Plus500 has launched its own prediction markets for its United States retail customer base and will offer event contracts, including products from locally regulated Kalshi. The new platform will be a part of Plus500's US B2C brand, 'Plus500 Futures'.

Plus500's Bet on Event Contracts

The announcement today (Tuesday) came about a couple of months after the London-listed broker became the clearing partner for CME and FanDuel’s new event-based contracts platform.

- Plus500 Enters Weekly Options Game with Gold, Oil and Indices

- Plus500 Halts New CFD Onboarding in Spain amid Tough Marketing Rules

- Plus500 Reports Half Its Revenue Now Comes From Customers Trading Over Five Years

“Prediction markets are attracting increasing interest from both retail and institutional participants alike, reflecting their growing relevance as a transparent and fully regulated way to express views on real-world outcomes,” the broker noted.

“The introduction of prediction markets aligns with Plus500's continued focus on technological innovation, customer-centric approach and product development.”

The broker stressed that it will offer its B2C customers “a broad range of regulated prediction markets”, which would include economic indicators, financial events, geopolitical developments and other measurable real-world outcomes.

Kalshi will deliver the offering, but the event contracts will be cleared directly by Plus500, a member of Kalshi's clearing unit.

The broker further stressed that, in the future, its scalable institutional infrastructure will support broader participation across the prediction markets ecosystem.

Mainstream Players Entering Prediction Markets

The popularity of prediction markets has exploded in recent years, especially during the wagers on the last US Presidential election. Although the industry is massive offshore, where crypto-based Polymarket dominates, Kalshi played a significant role in popularising the regulated version within US borders.

The trading volume of event contracts even climbed past $13 billion a month.

While disrupters like Robinhood have already been offering event contracts for some time, the CME Group's entry into the industry last year showcased its future in the mainstream financial markets.

Meanwhile, Plus500 is also entering into other trending sectors. A few months ago, it also signed an exclusive agreement with Topstep, under which the London-listed broker will handle all clearing and technology infrastructure for the Chicago prop firm’s brokerage arm and its wider operations.

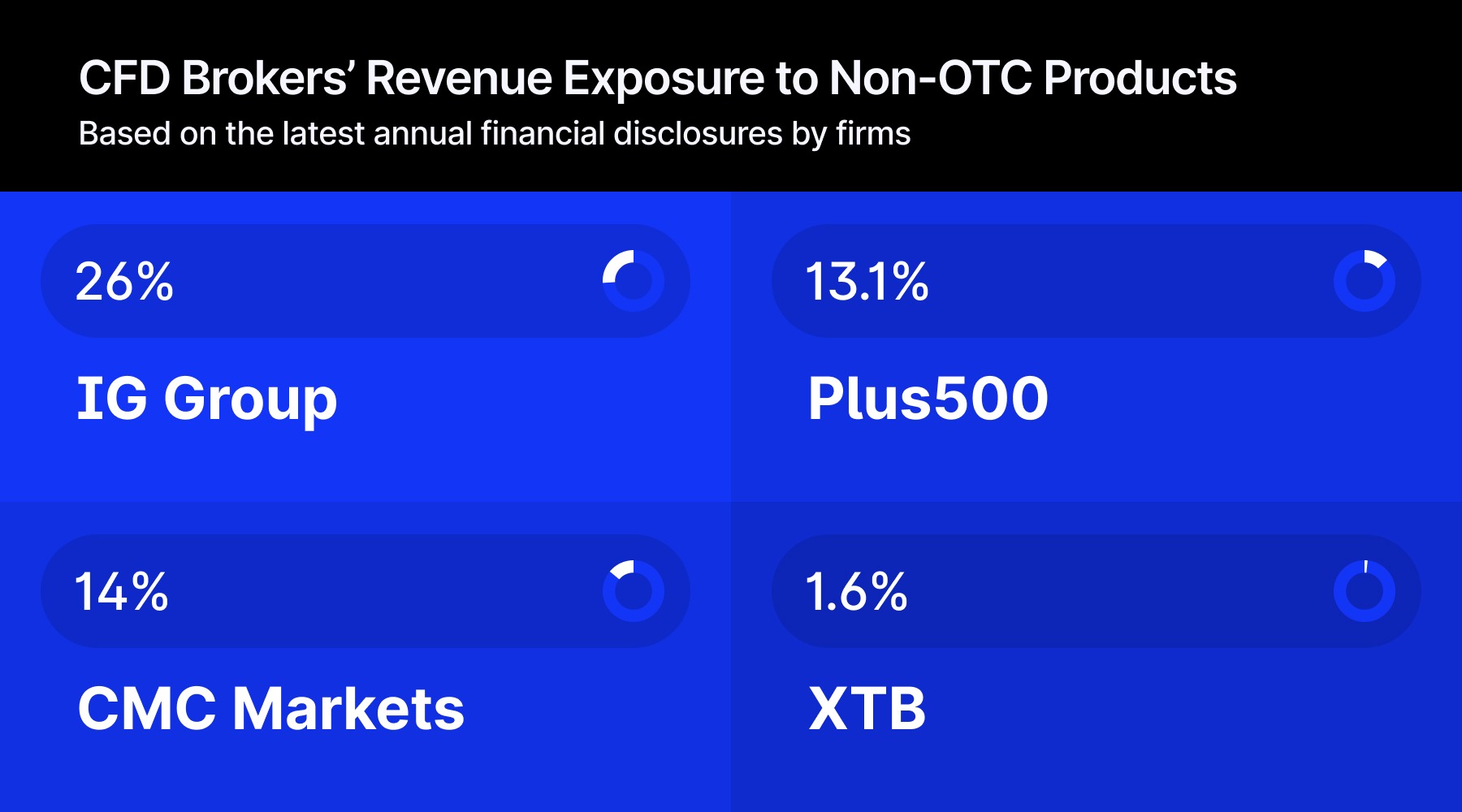

Plus500 generated $182.7 million in revenue in the third quarter of 2025, down 2.5 per cent year over year and 12.7 per cent quarter over quarter. The company is known for offering contracts for differences (CFDs), but now it focuses on expanding beyond over-the-counter (OTC) instruments.

About 15 per cent of total group revenue was generated by its non-OTC business, along with 18 per cent of new customers.