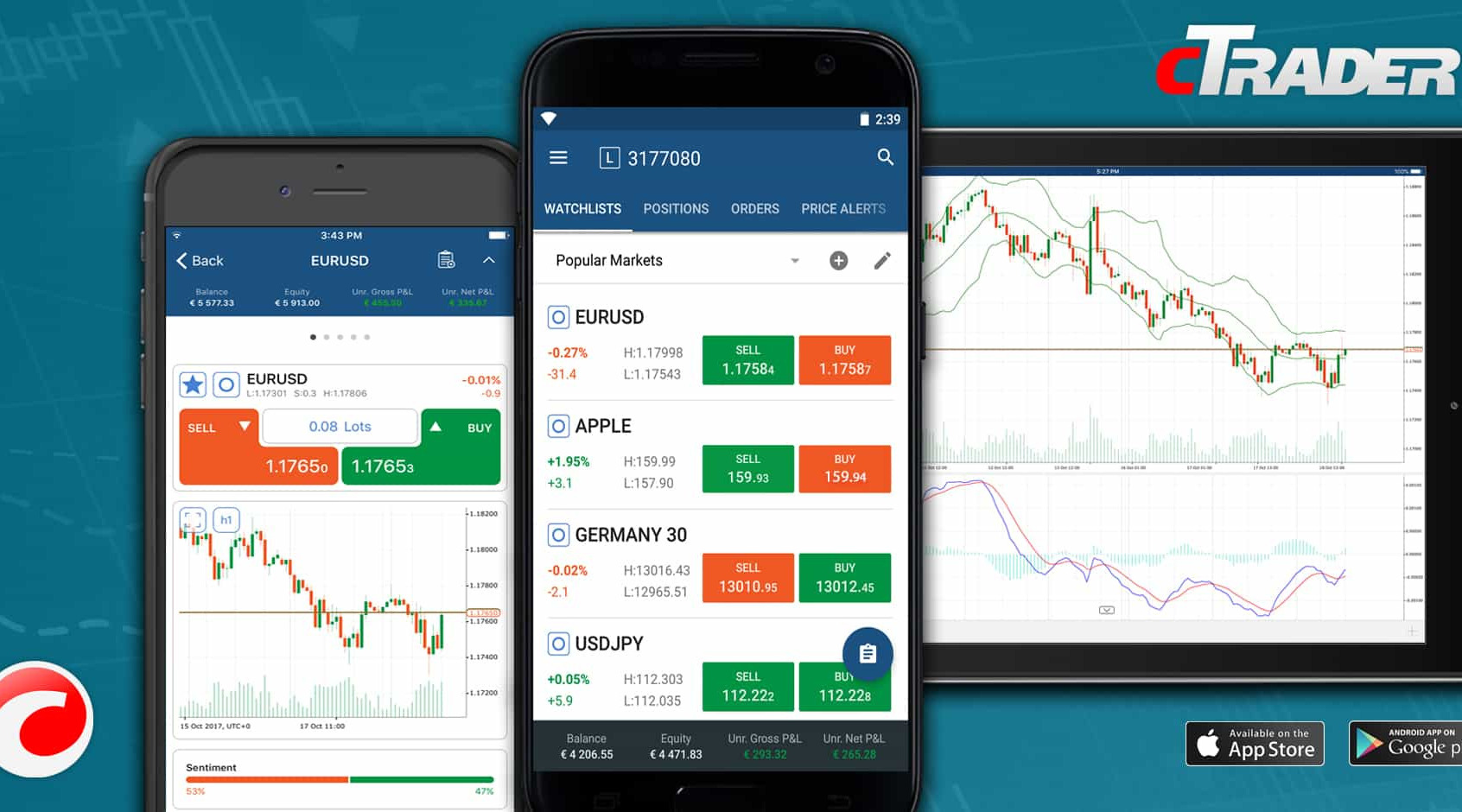

Spotware, the developer of the multi-asset trading platform cTrader, has released version 5.4 of its platform. The update introduces native Python support for algorithmic trading, WebView plugins for mobile integration, and an advanced risk-reward tool. The release also includes expanded APIs and enhanced charting features.

cBots, Indicators Now Built with Python

With Python support, traders and developers can now create cBots, indicators, and plugins using one of the world’s most widely used programming languages. This complements existing C# support and provides greater accessibility for algorithm design.

Linux users can access cTrader through an officially supported Docker image, allowing full console functionality, including running cBots and performing backtests.

“With native Python support within cTrader, we are opening the platform to an even wider community of algo developers, giving them the freedom to work in the language that suits them best,” commented Ilia Iarovitcyn, CEO of Spotware.

Plugins Gain Custom Settings, Dashboard Integration

The update brings expanded API capabilities. Developers can now include user-configurable settings in plugins, embed custom pages and dashboards in the main interface, and display indicator outputs as bars or candles.

You may find it interesting at FinanceMagnates.com: cBroker Latest Update Puts Trader Sessions Under Microscope.

Additional API features allow chart frame activation, registration of custom hotkeys, and deeper integration for algorithmic workflows.

Charting Upgrades Improve Data Visualization Tools

On mobile, WebView plugins enable the integration of third-party tools, technical analysis widgets, and market dashboards directly into the app. Charting features have also been upgraded.

Read More: cTrader Adds Python Support in Bid to Capture Market Share from Rivals.

A new time axis improves historical data visualization, while preset date ranges and a “Go to” function allow faster navigation through charts. The interface has been redesigned with full-screen configuration options, colour themes, and automatic time zone detection.

Risk-Reward Tool Added for Mac

For Mac users, the update introduces a risk-reward tool. Traders can calculate deal volumes based on risk tolerance or target reward. Stop-loss and take-profit levels can be aligned automatically. Mac APIs have also been expanded, including interfaces for risk-reward visualization, price alerts, inter-algo messaging, transaction tracking, and content tabbing.