WxTrade is preparing for its official launch at iFX EXPO Asia 2025 in Hong Kong, bringing first-hand fintech operating experience to the forefront of brokerage technology innovation. Purpose-built for modern broker operations, WxTrade presents a seamless Multi-Platform Trading Ecosystem—not just another interface—so firms can align people, processes, and technology under one controllable operating model.

WxTrade has developed a blueprint for engineering advanced brokerage infrastructure. At its core is a capable CRM and broker console designed to maximize operational efficiency through centralized control and coordinated workflows. This comprehensive approach addresses the industry’s critical gap: fragmented tools that slow onboarding, complicate risk and finance, and make it hard to surface compliance evidence precisely when it’s needed.

This blog maps the ecosystem of platforms that matter and shows how WxTrade’s comprehensive approach reframes trading technology for long-term scale and control. The goal is to help leaders decide which capabilities to activate first—and where a unified operating model outperforms a standalone platform. If you’d like to see how the pieces come together in practice, the team can walk through the architecture privately.

(Information only; not legal or compliance advice.)

The Platform Arms Race Is Over

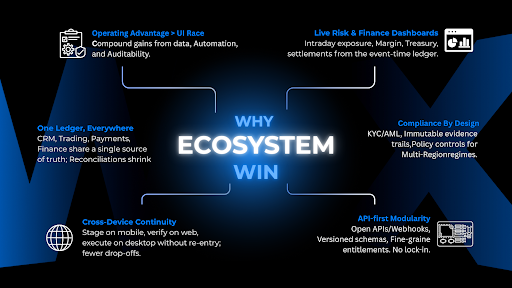

Front-end features commoditize quickly. Durable advantage has shifted to the operating system behind the brokerage: data models, integration fabric, workflow automation, and auditability. WxTrade is built around that operating model—so evaluation centers on time to onboard, risk visibility, and compliance readiness rather than the latest interface flourish.

What a Brokerage Ecosystem Actually Is

A brokerage ecosystem is a unified backbone connecting trading interfaces (desktop/web/mobile), CRM, client portal, risk, finance, payments, and retention tooling around a consistent identity and data model. In this approach, those modules are delivered as a one-stop service: consulting for entity formation and licensing pathways (jurisdiction-specific guidance), plus the core Client Portal and CRM that anchor daily operations.

The Canonical Layers

Think of the ecosystem as six quiet layers that work in concert rather than a checklist of features. Client interfaces feel consistent across desktop, web, and mobile, so traders can move between screens without losing context. A broker console brings everyday operations—onboarding, support, finance, and risk—into one place, giving small teams outsized control. The risk/finance core reads from the same source of truth as trading, so exposure, P&L, and funding needs line up without end-of-day drama. An engagement layer coordinates alerts and education so outreach feels timely instead of generic. Beneath it all, an integration fabric abstracts third-party services and trading terminals into a single operating model, keeping options open as the business evolves. And a governance layer turns normal activity into usable evidence, so audits don’t require reconstruction. If you’re curious how these layers take shape in practice—or which ones to activate first—happy to walk through the architecture privately.

The Unified Client & Account Data Model

At the heart of effective brokerage ecosystems is a normalized client/account schema that eliminates duplicate states. WxTrade data model emits event streams (positions, balances, financial transaction, KYC artifacts) that risk, finance, and portals consume in real time. This single source of truth reduces end-of-day firefighting, powers live dashboards, and creates clean, queryable audit trails.

Mid-Article Resource: For the step-by-step blueprint, see How to Start a Brokerage in 2025: The Essential Technology Stack for Long-Term Success (internal guide).

Third-Party Integrations That Actually Simplify Ops

To expand the platform—and push a brokerage’s capabilities beyond the limits of any single trading front end—the suite exposes open APIs and a webhook catalog that support third-party integrations as first-class citizens. Partners and in-house teams can extend workflows (onboarding, payments, risk, reporting), attach new regional payment rails, or add analytics and retention tools without re-architecting core systems. Versioned endpoints, idempotent flows, and entitlement controls keep these extensions stable and secure, while the integration fabric standardizes data contracts so multiple providers can run side-by-side. In practice, this API-first approach turns “platform constraints” into extensible surfaces—letting operators iterate faster, test new providers, and scale across regions without bespoke, fragile code.

Web-Based, Customizable, and Cost-Effective by Design

The quiet tax on growth is old tooling: desktop installs, look-alike portals, and rigid templates that slow every brand or UX improvement. A browser-native suite removes that tax. The client portal and CRM run fully on the web with SSO and responsive layouts for staff and traders, while a theme and layout system gives full control over colors, typography, components, and page structure—so the experience reflects the broker’s brand, not a template. Because these portals sit on the same unified data layer as risk and finance, changes to copy, onboarding flows, and segmentation land without re-plumbing data or duplicating state.

Build vs. Buy: Optionality Without Vendor Lock-In

Leaders are often boxed into a false choice: stitch together point tools (and inherit brittleness) or adopt a monolith (and lose leverage on data and roadmaps). A modular, API-first stack avoids both traps. Versioned endpoints and a webhook catalog expose events cleanly; guaranteed data-export rights (raw and modeled) support independent analytics and warehousing; and an orchestration layer decouples connectors from business logic so components can be swapped without destabilizing the rest of the system.

Your 90-Day Implementation Blueprint

Days 0–30: Identity + Unified Data

Finalize client/account schema, SSO, and event bus; cut over core identity and balances in our platform to establish the single source of truth.Days 31–60: Risk/Finance + Payments

Wire exposure and P&L calculators to the event stream; enable automated reconciliations; stand up treasury and settlement views.Days 61–90: Retention + Portal Self-Service

Launch alerts, segmentation, loyalty tiers; expose self-service actions (banking, limits, statements); instrument KPIs (onboarding time, first-fund time, 28-day retention). Depending on scope and jurisdiction, some teams target go-live in weeks rather than quarters [DATA NEEDED – SOURCE & YEAR].

Conclusion: Brokerage Ecosystems Create Compounding Advantage

Brokerage Ecosystems turn trading platforms into durable, controllable businesses by unifying client data, risk/finance, payments, and compliance. WxTrade operationalizes this approach as a one-stop service—consulting and setup plus the core CRM/Client Portal and third-party integrations—so gains in onboarding speed, reconciliation, retention, and audit readiness compound over time.

Soft CTA: Ready to operationalize this? Read How to Start a Brokerage in 2025: The Essential Technology Stack for Long-Term Success (internal guide).

Disclaimer: This article is for information only and does not constitute legal or compliance advice.

Internal anchor text ideas: how to start a brokerage in 2025; brokerage technology stack blueprint; unified data model for brokers; risk & finance dashboards; compliance by design for brokerages.