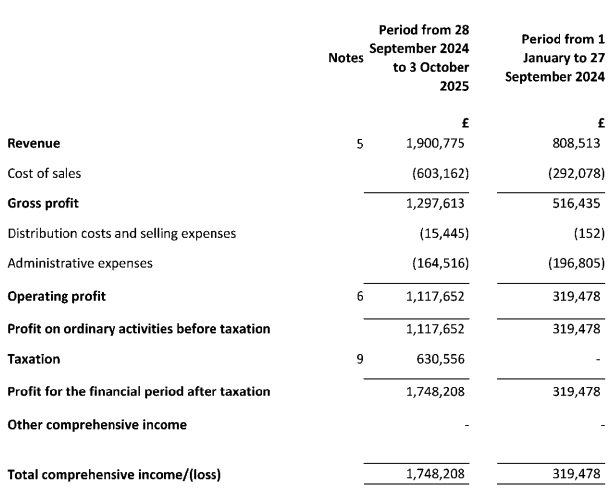

YCM-Invest, which offers brokerage and prop trading services only to professional clients, revealed that it clears an average of US$6 billion in trades per month, mainly in contracts for differences (CFD) instruments, and brought in £1.9 million in revenue. This compares with £808,513 in the previous nine months.

According to Companies House filings, the firm generated all of its revenue from brokerage services.

- Prop Trading Meets the Octagon: Tradeify Signs UFC Champion Israel Adesanya

- Following Profit Cuts and Trading Limits, Prop Firm FundingTicks Begins Winding Down

- "Gamified Features in the Evaluation Stages": Arizet Launches Trading Platform for Prop Firms

A Significant Improvement in Numbers

The company reported its latest financials for the fiscal year that started on 28 September 2024 and ended on 3 October 2025. The previous fiscal year ran from 1 January 2024 to 27 September 2024.

Although a direct comparison cannot be made due to differences in the two fiscal periods, the improvement in the figures is clear.

Alongside revenue growth, the cost of sales increased to £603,162 from £292,078. Gross profit therefore reached nearly £1.3 million, up from £516,435. After administrative expenses and other costs, the company recorded an operating profit of £1.12 million.

Following a tax credit, YCM-Invest netted almost £1.7 million in the last fiscal year, up from £319,478 in the previous year.

Professionals Only

The Financial Conduct Authority (FCA)-regulated YCM-Invest provides prop trading services exclusively to professional traders. It mainly generates revenue from spreads and commissions charged to traders on its platform through brokerage services.

“Since 2008, YCM-Invest Ltd has operated a matched principal business model, ensuring that its interests align with those of its clients,” the Companies House filing stated. “At the core of YCM-Invest Ltd’s strategy is its role as a service-based business that does not take market risk. As a consolidator of liquidity, YCM-Invest Ltd reduces one of the key risks it faces by offering connectivity to a wide range of liquidity providers rather than relying on a limited selection.”