ForexTime (FXTM), the Cyprus-regulated FX broker, has released a free, all-in-one trading app that will offer traders and investors access to the latest news, live currency rates, and any relevant analysis they might need. The app can be downloaded immediately and is available in English, Chinese and Indonesian for Android and iOS mobile devices. iOS users can also download the Arabic version of the app from today, with the version for Android coming soon. The app can be downloaded from the broker's website, the Apple App Store, or Google Play.

Customizable Service

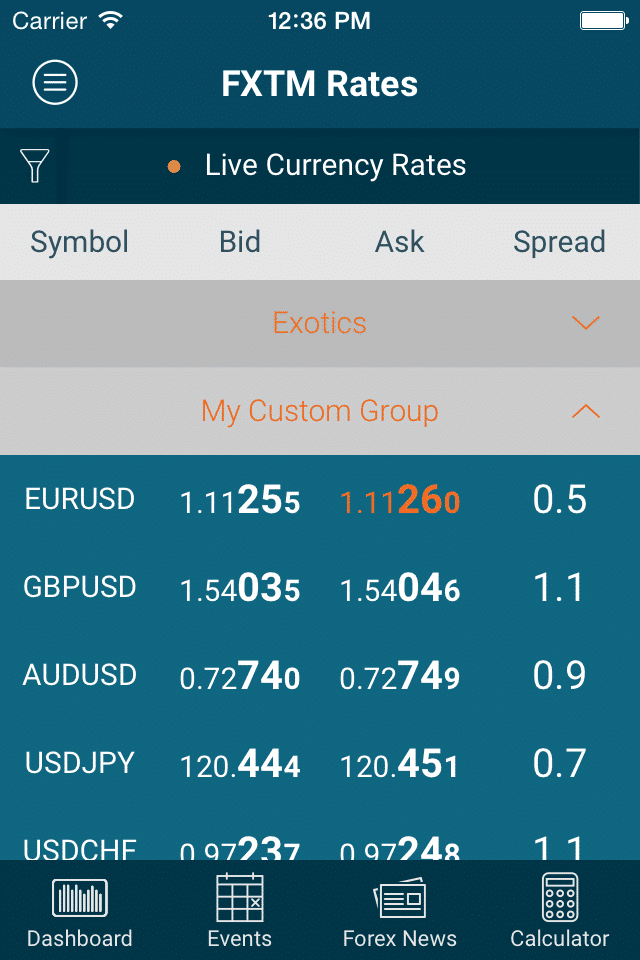

The app has a customizable interface, through which users can create custom groups uniting the financial instruments they are interested in, and they can also create news filters to receive only the news they find relevant to their trading activities.

“Access to live currency rates, breaking financial news and useful analysis”

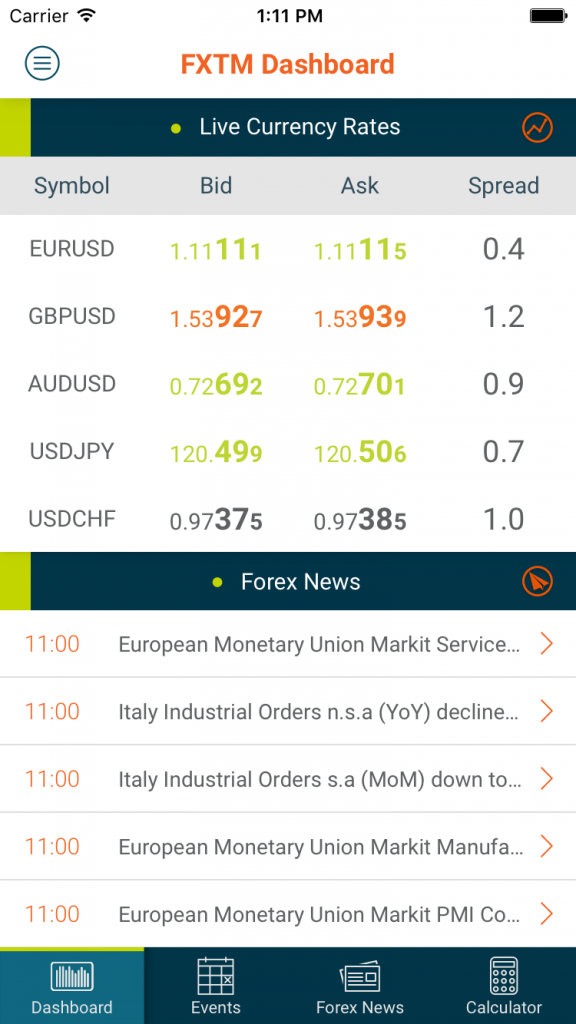

Live currency rates are sourced from leading Liquidity providers and include major and minor currency pairs, exotics, as well as spot metal rates. In addition, the app features a forex trading calculator to help users calculate pips, exchange rates, and profits. In the graphic department, the app offers real-time candlestick, bar and line charts for the visualization of market movements across different time periods.

New features to Come

FXTM’s Chief Executive Officer, Olga Rybalkina, commented: “We are proactively track evolving global trends, so that we can effectively anticipate the needs of our clients. The ForexTime App is our latest release and it taps into the mobile trading trend by giving traders reliable access to live currency rates, breaking financial news and useful analysis, wherever they are in the world. We are constantly looking for ways to integrate new features into the app and several upgrades will implanted over the coming months.”