I want to share a wonderful insight from Jordan Belfort, the real Wolf of Wall Street: “Sales is what makes the world goes round…if you want to succeed in sales you must learn how to change the way you use your brain and your subconscious mind.”

According to Belfort, there is a scientific way to increase sales performance, where the main idea is to expand your cognitive capacity. Instead of mainly using your conscious awareness as most people do, you need to tap into your subconscious mind. When you work with your conscious mind, you only utilize 10% of your brainpower; BUT, when you shift your attention to your subconscious mind you can increase this level up to 90%!

Expanding your capacity and leveraging your subconscious mind will enable you to communicate better with traders and it will allow you to easily change traders' perceptions about your brand. Sure, it takes time and practice to get there, but you will find the investment to be very worthwhile. By using your subconscious mind, you can become nine times more powerful and convincing.

Invest more effort in your sales team training on the subject of their subconscious mind and teach them how to access all of their brain’s resources. You will be surprised to discover the many new ways and techniques you can Leverage every day with your customers. I have demonstrated this concept to many binary and Forex brands and they were amazed by the results - and they dramatically increased their sales soon afterwards.

From door-to-door sales, to advertising deals worth millions at Google

I started my career 20 years ago as a door-to-door salesperson. I knocked on doors trying to convince people to buy children’s newspaper subscriptions. In the beginning, I found the job very complicated and I was terrified. Just the thought of entering someone's house and persuading them to buy something they had never even considered buying made me anxious. However, I was determined to learn as much as I could about the science of sales.

I decided to become the sales champion, and in order to do so I programmed my brain for success. I spent long hours speaking with my managers, learning and practicing new techniques, and reading books. And then one day everything was clear - I had found the right way to approach clients and be an excellent salesman; I was way better than my peers and even better than my managers.

Ten years later, the outstanding sales skills I developed helped me to become one of the founders of Google's Israeli office, where I closed millions of dollars of advertising deals involving very large corporations. One day I was asked by one of Google’s top executives, "I see that you have a remarkable ability to bring in huge deals, how do you do it?"

I replied, "Sales is a magical process and I love it because I enjoy new challenges - I find it very exciting. I am always interested in learning new tools, new ways to improve my sales skills and how to communicate with customers. Most importantly, I trust that my subconscious mind will help me to succeed. Today I know that in order to move forward with my clients, I have to use both imagination and creativity. I find it easy to speak directly with people in a special way, using language patterns that their subconscious mind will easily understand.”

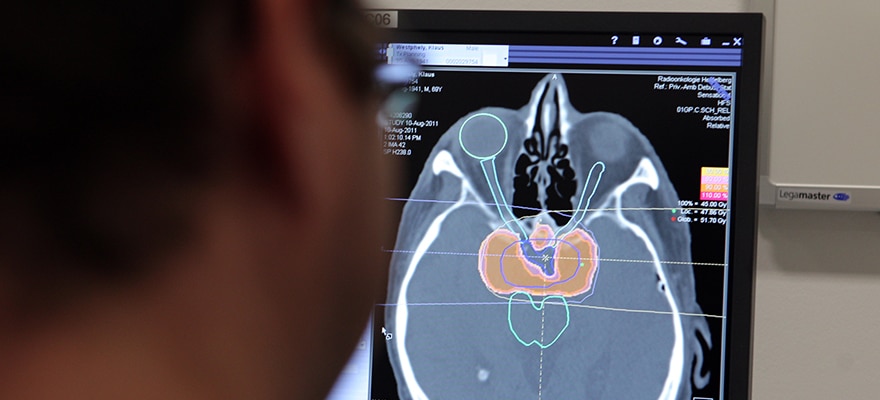

(Photo: Bloomberg)

How can NLP improve your team's ability to influence and persuade new and existing traders?

Forty years ago, the genius Dr. Richard Bandler developed the most effective cognitive method in modern time. Bandler came up with the term NLP (Neuro-Linguistic Programming) and created groundbreaking methodology to program the subconscious for human excellence.

According to Science Digest, “NLP could be the most important synthesis of knowledge about human communication to emerge since … the sixties,” and Psychology Today describes NLP as "the most powerful vehicle for change in the 21st Century!"

So, what exactly do we have here? On one hand, we have the most important human communication tool ever discovered, and on the other hand a very powerful method for change. Both are extremely important for a successful sales process. Utilizing NLP in sales creates superior communication with traders and it is the most effective way to change their perception about your brand.

What is NLP?

Neuro-linguistic programming (NLP) has changed the lives of millions of people, helping them to create dramatic breakthroughs in the way they think and perform. This is the best tool we know to increase confidence and motivation, in addition to overcoming fears and anxieties. Dr. Bandler learned how the brain is wired and developed a unique method for human excellence. In his research, Bandler focused on neurological configuration and linguistic structure, and then created new technology for achievement.

Once NLP is properly implemented, you can achieve unlimited success. This approach allows people to program their brain the same way you program a computer based on experience. Learning through NLP creates a rapid change in perception and behavior; it takes people to a higher level of cognitive thinking and improves performance in business and in our day-to-day life.

In the past 10 years, I have mastered NLP and developed a unique method that Forex and Binary Options brands readily embrace. In such highly competitive environments, brands are more committed and open to implement outstanding technology and tools. For example, in his book, 'Persuasion Engineering', Bandler explains how to use and leverage special communication patterns that create highly effective sales process. "It's not enough to persuade other people, you have to start with yourself," writes Bandler. In order to convince others, you must build your confidence and change the way you speak – optimizing your tone and speed of delivery. You must learn to use the right words and phrases, and how to increase your energy level. Bandler discovered the most powerful linguistic patterns that sales teams can use in different situations.

Do This Now

You can always find better ways to approach traders subconsciously; ask yourself what kind of linguistic patterns might improve your sales scripts. Invest more time and effort in your sales team training - teach them how the brain works and the importance of the subconscious mind. Use NLP methodology that strengthens your sales teams’ confidence. Teach them how to change the way they speak, how to change their tonality and speech delivery. Test different patterns and optimize your scripts.