Quant trading firms are facing trading infrastructures that often fails at the very moment markets offer the richest opportunities.

In one recent US policy shock, intraday equity volume jumped to 29 billion shares, around 190% above typical levels, yet only 3% of surveyed firms say they captured all the opportunities that volatility created.

According to Exegy and Acuiti's report, almost three‑quarters reported market data stress in high‑volatility episodes, while 20% admit they have no backup market data solution at all, and fewer than one‑third believe their current front‑office stack can cope with the volumes they expect by 2030 without further investment.

Liquidity Leaves the Classic US Session

Liquidity in US and European markets now spreads across extended hours and more venues, instead of clustering in a single daytime window.

- Offering Liquidity, Not Illusions: The Tough Road to B2B for Brokers

- Regulatory Shifts Reshape Trade Reporting: Liquidity Provider Agreements Require Changes

- If These Aren’t in Your Brokerage’s Liquidity Agreement, Something’s Wrong

Survey respondents report thinner depth on traditional exchanges and missed trades during volatile spells. Firms that built infrastructure around the legacy US cash session now struggle to follow price formation that continues overnight and across time zones.

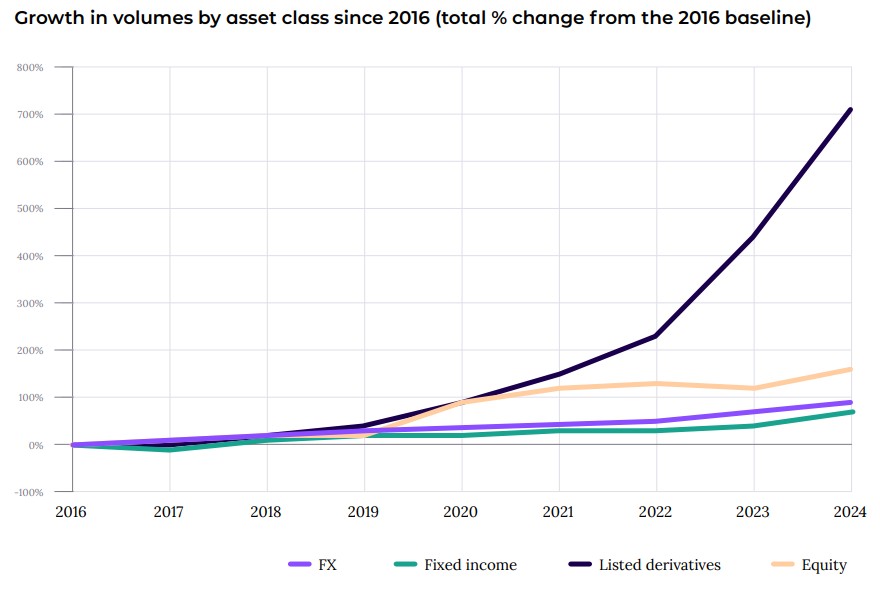

Average daily US equity volume often meets or exceeds 10 billion shares and reached roughly 12.2 billion shares in 2024, about 24% more than in 2023. Listed derivatives also posted record or near‑record volumes, lifting baseline data loads across asset classes.

Regulatory tweaks add further pressure. The SEC’s expansion of half‑penny quoting increases quote churn and message rates, while new price‑based round‑lot definitions force systems to reference and apply daily data instead of relying on static 100‑share assumptions.

Related: Offering Liquidity, Not Illusions: The Tough Road to B2B for Brokers

Only 27% of firms say their current front‑office infrastructure can handle 2030 volumes without more investment.

“Volatility has been an ever-present factor in global markets since 2020 and this is presenting both significant opportunity and also challenges for quant firms,” commented Ross Lancaster, head of research at Acuiti.

“This research suggests that firms are increasingly missing opportunities not because of strategy, but because their infrastructure cannot absorb today’s volumes and structural complexity.”

Almost three‑quarters of respondents saw latency spikes, dropped packets or full outages during high‑volatility periods, with market data processing the first layer to struggle. Only 3% say they captured all the opportunities that volatility presented; 43% captured most, while the rest missed a large share.

Crypto Integration Adds 24/7 Load

Firms expect the fastest market data growth in crypto, ahead of equities , fixed income and FX. The rise of Bitcoin futures and other crypto‑linked products on traditional venues such as CME shows how digital assets now embed within established market structures.

Latency still ranks as a key competitive factor. Around 62% of firms say they must remain competitive on latency and 24% say they need to be at the front of the pack.

On redundancy, 20% of firms have no backup market data solution and many others rely on cheaper backups that sacrifice latency or vary by asset class to contain costs.