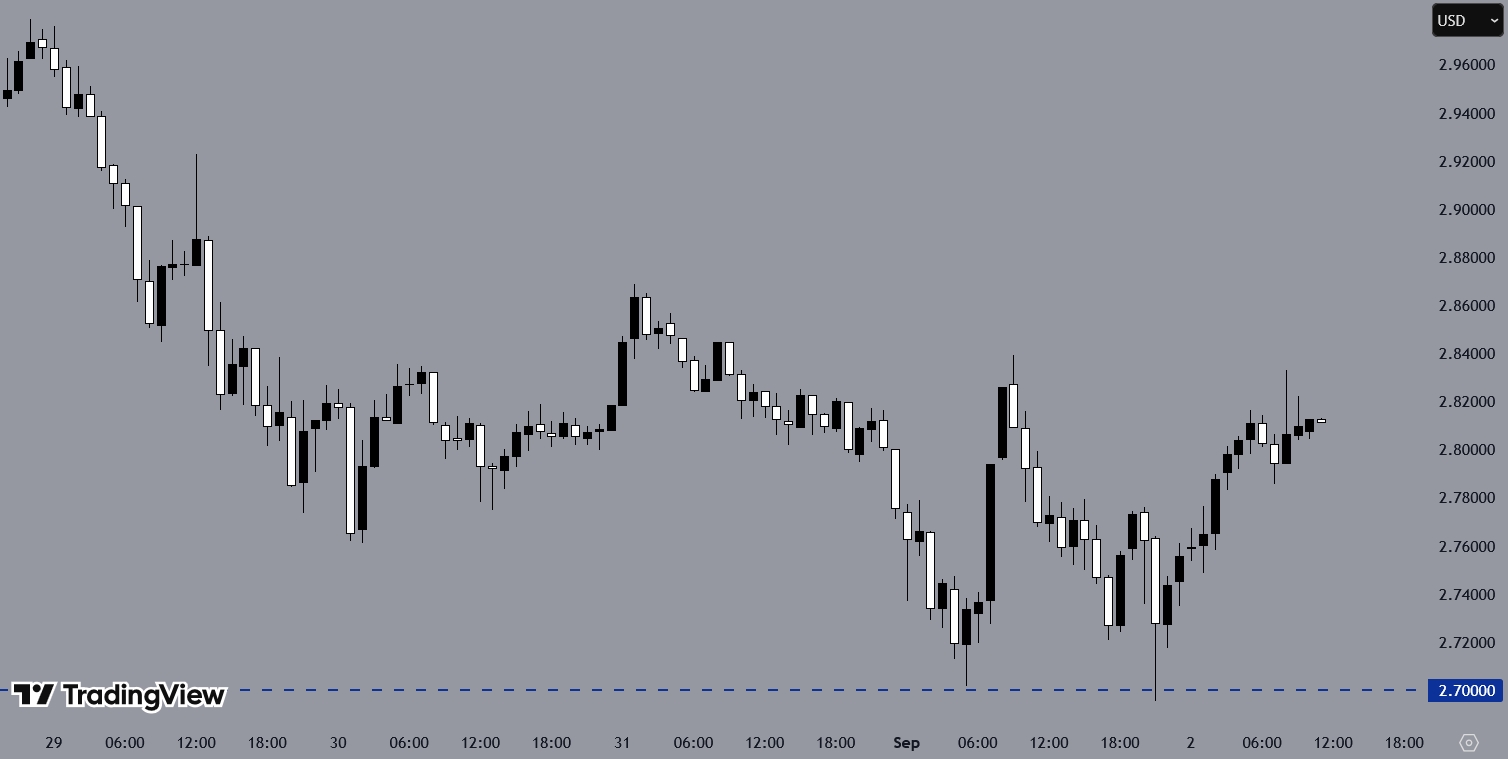

XRPUSD formed a double bottom at $2.70 and has since moved higher. The cryptocurrency is currently trading around $2.83, where it recently faced resistance. A successful breakout above this level could drive further upward momentum, potentially pushing the price higher.

Analysts see XRP in a potentially oversold situation, suggesting it could benefit from upcoming market catalysts. While near-term movements may be limited, broader adoption and positive trends could support stronger gains over time.

“Crypto Slump Seasonal, October Rally Expected”

Crypto analyst Oscar Ramos said XRP holders remain steadfast despite recent price fluctuations. XRP currently trades around $2.70, with Bitcoin near $110K and Ethereum at $4.3K. Ramos noted that historical trends show September often underperforms, while higher price movements are typically seen in October and November.

He highlighted technical indicators suggesting XRP could approach oversold levels near $2.70, describing it as a potential buying opportunity.

Looking ahead, Ramos identified several potential market catalysts for the month, including the upcoming Federal Open Market Committee meeting and key economic data releases like the Consumer Price Index and unemployment figures. While mentioning geopolitical events, they clarified these are “too unpredictable” to bet on.

Ramos cautioned that markets remain unpredictable, with external factors such as geopolitical developments unlikely to be reliable drivers. He encouraged disciplined trading, highlighting that crypto gains require preparation, risk management , and active engagement.

XRP Forecasts Range Widely Amid Market and Adoption Trends

A recent analysis by Discover Crypto noted that larger XRP allocations may yield limited returns unless prices reach extreme levels, requiring market caps beyond the current global crypto size. Technically, the XRP/BTC pair shows tightening Bollinger Bands, indicating potential price movement.

Analysts suggest short-term targets around $2.90–$3.10 and possible medium-term levels of $4–$5, though larger gains would depend on adoption and capital inflows not currently evident.

Crypto analyst Cilinix Crypto provided an update on XRP, noting that technical conditions are currently stable, with broader trends potentially supporting upward movement. Near-term targets were identified between $3.07 and $3.13, with $3.13 as the primary level, while a longer-term $3.30 target may encounter resistance.

Other analysts have offered varying projections. CoinsKid sees a minimum upside of $4.13, with short-term support at $2.66. DeepSeek AI expects XRP to trade between $3.50 and $5.00 by late 2025, potentially reaching $8–$15 by 2030.

James Crypto Space and Zack Rector suggest ranges up to $9 and $5–$15, respectively, depending on market conditions, regulation , and adoption trends.