As retail investors in the US continue their steady migration from mutual funds to exchange-traded funds (ETFs), an unintended casualty may be the commission-free trading model that has defined the past decade of retail brokerage. According to JP Morgan, as reported by Reuters, US brokers and custodians may start seeking distribution fees from ETF managers.

The zero-commission model began in earnest in 2013, when Robinhood popularised free trading through a slick mobile interface. Millions of first-time investors followed.

Legacy players soon capitulated. In 2019, Charles Schwab cut online trading fees on US equities, ETFs and options from US$4.95 to zero.

Why the Shift to ETFs Hurts Revenue

Mutual funds, long a staple of retail portfolios, typically paid distribution or servicing fees to brokers in exchange for shelf space and access to clients. ETFs, by contrast, trade like stocks and were swept into the same zero-fee regime. To offset the loss of commissions, brokers turned to payment for order flow (PFOF), routing client orders to market-makers in exchange for rebates. That reliance has since waned, as regulatory scrutiny has intensified.

- Tradeview Executives Break Down Zero-Commission Model in US Stocks

- Robinhood Seals Bitstamp Acquisition, Marks Entry into Crypto Trading

- 80% of CFD Brokers Plan Futures Pivot as Regulatory Squeeze and US Competition Intensify

As investors rotated out of mutual funds and into ETFs, a dependable revenue stream quietly dried up.

The scale of the shift is striking. According to analytics company FactSet, more than 1,000 ETFs were launched in the United States last year, pushing total ETF assets to roughly US$13.5 trillion. The US Federal Reserve noted in 2025 that strong inflows into equity ETFs over the past decade had coincided with “notable outflows” from equity mutual funds.

For brokers, this represents a double squeeze: declining fund-related payments and no explicit commission income from ETF trading.

The Case for ETF Distribution Fees

JP Morgan estimates the US ETF management-fee pool at around US$21 billion annually. If intermediaries were to capture 10-20% of total expense ratios, this could translate into US$2-US$4 billion a year in new costs for fund managers.

The bank argued that urgency is growing, particularly if regulatory changes accelerate the tax-free conversion of mutual funds into ETFs.

The burden, however, would not fall evenly. Large players such as BlackRock and Vanguard are likely to wield enough market power to negotiate favourable terms. Mid-sized managers may find themselves with less room to manoeuvre.

Pressures for Diversification Increase

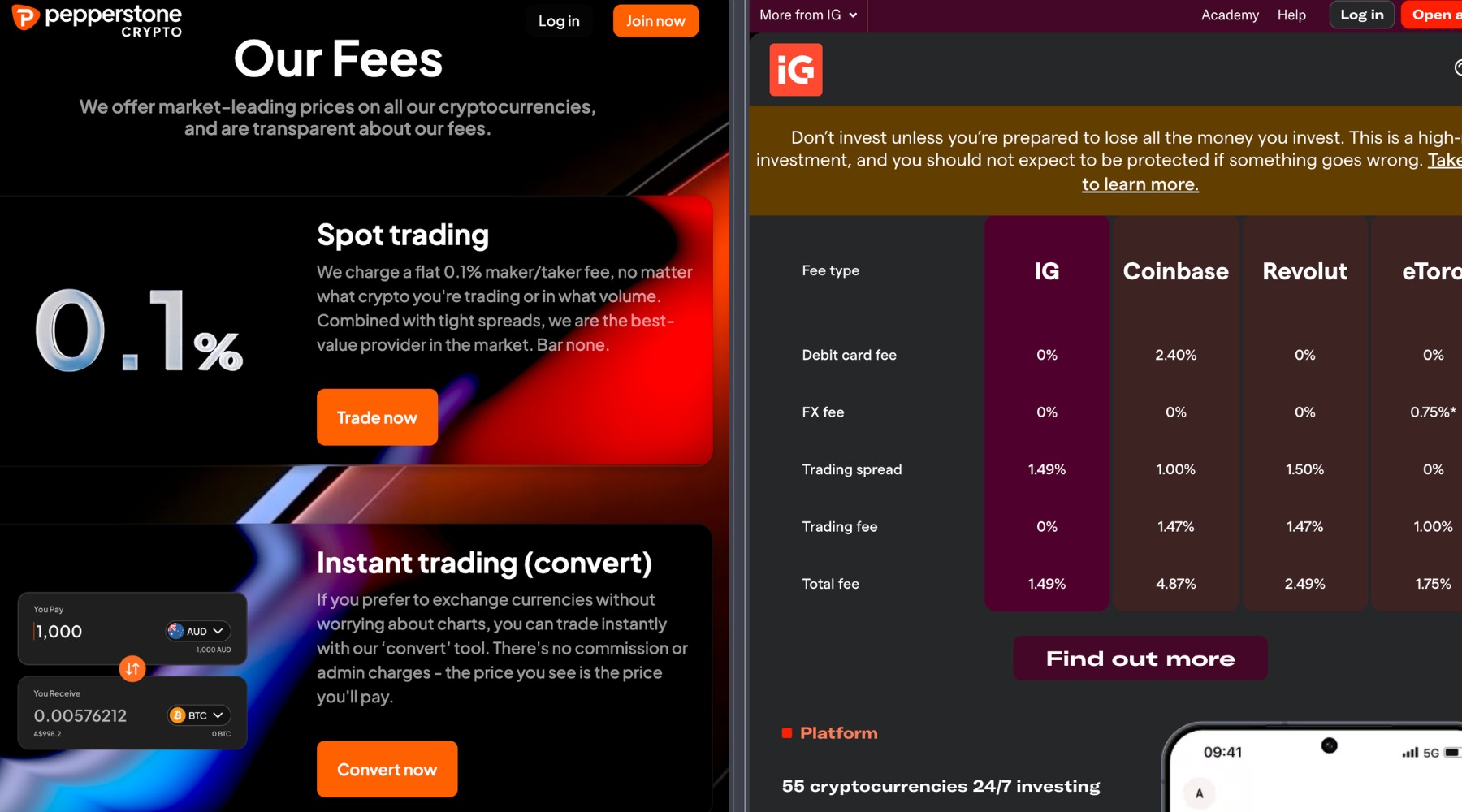

Meanwhile, US retail brokers are eyeing Europe for diversification, including Robinhood, which acquired Luxembourg-based crypto exchange Bitstamp Ltd. to expand its crypto offerings. Indeed, the traditional retail FX and CFD landscape is converging with crypto. .

In a recent interview with Finance Magnates, Kaledora Fontanta Kiernan-Lin, the co-founder and CEO of Ostium, a blockchain-based perpetual swaps platform, argued that decentralised finance will further disrupt the global CFD market within five years, a shift that could further erode over-the-counter revenues and accelerate the industry’s move toward exchange-style products.

Among other strategies, many brokers are now also increasingly giving retail traders access to tools and market structures once reserved for institutional investors.

Taken together, these shifts suggest that the zero-commission model will continue to lose ground, as brokers diversify products and geographies to make their economics more resilient.