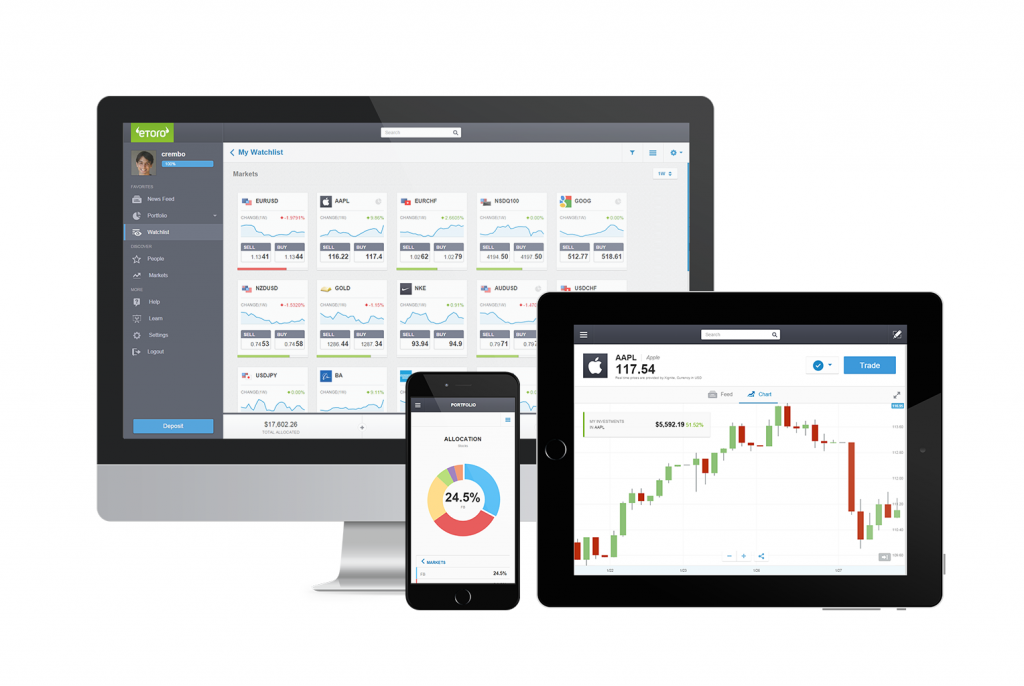

Firstly, eToro aims to finally merge its trading and social offerings in one united platform. Currently, more advanced trading features are only available on the broker’s webtrader platform. However, that platform lacks eToro’s social features which they are known for. The split between the two platforms is specifically an issue on their mobile apps, where moving between the social and trading apps isn’t as simple as it is on a computer.

Secondly, part of eToro’s focus for the future is its ‘Popular Investor Program'. This model is based on attracting successful traders to their offering who in turn are compensated based on receiving a percentage of assets under management that is copying their trades. As a result, the new OpenBook needed to contain analysis and Risk Management features to attract existing traders from other brokers who see a benefit in switching to eToro to expand their revenue potential.

Copy Traders

While having a focus on being able to source successful trade leaders, that group represents only a small fraction of eToro’s customers. The vast majority are there to copy and learn from others or are attracted from the social and engaging interface eToro provides. For this group, the new OpenBook comes with several new features. Among three of the more important ones are the graphical watchlist, new search user interface for finding leaders to follow, and advances to stock trading.

One of the innovations that eToro created that other copy trading platforms have begun to ‘copy’, is treating trade leaders as assets. Viewed as individual assets, eToro treats leaders like they would other securities such as stocks and forex. This is seen in the fact that trade leaders will have their own performance and social feed pages that resemble that of any other asset.

Another area where leaders appear is in the markets watchlist. This is eToro’s version of a quotes list. Rather than the familiar linear quote with name, bid, ask, price change that appears universally on trading platforms, eToro uses a graphical interface. Included in the watchlist is the ability to create sector lists where leaders can be added. Therefore, like the one that can create a portfolio of technology stocks, including Apple, Google, Facebook and Cisco, they can similarly create a portfolio of leaders they are copying.

The emphasis on leaders also appears on their copy trading search page. eToro created a new user interface for searching for trade leaders. While some of the features, including risk score, number of copiers and performance filters have existed in the past, they added parameters such as assets under management and the percentage change in copiers. In addition, the broker plans on adding the ability for users to copy leaders per security in the future to enhance the overall copy trading customization.

Another major change that was explained, to be based on strong user demand, is the initiation of real-time stock trading. Currently, stocks are available for purchase at the end of trading each day and resemble more of a mutual fund than equity trading product. With the upgrade to OpenBook, this model will be changed to allow for real- time trading, as well as short positions. By the end of the year, eToro also plans to widen its available stocks to trade to reach over a thousand.

Cross Device Layout

One of the more impacting interface features was the decision to create a unified appearance across all devices. As a result, whether using a smartphone, tablet, or PC, OpenBook uses a single page layout. This continues the existing model used by the current version of OpenBook.

Practically speaking, what this means is that users will be unable to view multiple trading features on a single page. Therefore, users will have to switch pages or open multiple browsers if they want to view charts, social feeds and watchlists simultaneously. A floating P&L bar though does appear across all pages. The single feature layout contrasts from typical trading platforms which allow customization of multiple windows of charts, quotes and positions simultaneously.

A ‘New’ Type of Broker

Reviewing OpenBook, my personal bias after having traded stocks with multiple screens and data in front of me, as well as having reviewed other trading platforms, is that a single page with single feature structure is less appealing. It does solve the problem of cross-device structure design which many platforms struggle with, as their mobile devices end out being cluttered miniature apps of a larger system.

Having always been positioning itself as a broker that is unique in its offering to the market, the new OpenBook continues this vision. As a result, while the product may not be found to be adaptive to the requirements of active traders, it does fit an emerging class of customers.

This group can be described as individuals who have an interest in finance and the capital markets, but little experience in trading. OpenBook provides a social network for them to learn from others as well as share ideas to a larger audience using a platform that is fairly easy to understand. Another item worth noting is that many of these types of customers arrive to eToro via social marketing channels on Facebook and Twitter campaigns. Therefore, while they may be lacking ‘intent’, which is a key ingredient of search-based advertising leads, they arrive with ‘interest’ and comfort of social networks, which is the foundation of successful Twitter and Facebook driven campaigns.

Adding to the branding of the platform to meet the requirements of new traders, eToro is also soon to be revamping its trading education and analysis content with the arrival of new hires with similar experience from other brokers. In addition, by widening its equity offering, it will be interesting to see what type of community eToro will be able to create for analysis driven stock investors. If it becomes active, the upside is a StockTwits/Seeking Alpha type of community with an added layer of real trades being reported publicly.

Overall, one of the ideas of OpenBook and other social networks, such as TradingFloor from Saxo Bank, is the ‘democratizing of asset management’ where any successful investor can be ‘found’ and chosen to manage large fund amounts. Other social networks such as YouTube have proved that content creators can leverage such platforms to become ‘YouTube famous’ and build sustainable businesses. eToro’s goal is that their revamped OpenBook will pave the way for such a trend to take place with investing.