The second full week of January in the financial markets was relatively quiet in comparison to the first week. Volumes were muted across the board, as stocks, and metals have entered consolidation areas. The series of events within the week included the US CPI report and earnings reports of financial companies from the US.

So far, the data hasn’t added anything: the CPI report was slightly softer than expected (2.5% vs 2.6% anticipated), though probabilities of the interest rate kept unchanged for two upcoming meetings of FOMC have increased. Despite that, yields of 30-year bonds of the US have declined displaying some safe haven demand.

30-year bond yields for the US. Source: https://www.cnbc.com/quotes/US30Y

The main intrigue within the week, however, was not the interest rate. It was a geopolitical factor: the unrest in Iran and the related threat from the US president Donald Trump to Iran’s authorities, has created a speculation for Crude oil.

Despite the softening rethorics, there’s still a possibility of a strike from the US towards Iran. Markets, however, seem to not bet on any escalation, as volatility dropped across the board, with Gold keeping in the tight trading range, indices shaking within the range, and Crude oil erasing most of the week’s rally.

Tech stocks back in play

Nasdaq was lagging behind Russell2000 and S&P500 during the first two weeks of January, as basic material, industrial, and oil stocks were moving in a bullish rally.

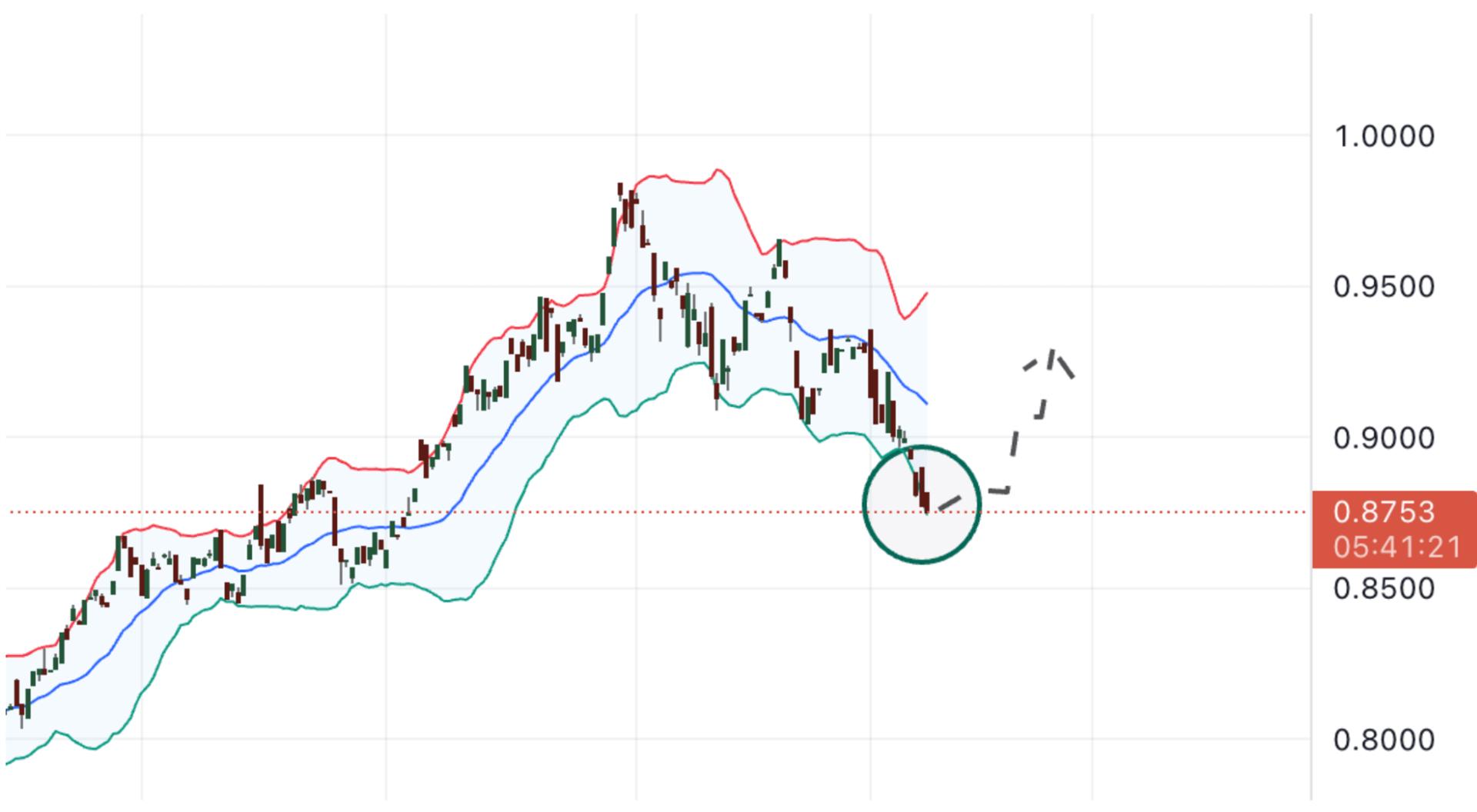

The spread between tech and industrial stocks has reached the lower band of the Bollinger Bands (which stands for 2 standard deviations from the 20-day moving average).

Usually, that is a moment for rotation, and Nasdaq might fuel up the rally at the 2nd part of January.

XLK/XLI spread: it indicates the ratio between two ETFs representing tech and industrial sectors respectively. If the spread reaches the supposed bottom of the trading range, it’s expected to bounce, which usually means acceleration of the sector in the numerator. Source: Tradingview.com

The CNN’s fear-and-greed index also flashes a “greed” mode, having good strength and momentum, whereas breadth (i.e. the stability of the flow) is neutral, but not negative.

Next week, traders will await the publication of the PCE index on Thursday (also known as “FED’s inflation”). The World economic forum in Davos will take place between 19 and 23th of January, and traders will also focus on statements and speeches of politicians and central bankers,

Now, let’s dive into the performance of Nasdaq and Gold, and try to figure out the possible track for the upcoming period.

Gold (XAUUSD)

Gold has reached the new all-time-high, not being able to keep the momentum and having locked in a consolidation for several days, as demand for safe haven assets. Volume and open was rising for Gold futures according to the data from Chicago Mercantile Exchange, but the price action didn’t confirm the follow-through.

That skews probability for some correction, as the market would need to deleverage before resuming the uptrend. From a technical standpoint, the price is locked in a very narrow trading range (coil), and if the new peak won’t be achieved early in the week, the possibility of a correction would increase: that might push the price towards the $4500 area as shown at the chart.

Gold (XAUUSD), D1. Source: Exness.com

Nasdaq

Nasdaq might be completing the consolidation phase before making another leg up. Technical and financial sectors were lagging behind other sectors (basic materials, industrial, energy sectors), but should the bull market continue, the rotation of sectors might start and drive Nasdaq from the trading range as shown at the chart.

The market is entering the earnings season, and many big tech companies were in a drawdown (AAPL, NVDA, PLTR) dragging the Nasdaq down. If the buying activity will get back to techs, we might observe another round of buying for the US tech sector.

Nasdaq (USTEC), D1. Source: Exness.com