Which Currency Didn’t Like the FOMC Meeting? Look at the New Zealand Dollar

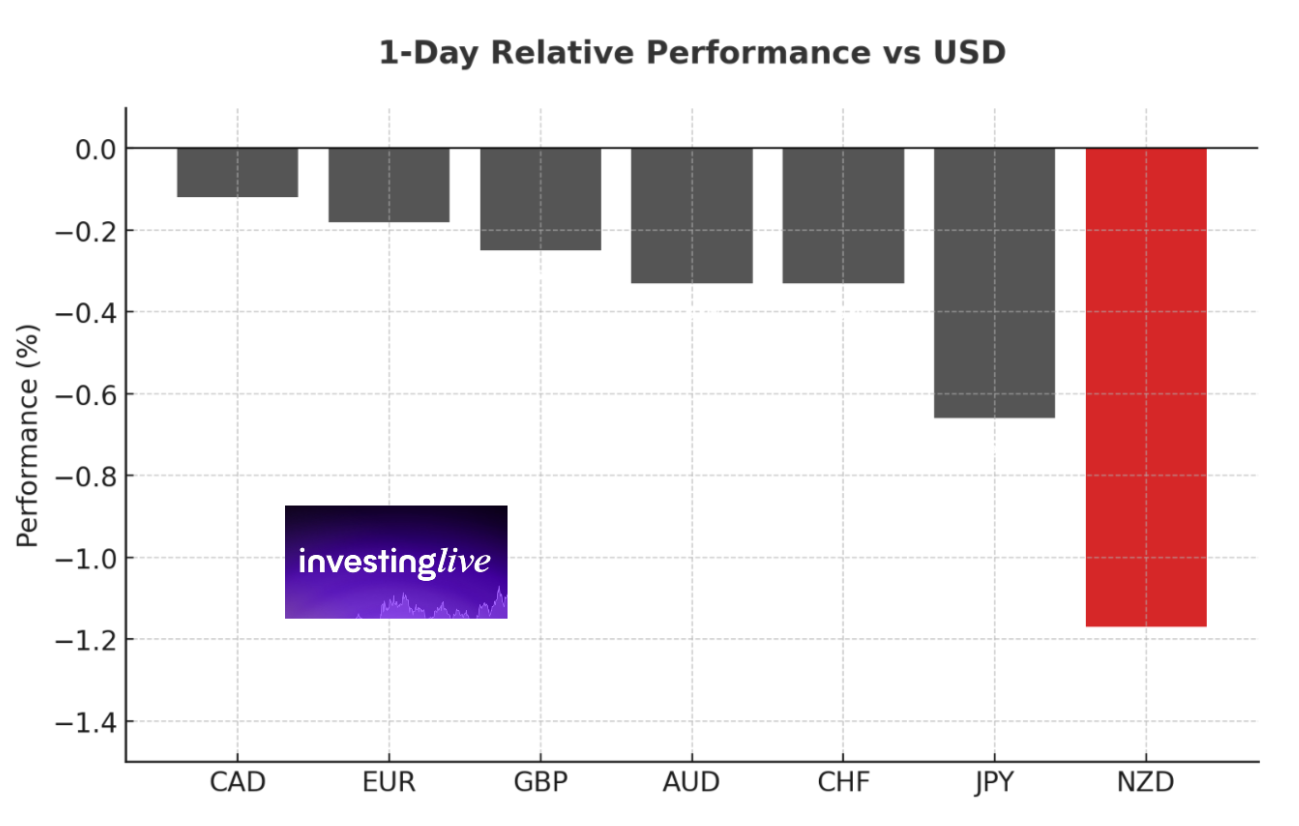

The U.S. dollar may have softened modestly after yesterday’s FOMC meeting, but the real underperformer was the New Zealand dollar, which tumbled more than 1.1 percent on the day. While most major currencies lost ground against the greenback, the NZD stood out as the weakest, highlighting that its troubles go beyond just the Fed.

Indeed, part of the move reflects local weakness. The New Zealand dollar has been extending its losses after terrible domestic data and forecasts for more rate cuts. Adding fuel to the fire, the latest GDP print showed the economy grew just 0.6% quarter-on-quarter in Q2, missing the 0.8% forecast and barely topping 0.3% expected — another signal that growth momentum is fading (read more here at investingLive.com, formerly ForexLive.com).

Relative to peers, the Canadian dollar lost only 0.12%, the euro 0.18%, and sterling 0.25%. Even the yen, often quick to weaken on U.S. policy divergence, fell a smaller 0.66%. The New Zealand dollar’s 1.17% drop clearly marks it as the most vulnerable of the group.

So while yesterday’s FOMC decision to hold rates steady pressured most currencies, the NZD’s decline looks like a combination punch: global dollar strength following the Fed and homegrown weakness from poor economic data and rate cut expectations.

Interestingly, while the NZD disliked the Fed outcome, the crypto space had a different response. XRP surged after the FOMC decision, with traders taking Powell’s comments as a green light for risk-on sentiment. The divergence is a reminder that not all assets respond to the Fed the same way; some crack under the weight of policy signals, while others use them as fuel.

This article is for information purposes only and does not constitute financial advice.