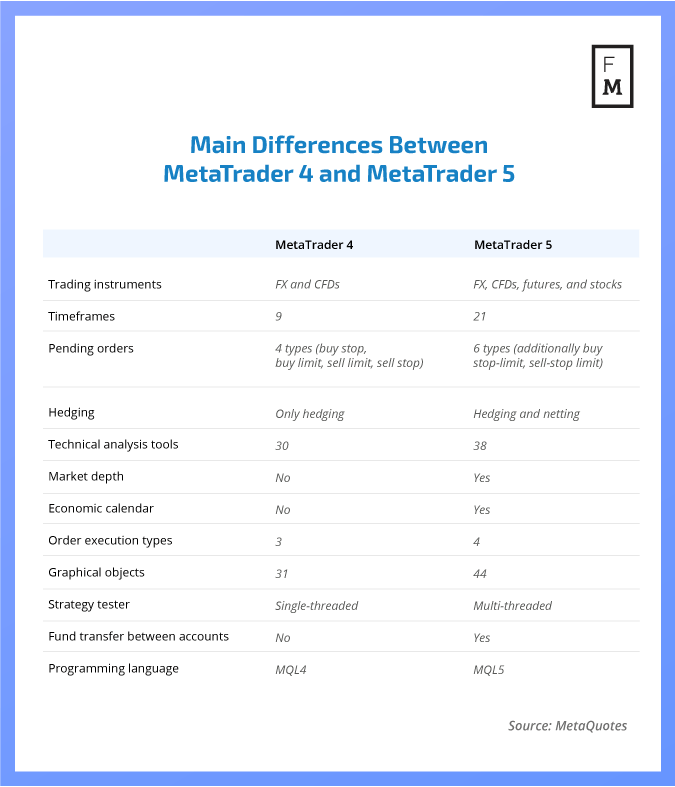

MetaQuotes, the Cyprus based software company originating from Russia, offers the most recognized and well-known Trading Platform of the retail trading industry. The real technological breakthrough came in the last decade when MetaTrader 4 (MT4) ) was released, and since then has been the most common choice of investors in different parts of the world.

The platform has become the flagship symbol of dynamically developing retail electronic trading, and almost 15 years later, despite its "old-fashioned" design and the emergence of a huge number of alternative apps and proprietary brokerage platforms, MT4 still retains a dominant position. Meanwhile, the refreshed version, MetaTrader 5 (MT5), has been available on the market for nine years.

Nevertheless, MetaQuotes still encounters considerable difficulties in making it the first choice among brokers and their clients. Finance Magnates tried to find an answer to this unusual phenomenon during talks with several FX/CFD brokers. The findings were summarized in the newest edition of the Quarterly Industry Report brought to you by our Intelligence Department.

An improvement for trading firms, but not for traders?

MetaQuotes made an official announcement in January 2018 that it is no longer selling the MetaTrader 4 trading platform. The company elaborated that the system is outdated and cannot be developed further. It should be noted that the decision came amid an increasing push for MetaTrader 5 adoption which started in 2016. Before MetaQuotes decided to stop selling MT4 completely, it first offered preferential license purchase rates to brokers for a newer platform, while increasing the fees for the earlier version.

Despite the developer's actions, a large number of clients still prefer MT4, so brokers keep the platform on offer. However, according to industry participants, for the investment firms themselves, the version no. 5 is definitely more advantageous. MT5's supremacy over MT4 when it comes to additional features was confirmed by Piotr Baszak, Head of Trading Department at TMS Brokers Dom Maklerski. "From MQ we know that the main idea behind building MT5 platform was to make the architecture of the system more reliable and be prepared to support also other asset classes. MetaQuotes does not work on development on new features in MT4. MT5 now is the priority. When it comes to interfaces MT4 and MT5 are similar therefore we do not see clients having problems with MT5."

Clients’ interests show, however, that they still prefer to use MT4 - at least in terms of traditional FX and CFD trading. The monopoly that MT4 has established during recent years ironically works against MetaQuotes' attempts to promote MT5. Clients are more comfortable with MetaTrader 4 due to its stability, availability, myriad of add-ons and extras created by the strong community.

MT4 is still vital

According to data gathered by Finance Magnates' Intelligence Department, MetaTrader 4's market share amongst top brokers still looks very healthy. Throughout 2018, and in individual quarters, around 50-55% brokers offered MT4.

To get the full article together with in-depth data and the bigger-picture perspective on the MT4 situation, get our latest Quarterly Industry Report.