Liquidations Slow as the Crypto Market Today Eyes Bitcoin and Ethereum Support

The bigger picture in the crypto market today

The crypto market today is showing signs that it may have passed through the most intense phase of forced selling. Nearly $290 million in liquidations hit traders in the past 24 hours, impacting more than 130,000 accounts, with the majority falling on the long side. That heavy flush drove prices lower earlier in the session, but the way liquidation activity has shifted in recent hours is what matters most.

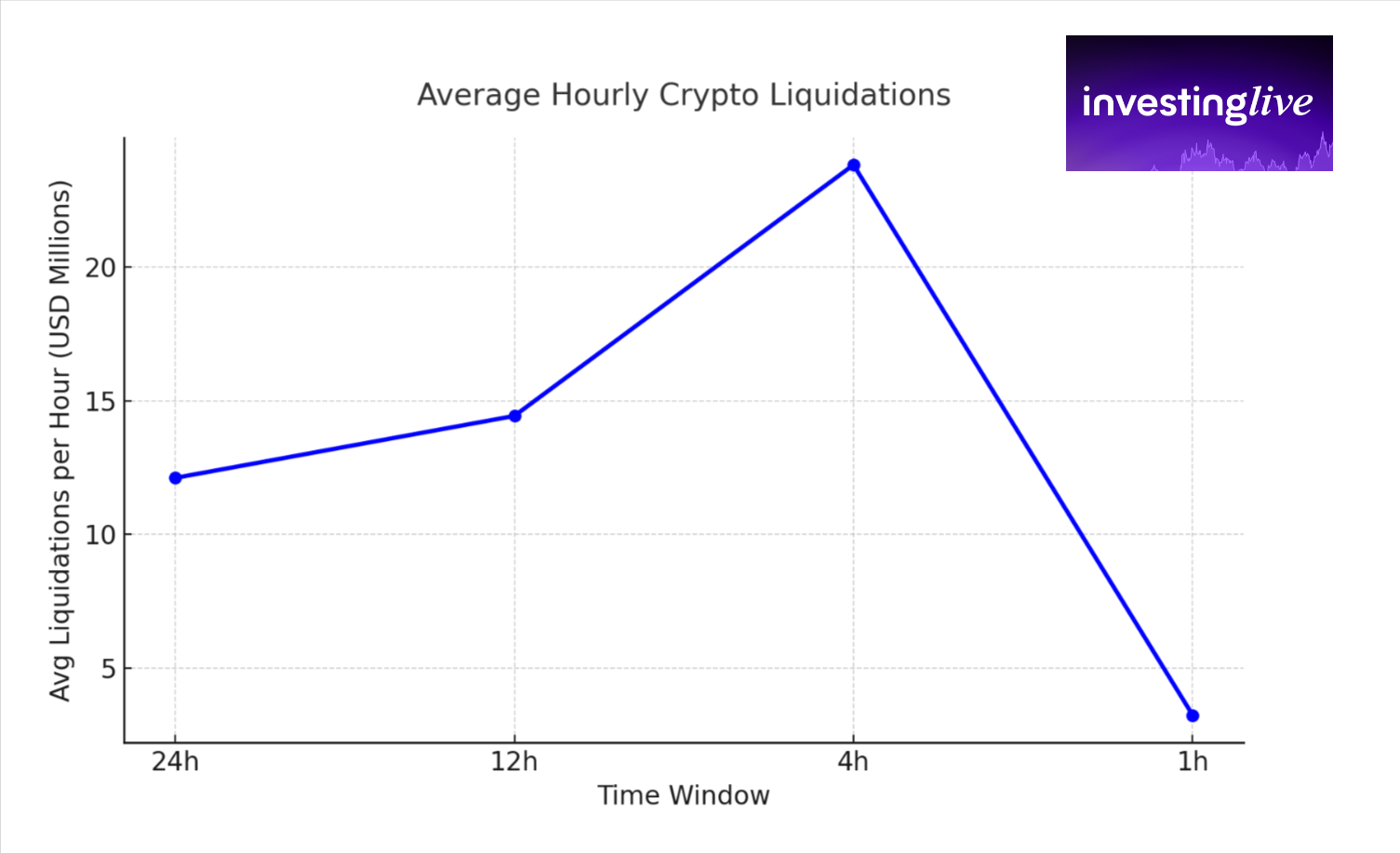

Instead of just looking at raw totals, which naturally get bigger in larger timeframes, we break the data down into an average per hour pace. This shows that liquidation intensity accelerated during the selloff and then abruptly collapsed:

24h average: about $12M per hour

12h average: about $14M per hour

4h average: close to $24M per hour

Last 1h: only $3.2M per hour

This pattern suggests forced selling pressure may have exhausted itself. The acceleration into the 4h block was typical of a capitulation flush, while the collapse to just $3.2M in the last hour points toward stabilization

Bitcoin: watching the $111,800 floor

According to proprietary analysis at investingLive.com, Bitcoin Futures has a key support at $111,800. So far the market has reached a low of $111,860, which means that support remains untested but intact. This makes it an important reference point for risk desks and traders.

The tradeCompass methodology at investingLive.com, which combines key levels, liquidity pools, and order flow signals, highlights $113,140 as the line that keeps Bitcoin bullish. Futures are currently trading at $113,450, which places the market above that threshold. In practical terms, Bitcoin is holding a range between $111,800 and $114,000, and staying inside this band improves the odds that it is attempting to build a floor.

Ethereum: guided by the $4,200 line

Ethereum continues to follow a similar pattern. The latest tradeCompass outlook remains bullish while ETH futures are above $4,200. The shift in liquidation patterns, combined with ETH holding over that level, makes $4,200 the most relevant marker for traders today. If the market sustains that line, Ethereum has room to stabilize and potentially rebound.

- Crypto Market Today: Binance Coin (BNB) Outshines Peers as Broader Crypto Flows Still Show Caution

- Crypto Prices Today: Sharp Selloff as Volume Spikes

- Enosys Loans Lets Users Mint First XRP-Backed Stablecoins on Flare

What this means for brokers and traders

For crypto brokers and exchanges, the sharp cooldown in forced selling reduces immediate stress but still calls for careful leverage and margin monitoring as open interest rebuilds. For traders and investors, the message is more straightforward. If Bitcoin holds above $113,140 and Ethereum above $4,200, the near term bias points toward stabilization and possible recovery. If either level gives way with another spike in long-side liquidations, the bearish pressure could return quickly.