The brokerage revenue of the Cypriot entity of Trading212 more than doubled to £42.2 million in 2024. Furthermore, Germany’s FXFlat brought in over £1 million after its acquisition.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Solid Revenue for the Group

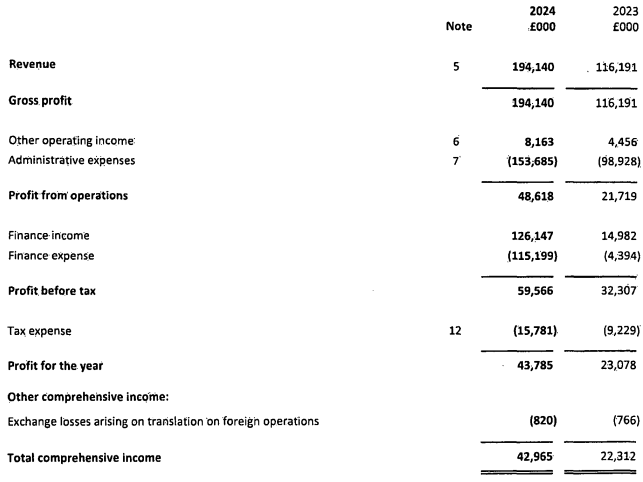

The figures came as the Trading212 Group revealed it generated more than £194 million in revenue in 2024, a yearly jump of 67.2 per cent.

“The 67 per cent growth in revenues year on year continues to demonstrate the increasing popularity of technology-based trading and wealth-building apps that allow the new generation to manage their financial portfolios using tech that is both familiar to them, whilst removing significant costs of both entry and ongoing transaction-based costs,” the latest Companies House filing of the company noted.

FinanceMagnates.com earlier reported that the UK unit generated £161.7 million in revenue in 2024, netting £39.7 million in profit. The UK unit generated £150 million from investment brokerage services, while the rest came from interest income.

The group numbers include the performance of several Trading212 subsidiaries, which include entities in the UK, Bulgaria, Cyprus, Australia, and FXFlat in Germany. It completed the acquisition of FXFlat in July 2024 and began onboarding new clients under the brand in January 2025.

The net profit of the group came in at £43.8 million, compared to £23 million in the previous year, meaning the non-UK entities were also profitable overall.

Trading212 Is Spending Heavily on Marketing

The administrative expenses of the group also jumped significantly. It spent more than £65 million on advertising and marketing, which was an increase of almost 110 per cent. FinanceMagnates.com earlier reported that the UK unit alone spent £39.5 million on marketing.

Staff costs also increased to £27.7 million. The group had 422 staff by the end of 2024, up from 320 in the previous year.

The group further revealed that during 2024, the number of funded Invest/ISA accounts jumped 52 per cent, monthly active users rose 85 per cent, and monthly active traders increased 113 per cent.

The total value of client deposits on the platform also increased by 286 per cent, while total client money rose 409 per cent.

Meanwhile, the group also incorporated a separate entity in Cyprus and obtained a crypto licence last year. Although its plans for crypto offerings have yet to be revealed, it recently onboarded a head for its crypto operations.

Read more about Trading212: