The brokerage technology conversation has shifted. While cloud platforms dominated discussions for the past five years, self-hosted infrastructure is experiencing a quiet resurgence — not because brokers are reverting to outdated models, but because they're discovering a third option that combines modern deployment speed with genuine operational control.

This isn't about choosing between yesterday's legacy systems and today's cloud rentals. Self-hosted infrastructure has evolved. Pre-configured platforms now deploy in weeks rather than years, cost structures have become predictable, and the technology itself has matured to the point where brokers gain cloud-level convenience without the limitations that come with vendor dependencies.

Yet misconceptions persist. Many brokers still operate under outdated assumptions about what self-hosting actually requires in 2025. This creates strategic blind spots — brokers who would benefit from self-hosted deployment remain on cloud platforms that increasingly constrain their economics, while others waste resources on custom development that solves problems already addressed by modern pre-built solutions.

Myth One: Self-Hosted Means Building Everything From Scratch

The most persistent myth equates self-hosted deployment with custom development. Brokers hear "self-hosted" and immediately envision eighteen-month timelines, engineering teams building trading engines from the ground up, and endless integration work connecting CRM systems to payment gateways.

This conflation made sense five years ago. Self-hosting typically meant custom builds. But the technology landscape has fundamentally changed. Pre-configured self-hosted platforms now exist—complete systems tested across multiple brokers and market conditions, ready to deploy on infrastructure you control.

The distinction matters operationally. Custom development requires architectural decisions about database schemas, API designs, and system integrations. Every feature represents months of specification, coding, testing, and debugging. You're not just deploying infrastructure; you're inventing it.

Self-hosted platforms eliminate this complexity entirely. Trading engines arrive already optimized for thousands of simultaneous instruments. CRM workflows come configured for KYC compliance and client lifecycle management. Payment integrations connect to regional banking networks and crypto settlement systems. The technology exists; deployment simply means installing it on servers you manage.

ScaleTrade exemplifies this approach — production-ready infrastructure deployed on broker-controlled servers in fourteen days. Not proof-of-concept systems requiring months of additional development. Complete platforms capable of accepting deposits, executing trades, and processing withdrawals from day one.

This architectural shift changes the strategic calculation. Brokers no longer choose between building everything themselves or renting someone else's infrastructure. A third path exists: proven systems, full control, rapid deployment.

Myth Two: Cloud Platforms Cost Less Than Self-Hosted Infrastructure

Cloud platform economics appear attractive initially. Low entry barriers, pay-as-you-grow pricing, no upfront infrastructure investment. Marketing materials emphasize these advantages heavily.

The economic reality shifts as operations scale. Cloud platforms typically tier pricing based on client count, trading volumes, and data consumption. What costs a few thousand monthly at launch can reach five figures as the business grows to thousands of active traders.

Self-hosted infrastructure follows different economics. Higher initial investment — server costs, deployment configuration, setup work — but fundamentally different long-term structure. Infrastructure expenses scale with actual resource consumption rather than arbitrary vendor pricing tiers.

The inflection point typically arrives between two and ten thousand active clients, depending on trading volumes and business model. Beyond this threshold, self-hosted economics increasingly favor the broker. Organizations running high data volumes often find self-hosting more cost-efficient long-term, as infrastructure costs grow linearly with needs rather than accelerating through vendor pricing structures.

For ScaleTrade clients, this translates to meaningful capital efficiency. The platform's architecture enables brokers to reduce IT infrastructure costs by approximately 30% compared to equivalent cloud solutions at scale — capital that can instead fund client acquisition, market expansion, or product development.

This doesn't mean cloud platforms never make economic sense. Brokers testing market viability or operating in regions where client acquisition proves challenging may benefit from lower initial investment. But brokers building businesses intended to scale beyond regional operations should evaluate long-term economics carefully rather than optimizing solely for year-one costs.

Myth Three: Self-Hosted Infrastructure Creates Security Vulnerabilities

The security perception typically favors cloud platforms. Professional security teams, regular audits, compliance certifications — the assumption that managed services inherently provide better protection than self-operated infrastructure.

Reality proves more nuanced. Self-hosted data stays behind your firewall with control over storage and access logs, eliminating exposure to vendor incidents that cascade across multiple clients. When cloud platforms experience security breaches, all tenants face potential exposure regardless of individual operational quality.

Self-hosted deployment provides infrastructure isolation. Security protocols can be tailored to specific risk profiles and client demographics. Penetration testing happens on schedules matching business requirements rather than vendor timelines. Incident response occurs under direct broker control rather than through support ticket systems where response speed depends on vendor prioritization.

This independence becomes particularly relevant as data sovereignty regulations expand globally. Data stored within specific borders is governed by that jurisdiction's legal framework, regardless of the company's headquarters location, creating compliance complexities for cloud platforms operating across multiple regions. European brokers managing GDPR-regulated information face strict data handling requirements. Middle Eastern operators entering markets with data residency mandates need clear infrastructure ownership.

ScaleTrade's self-hosted model addresses these requirements directly. Client data remains on broker-controlled infrastructure in specific jurisdictions, simplifying regulatory compliance and demonstrating operational resilience to authorities who increasingly scrutinize technology partnerships.

Myth Four: Self-Hosting Requires Large Internal Engineering Teams

Another persistent misconception positions self-hosted infrastructure as viable only for brokers with substantial technical departments capable of managing servers, debugging system issues, and implementing updates.

Modern self-hosted platforms challenge this assumption through comprehensive support models. Quality providers offer deployment assistance, ongoing technical guidance, and continuous platform updates while brokers maintain operational control.

This partnership approach delivers distinct advantages. Deployment expertise means technical teams handle initial setup, configuration, and testing — brokers benefit from experience deploying similar systems across different operational contexts. Ongoing support provides direct access to engineering teams for integration assistance and troubleshooting. Platform updates deliver new features, security enhancements, and performance improvements without internal development work.

ScaleTrade's model illustrates this structure. Brokers control their infrastructure and benefit from expertise that would require substantial full-time engineering teams to replicate internally. Documentation, training materials, and best practices developed across multiple deployments become available to each client.

The practical result: self-hosted deployment doesn't mean operating in isolation. Brokers gain infrastructure independence without assuming the full technical burden of maintaining sophisticated trading systems alone.

Myth Five: Migration From Existing Systems Creates Unacceptable Disruption

Established brokers face different challenges than startups. Active client relationships, ongoing trading operations, revenue flows that can't pause for technology upgrades — legitimate concerns that make migration feel risky regardless of the destination platform's quality.

The assumption that platform migrations inevitably cause operational chaos stems from experiences with all-or-nothing cutover approaches. Legacy systems shut down on specific dates, clients forced to new platforms immediately, support teams scrambling to handle unfamiliar workflows under pressure.

Modern migration strategies avoid these problems through parallel operation. New platforms run alongside existing systems during transitions. Clients migrate gradually rather than facing forced cutover dates. This allows testing under real trading conditions while maintaining existing operations.

Data portability ensures client information, trading history, and account balances transfer without loss or corruption. Regulatory audit trails remain intact across transitions. Client communication becomes personalized outreach explaining upgrade benefits rather than urgent notices about mandatory system changes. Team training happens while existing infrastructure handles daily operations, eliminating pressure to master new workflows overnight.

This staged approach transforms platform migrations from risky disruptions into manageable upgrades. ScaleTrade's migration framework demonstrates this model — established brokers improve infrastructure quality without the client attrition that typically accompanies major technology changes.

When Self-Hosted Infrastructure Actually Makes Strategic Sense

Not every broker benefits equally from self-hosted deployment. The decision depends on specific business characteristics, growth trajectories, and strategic priorities.

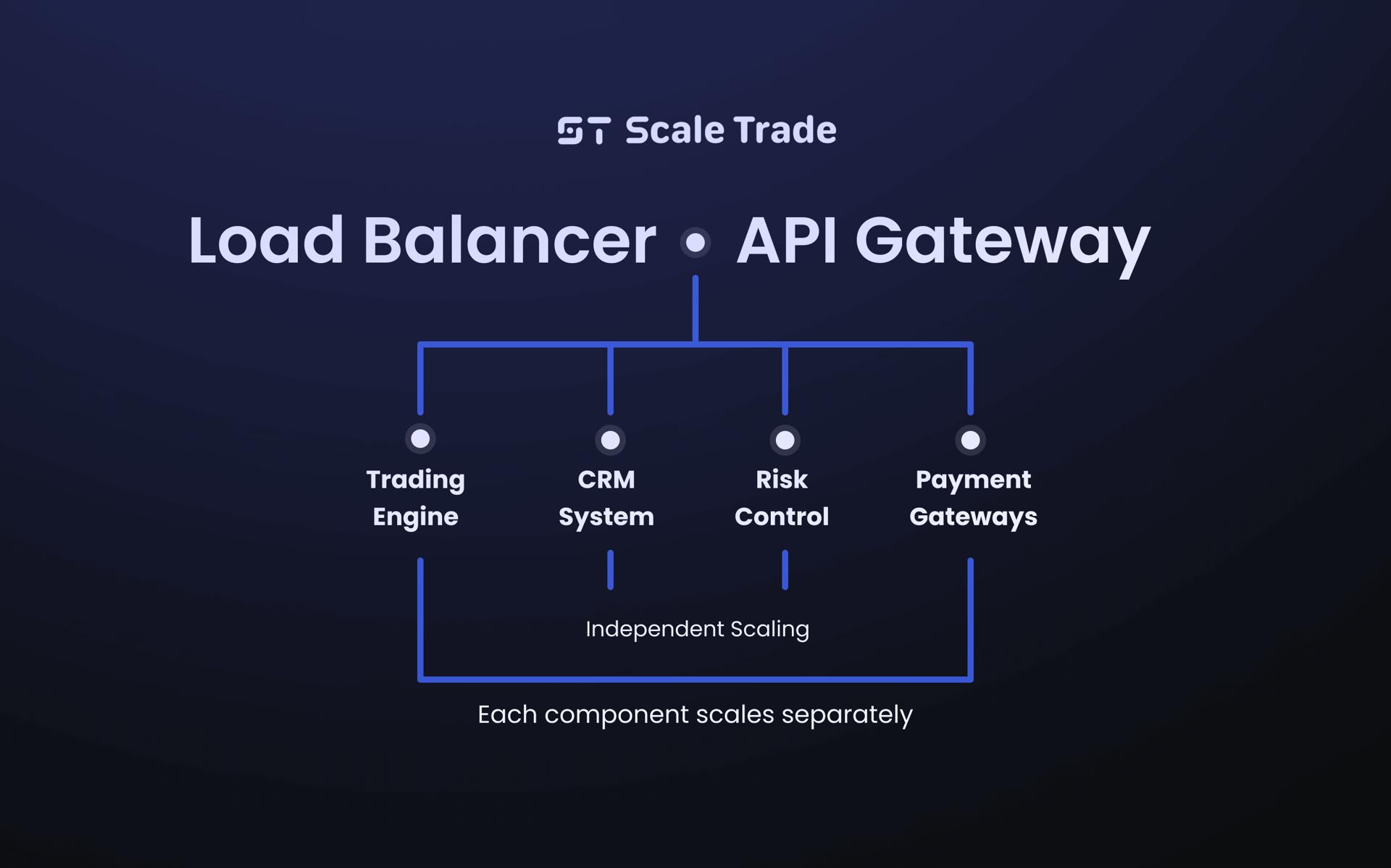

Most broker platforms treat components as separate tools. CRM lives in one system, trading infrastructure in another, analytics dashboards pull data from multiple sources, risk management operates independently. This fragmentation creates operational friction that compounds as the business scales — teams spend hours reconciling data across systems, decisions get delayed waiting for manual reports, automation breaks at the boundaries between disconnected tools.

ScaleTrade takes a fundamentally different approach. The platform unifies analytics, automation, and trading processes into a single ecosystem where data flows seamlessly between components. Client acquisition metrics connect directly to CRM workflows. Trading activity feeds real-time risk analytics. Payment processing integrates with compliance monitoring.

The alternative — cobbling together best-of-breed tools from different vendors — sounds appealing until integration costs and operational complexity become apparent. Each new connection point represents potential failure during peak loads. Each data transfer between systems creates opportunities for inconsistency. Each separate vendor relationship multiplies support complexity when issues arise.

Self-hosted infrastructure suits particular broker profiles especially well:

Startups with capital access

Brokers securing seed funding benefit from infrastructure investment that improves unit economics during growth rather than creating escalating recurring costs that erode runway. The initial investment becomes strategic positioning rather than premature optimization.

Established brokers upgrading legacy systems

Firms outgrowing MetaTrader installations or proprietary platforms built years ago. Operations requiring infrastructure independence without custom development timelines or cloud platform limitations.

Multi-jurisdiction operators

Brokers expanding internationally need compliance flexibility and data residency control that cloud models complicate. Regulatory requirements fragment dramatically across markets — European MiFID II differs substantially from Middle Eastern frameworks, and each implements distinct approaches to leverage limits and reporting obligations.

High-volume operations

Brokers process significant daily trading volumes where self-hosted economics provide substantial advantages at scale. The cost differential compounds as transaction counts increase.

Prop trading firms. Operations requiring deep platform customization, specialized risk controls, or trading strategies benefiting from infrastructure-level optimization. Firms needing copy trading modules for managed account programs.

Conversely, brokers testing market viability with limited capital or operating in regions where client acquisition proves challenging may benefit from cloud platforms' lower initial investment despite less favorable long-term economics.

The Technology Partnership That Makes Self-Hosting Practical

The evolution toward pre-built self-hosted platforms represents architectural innovation more than marketing repositioning. This changes what brokers can realistically accomplish.

ScaleTrade's approach illustrates the model: complete trading infrastructure — web, mobile, and desktop applications delivering consistent experiences across devices — support for thousands of simultaneous instruments across forex, cryptocurrencies, stocks, indices, and commodities. Order execution engines processing massive transaction volumes without latency degradation during peak activity.

Complete CRM systems handling onboarding workflows, document verification, KYC compliance, and analytics. Automated communication for client engagement, support ticket management, conversion tracking from initial contact through ongoing activity. Risk controls monitoring positions across all accounts in real-time, automated exposure limits preventing catastrophic losses, margin call workflows, stop-out procedures.

Pre-integrated connections to multiple liquidity providers offering competitive spreads and reliable execution. Gateway integrations supporting international wires, regional banking networks, and emerging payment methods. Compliance tools generating regulatory reporting in jurisdiction-specific formats, audit trails meeting scrutiny standards, configurable leverage restrictions based on client classification and jurisdiction.

This infrastructure exists and functions. The question for brokers becomes whether to access it through cloud rental or self-hosted deployment — not whether to build it from scratch or accept feature limitations.

Infrastructure as Competitive Foundation

Brokerage markets reward operational efficiency, execution quality, and client experience. Brokers spending excessive resources on platform costs or fighting infrastructure limitations have less capital for client acquisition and market expansion.

Infrastructure decisions made during early stages determine what becomes possible later. Custom development appropriate for initial scale often becomes a maintenance burden limiting agility. Cloud platforms adequate for early operations can become cost centers as the business grows. Self-hosted infrastructure designed for scalability from inception supports growth trajectories that would require expensive migrations on alternative platforms.

The choice framework has evolved beyond the traditional cloud-versus-custom dichotomy. Pre-built self-hosted platforms provide production-ready infrastructure, genuine operational control, deployment speed matching cloud models, and cost structures improving rather than degrading as operations scale.

For brokers building sustainable businesses with genuine growth ambitions, infrastructure independence represents competitive advantage. ScaleTrade delivers this independence without the timelines and costs that made custom development prohibitive historically — complete infrastructure control deployed in fourteen days, no vendor lock-in, production-ready technology tested across multiple brokers and market conditions.

That's the infrastructure foundation modern brokerages actually require: proven systems under their control, ready to support growth from launch through scale.

Building for Scale Without the Custom Development Burden

The conventional path to sophisticated infrastructure involves substantial in-house development. Hire engineering teams, build proprietary systems, customize everything to precise specifications. This approach promises complete control and perfect alignment with business requirements.

The reality proves far more expensive and time-consuming than initial projections suggest. Engineering teams capable of building production-grade trading infrastructure command premium salaries. Development timelines extend as complexity reveals itself. Maintenance demands grow continuously — every new feature, every security patch, every regulatory requirement needs custom implementation.

More fundamentally, in-house development diverts focus from core business activities. Leadership attention shifts from client acquisition and market strategy toward technology project management. Capital that could fund growth instead covers engineering salaries and infrastructure costs. The broker becomes a technology company that happens to operate in financial markets rather than a financial services firm leveraging technology strategically.

ScaleTrade eliminates this burden without sacrificing sophistication or control. The platform arrives production-ready with features that would take internal teams months or years to build — then deploys on infrastructure brokers manage completely. This combination resolves the core tension: brokers get enterprise-grade technology without enterprise-scale engineering departments.

For established brokers already operating on legacy platforms or basic cloud solutions, migration to ScaleTrade happens through carefully structured transitions rather than disruptive system overhauls. The platform runs in parallel with existing infrastructure initially. Client data migrates gradually with comprehensive validation at each stage. Trading operations continue uninterrupted while teams learn new systems. Support processes transition smoothly as confidence builds.

This measured approach matters enormously for brokers concerned about migration risks. Platform changes that force immediate cutover dates create genuine operational hazards — rushed training, confused clients, support teams overwhelmed with unfamiliar workflows. ScaleTrade's migration framework transforms these risky transitions into controlled upgrades where each phase completes successfully before the next begins.

The result: brokers gain sophisticated, scalable infrastructure without the development burden that makes custom builds prohibitive or the migration chaos that makes platform changes dangerous. They move to better technology on timelines that protect operational stability while accelerating capability improvements.

Infrastructure choices compound over time. Before scaling further, evaluate whether your current platform will support — or constrain — your growth trajectory.

About ScaleTrade

ScaleTrade provides pre-configured self-hosted trading infrastructure for brokers and proprietary trading firms. The platform supports multi-asset trading, complete operational management, and regulatory compliance across jurisdictions. With deployment typically completed in 7 days, ScaleTrade enables brokers to launch with enterprise-grade technology while maintaining full operational control and infrastructure independence. Managed self-hosted models provide vendor support while preserving the ownership and cost advantages that drive long-term business sustainability.