From P2P platforms and other alternative lending solutions to Payments providers and robo-advisers, 2016 saw a flurry of activity in the fintech sphere. Fintech startups have become attractive not only for venture capitalists, which have traditionally dominated funding in this sector, but also for mainstream investors who are now firmly involved in pursuing the opportunities presented by emerging technologies.

Regulators are in turn focusing more efforts and resources on these rapidly evolving solutions to protect the customer-centric experience that this industry has talked about for years.

In this article, we’ll try to highlight key fintech prospects and challenges around the world, as well as key trends and insights related to the fintech industry, to get a better understanding of what to expect in 2017.

Regulators’ support and concerns

Investment in fintech companies has gone parabolic in recent years and is set to continue in the years ahead. This resulted in governments and financial watchdogs taking steps to regulate the market.

First, regulators pledged to create ‘sandboxes’ and innovation labs for fintech startups to try out their ideas without compromising customer security or running afoul of local laws. The best example was the FCA’s Project Innovate program which lets companies test disruptive innovations under the government’s watch.

Japan, Australia, Hong Kong and the UAE, among many others, have moved to regulate the sector

Meanwhile, more and more countries are looking to follow the FCA’s example and create similar initiatives of their own. Japan, Australia, Hong Kong and the UAE, among many others, have moved to regulate the sector, while others have established working groups to dig deeper into their fintech potential. In addition, some regulators have signed co-operation agreements this year, in which they pledged to promote competition in the interests of consumers and refer innovative companies interested in entering each others’ markets.

The private sector has also accelerated its contribution, with most major banks setting up their own innovation labs and accelerators. We may be uncertain about the benefits that this approach could bring to the industry, or if it will continue in the long term, but it’s definitely a big shift from fintech being just a glint in the investment community’s eyes.

On the flip side, government oversight of fintech startups, although it aims to ensure that innovation be encouraged not stifled, could be a growing concern for the industry due to the possibility of being too heavily regulated.

China’s fintech shines bright

Global fintech funding surged throughout 2016 thanks in large part to tremendous funding rounds by Chinese fintech firms which outperformed competitors in the traditional Western hubs in terms of numbers and innovation. According to the 2016 Fintech Innovators Report, which evaluates and ranks the world’s top 100 fintech companies, China’s fintech firms have outperformed their counterparts in other countries this year.

According to the rankings, 13 UK firms featured in the Fintech 100 this year, down from 18 in 2015. Chinese fintechs stood out in 2016, with eight firms in the 100, but four of these – Ant Financial, Qudian, Lufax and ZhongAn – are in the top five. In contrast, Atom Bank was the only representative from England to appear on this year’s top 10 list. In the US, 24 companies made the list of 100 including three in the top 10.

Global fintech funding surged throughout 2016 thanks in large part to tremendous funding rounds by Chinese fintech firms

China is now hosting 8 of the 27 current fintech unicorns, a term used for start-ups valued at more than US$1 billion such as Ant Financial, JD Finance and Lufax. While China may be the central focus, the Asia-Pacific region overall witnessed massive investment into fintech companies, most notably a $4.5 billion round of private equity financing by Alibaba Group Holding affiliate Ant Financial Services. Over the past year, Hong Kong, Singapore, Australia and India have each found a way to set their fintech offerings apart.

Robo advisors have matured

Robo advisors, automated online tools that leverage automation and algorithms to help manage client portfolios, have become more and more popular in 2016. The sector is already getting crowded, with new platforms popping up almost every week.

The most exciting development with these automated trading platforms was that key players in the traditional asset management industry, such as Schwab, Vanguard, WisdomTree and Fidelity, have rushed to launch their own robo advisor programs, a sign that algorithm-based investing will become more specialized over time.

Algorithm-based investing will become more specialized over time

Although these firms have followed different approaches to robo advice, each one was apparently seeking to benefit from the growing demand, which bodes well for the industry, at least in terms of introducing hybrid services. Pairing robo-advice with human advisors is another path for growth and the model may serve to overcome many of the existing challenges impeding robotic trading platforms.

Aside from robo advice benefits, the approach in general offers greater competition, which often leads to innovation and reduces costs to appeal to a wider audience of investors who are no doubt attracted to the affordability of algorithm-based trading.

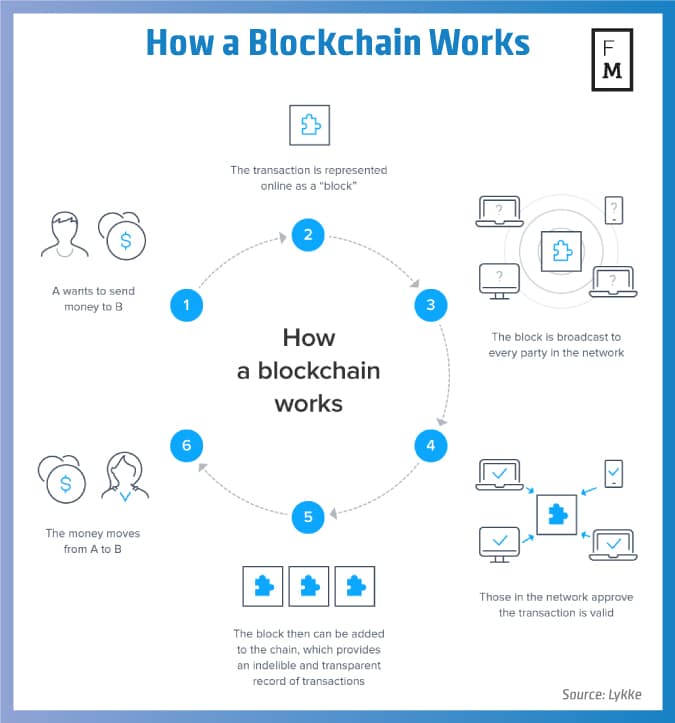

Blockchain remains in the classic sense

The speed at which blockchain technology, best known for powering Bitcoin and other cryptocurrencies, is being explored and adopted was unprecedented in 2016. We watched how the blockchain moved from a startup idea to an established technology in a detailed report. For this we have chosen just four big stories that dominated the news this year and spanned 2016 as backdrop to everything else.

Looking ahead — the fintech industry could experience even greater growth moving into the coming year. The future remains positive from an investment perspective. We may expect an uptick after relative slow growth in the second half of 2016 due to political risks such as the Brexit and the US elections which fueled great uncertainty across all emerging sectors. Along with increased attention, the industry could see a large number of fresh launches and fintech could make its way into an even stronger growth pattern in 2017 as investors have become more certain about industry prospects.

The main challenges would remain regulations, talent acquisition, security, profitability and meeting customer expectations

The main challenges would remain regulations, talent acquisition, security, profitability and meeting customer expectations.

On the regulatory front, the proposals are varied but seem to agree that a complex regulatory landscape shouldn’t stifle innovation in the promising sector. In addition, the UK also may still act as the most fintech-friendly jurisdiction thanks in part to the direction of Bank of England governor Mark Carney, who welcomes fintech involvement in the nation’s financial landscape, particularly after the Brexit shock.