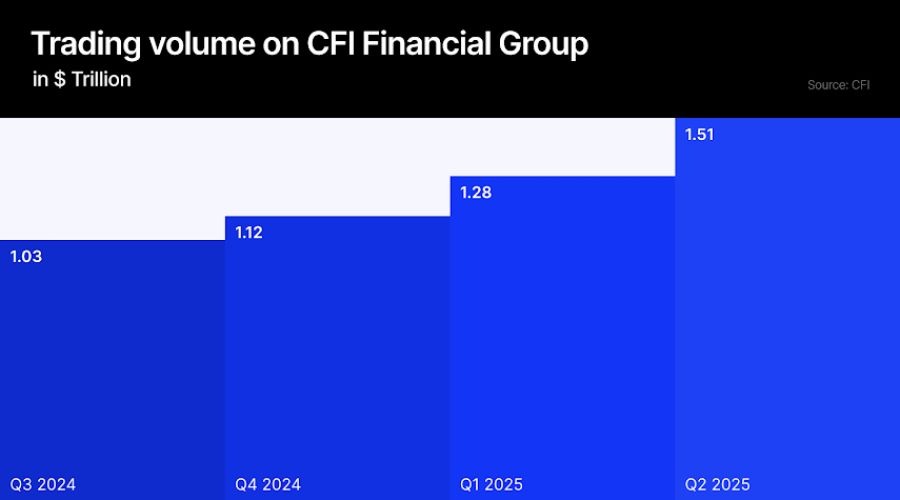

CFI Financial handled a record $1.51 trillion in trading volume during the second quarter of 2025. In comparison, the broker’s trading volume for the entire year of 2024 was $2.79 trillion, showing the growing interest in retail trading.

The record figure includes the period when US President Donald Trump’s tariff policies caused significant market volatility and lifted trading activity. Some retail trading market participants even said those were their “strongest days.”

Publicly listed IG Markets, which also noted April as a month with “higher levels of client trading activity than expected in typical market conditions,” recently reported record annual results.

Read more: Inside IG Group’s FY25 Results—Divestment, Marketing Costs and More

Quarterly Number Dwarfs Half-Year Figures

Announced today (Monday), CFI’s latest quarterly figure was 18 per cent higher than Q1 2025 and nearly double—specifically a 97 per cent rise—compared to the same quarter last year.

Another noteworthy comparison is that the Q2 volume jumped 110 per cent over the first half of 2024 and 31 per cent over the second half.

As for the number of traders, the broker said that funded accounts on its platform increased by 2 per cent in the first half of 2025 compared to the previous six months, with a year-on-year rise of 60 per cent.

Active accounts also increased by 22 per cent compared to H2 2024 and 84 per cent over H1 2024.

“Q2 2025 was not only about numbers, it was about momentum,” said Ziad Melhem, who became CFI’s Group CEO during the record quarter. Meanwhile, the two co-founders, Hisham Mansour and Eduardo Fakhoury, stepped down from their Managing Director roles to become Chairman and Vice Chairman, respectively.

Related: CFI Continues Its Sports Bet in the Middle East

The Race to Expand in the Middle East

CFI also grew its geographical presence. The broker launched operations in South Africa last December and recently entered Bahrain with a licence from the country’s central bank.

However, CFI—already well-established in the Middle East—is not the only broker expanding in the region. Tickmill recently opened an office in Oman through a local partnership, just a couple of months after OneRoyal, another CFD broker, set up its presence in the country. XS.com was another broker to expand, choosing Kuwait.

The most popular Middle Eastern destination for international CFD brokers, however, remains the UAE. The country’s clear financial regulation and large talent pool have attracted many brokers to set up base in the desert city.

Increased trading activity among Middle Eastern clients has made the region a top priority for many firms. Capital.com previously reported that 53 per cent of its Q1 trading volume came from the Middle East, compared to 24 per cent from Europe. That broker handled $656 billion in trading volume during the quarter and has yet to release its Q2 figures.