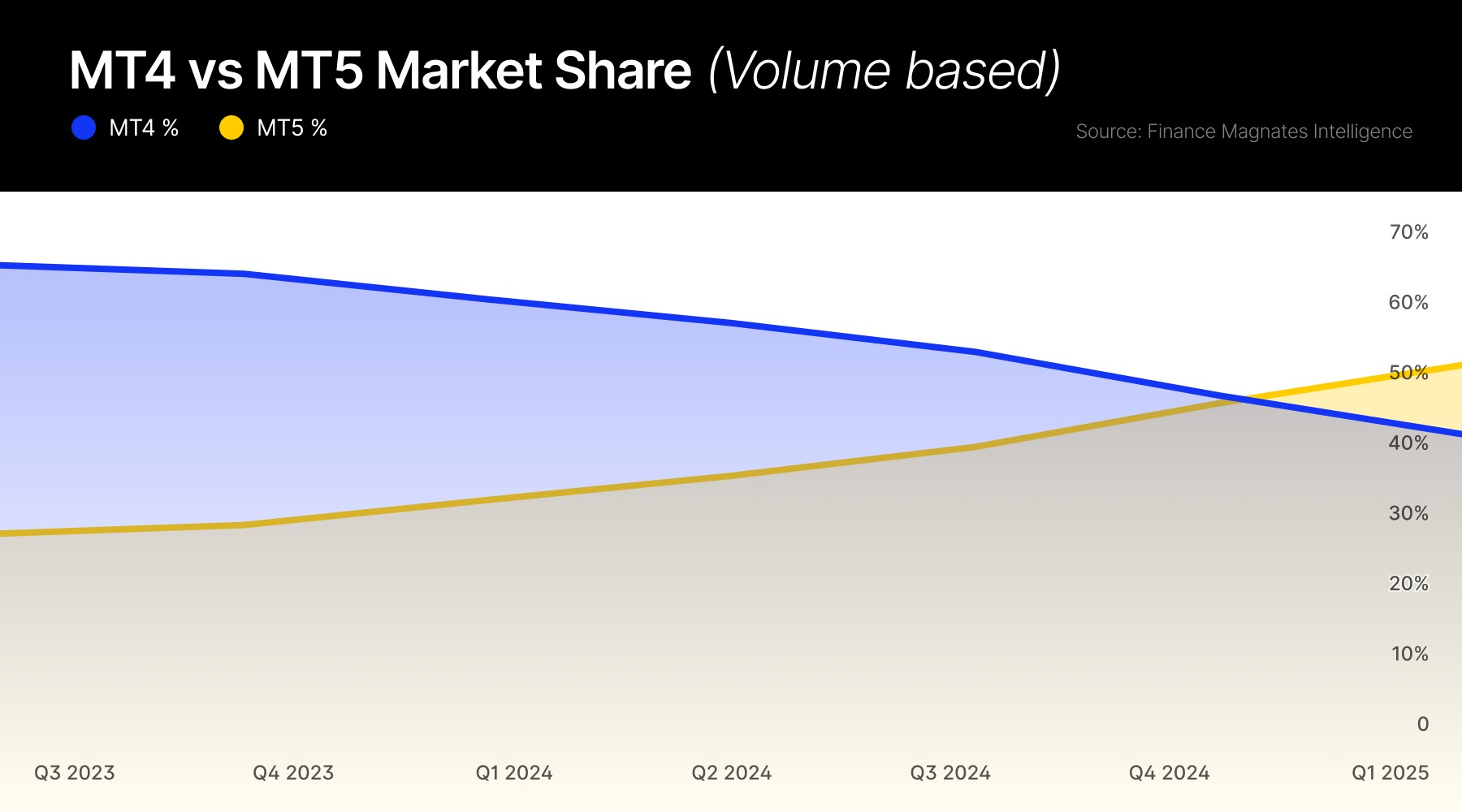

Finally, It Happened. Just as we predicted in our December article, MetaTrader 5 (MT5) has officially surpassed its older sibling, MetaTrader 4 (MT4), in terms of trading volume. According to our latest data from the upcoming Q1 Intelligence Report, this milestone has now been reached.

MT5 accounted for 54.2% of the total combined trading volume between MT4 and MT5, while MT4 held a 45.8% share. These figures even exceed our earlier projections, suggesting that MT5's popularity is gaining even stronger momentum among users.

A Generational Shift Was Inevitable

Since its launch in 2005, MT4 has reigned as the go-to platform for CFD trading. Its widespread popularity stemmed from its user-friendly design, rich ecosystem of third-party tools, and dependable performance. Traders praised its advanced charting features, algorithmic trading capabilities through Expert Advisors (EAs), and the abundance of educational resources available. Likewise, brokers favored MT4 for its easy integration and broad client familiarity. Together, these advantages solidified MT4’s status as the industry leader for many years.

However, in recent years, MT5 has been gaining ground. Technological upgrades, evolving regulatory standards, and a growing demand for more diverse trading instruments have all fueled its rise. Brokers are increasingly pushing MT5 as they modernize their offerings, while MetaQuotes—the developer behind both platforms—has gradually scaled back support for MT4, encouraging a shift toward MT5. The growing adoption of MT5 signals that we may be witnessing a significant turning point in this long-standing rivalry.

Other Platforms Are on the Rise Too

While MetaQuotes' platforms continue to dominate the retail FX/CFD landscape, it's worth noting that other platforms have also gained ground. In Q1, alternative platforms captured a 27% market share, up from just over 24% in Q4. Our upcoming Q1 Intelligence Report, coming next week, will provide more insights, volume breakdowns, and in-depth analysis of the trading industry's current state.