Mini apps on Telegram started gaining serious traction last year, with (as per Telegram) over half a billion of their existing users interacting with them. Now brokers are joining in with notable success. Why has this trend taken off, and how does it all work?

The success that’s validating the trend

Naga, a multi-asset social trading broker, was one of the first to launch a fully integrated trading service via Telegram mini apps last year. After only a few months of being live, they reported the mini app was already contributing to 8% of new client acquisition.

We also saw Blum, a crypto trading firm, launch solely as a Telegram mini app last April. By the end of 2024 they were listed as one of Telegram’s most visited mini apps. As of last month (May 2025), they have a daily trading volume of USD 250 million, which is a 400% increase since launching. In an interview, Blum CEO shared that more than 50% of active users were crypto newcomers, and ‘hadn’t interacted with web3 before’.

This is extremely telling of the new user acquisition opportunity Telegram’s enormous user base offers.

What is a Telegram mini app?

Think of ‘apps within apps’. There is a tab in Telegram, where users can search and open mini apps, like one would in an Apple or Google Play store. The main difference is that they don’t have to leave their Telegram app, and they don’t have to download another app. It simply opens and launches directly from Telegram.

For users, this means less clicks and a better experience. For brokers, in addition to accessing a huge new market, it means avoiding app stores. A very attractive capability for many firms struggling with strict app store approvals and requirements, and also agency over their services post-launching.

After a broker launches a mini app on Telegram, they can take advantage of deep-link buttons for channels and chats, Telegram ads, referral campaigns, and analytics features like Telemetree to analyze performance.

Can mini apps offer the same functionality as traditional apps?

In short, yes. The mini apps support authorization, third-party payment providers (Google Pay and Apple Pay), unique alerts and push notifications, and Telegram has launched a Wallet service to further centralize payment-related functionality.

KYC and onboarding capabilities to gather ID documents, complete onboarding processes, and process deposits are also supported.

According to Telegram, mini-apps are extremely flexible interfaces that can replace any website.

How do brokers launch Telegram mini apps?

Telegram provides brokers with documentation and a Software Development Kit that makes launching straightforward. However, looping back to our initial ‘in short yes’ statement: for brokers, an asterix is needed here, given that they need highly secure and advanced performance, due to the nature of their services, in comparison to say a game or photo-editing app, for example.

Let’s get into what this means in terms of launching for brokers. Would they need to build their own mini app, and how is it done?

How can brokers launch a mini app that’s secure and capable of performing at a level needed for brokerage services?

This has not only caught the attention of the brokers and users. Software vendors who have experience building apps/mini apps are already pivoting to leverage the demand.

Making sure it's worth it. What brokers will need to ensure:

To properly take advantage of this opportunity, brokers will need to make sure their mini app is not a frustrating web version of their traditional app. This could defeat the whole exercise and sabotage the easy acquisition that’s on offer.

Fintech vendors that already specialize in fintech apps can easily build and integrate a mini app into existing trading, CRM, risk, and compliance flows for brokers.

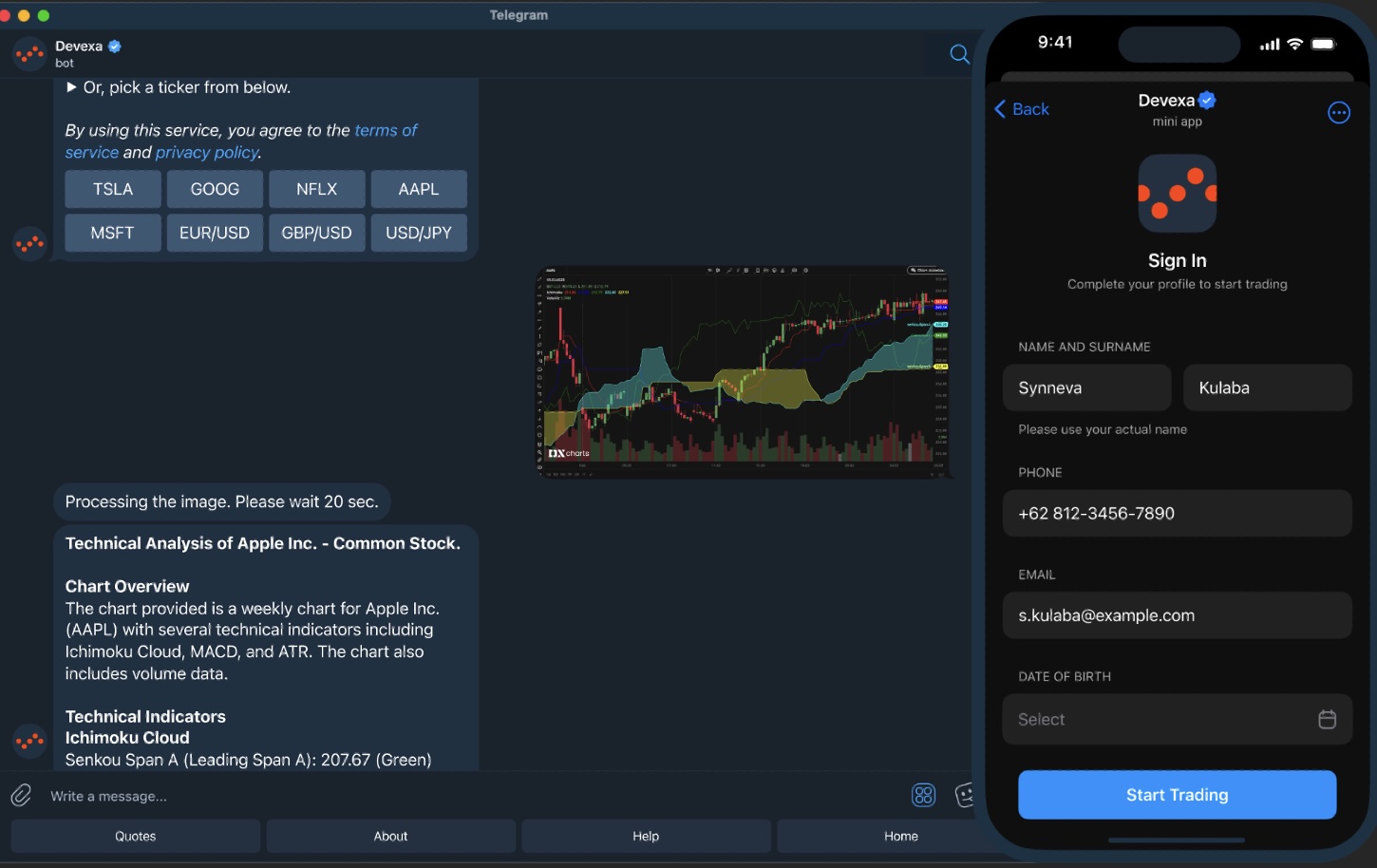

Devexperts, for example, is behind DXtrade native mobile apps, and Devexa, which focuses on using new AI capabilities to offer traders unique in-app trading features like DCA and recurring orders. (Directly from the chat of whatever social app the trader is using (e.g Telegram, WhatsApp). So, with fintech apps alongside trading platforms already their bread and butter for years, they’re now offering brokers fast industry-grade mini app solutions using their existing expertise and developers.

Will this trend become a new norm?

Among other features, Telegram has been rolling out a steady flow of fintech-related functions, including token-gated social trading, on-chain settlement, and one-tap DeFi. It seems that all the infrastructure needed to ensure mini apps are not just lightweight ‘nice to haves’, is being put into place. And, we already have live examples of successful mini apps that provide full-scale trading environments. With major names like TradingView already launching their own Telegram mini app, and global vendors like Devexperts offering to build mini apps for brokers, it looks like more brokers are going to follow suit, and we will see continued growth in the space.