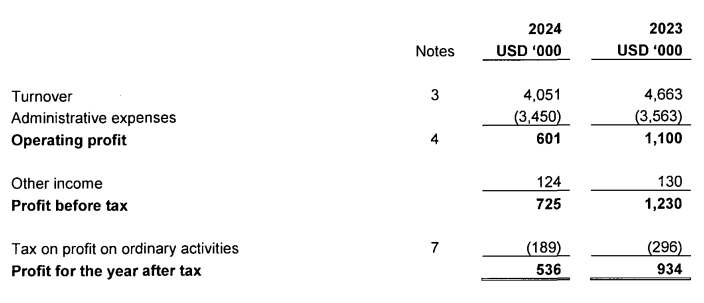

ParFX, the UK-regulated entity owned by Swiss interdealer broker Compagnie Financière Tradition, witnessed a 13 per cent decrease in its 2024 turnover to $4.05 million from the previous year’s $4.66 million.

It generated $2.8 million from its electronic brokerage business, while another $1.2 million came from API connection fees. In 2023, these figures stood at $3.3 million and $1.3 million, respectively.

Join IG, CMC, and Robinhood at London’s leading trading industry event!

Declining Revenue

The company, in its latest filing with Companies House, cited a declining customer base as the reason behind the turnover fall. In 2023, the firm’s turnover also dropped by 14 per cent due to similar reasons.

The operating profit of the company came in at $601K, down from the previous year’s $1.1 million. After a $124K gain from data provisioning to third parties, its pre-tax profit for the year was $725K, while netting $526K. Both figures were down 41 per cent and 43 per cent, respectively.

ParFX is a wholesale electronic spot FX trading platform that aims to bring transparency to the global foreign exchange market. Launched in 2013 by Tradition, one of the world's largest interdealer brokers, ParFX operates under the leadership of CEO Dan Marcus and COO Roger Rutherford.

The company, regulated by the UK's FCA, offers services to both banks and non-bank institutions, including hedge funds, asset managers, pension funds, and corporations.

“The Directors are satisfied that the Company has adequate resources to continue to operate as a going concern for a period of at least 12 months from when the financial statements were authorised for issue,” the Companies House filing noted.

“In reaching this conclusion, they have considered the current and forecast profitability and liquidity positions, as well as budgets and financial models for a period covering 2025 and up to at least 12 months,” it continued.

- ParFX Sees 84% Profit Drop in 2023 as Client Base Shrinks

- Exclusive: A Year into the FX Global Code with ParFX COO Roger Rutherford

- ParFX’s CEO, COO Outline FX Market and Platform Transparency

Compagnie’s Business Is Growing

Meanwhile, ParFX’s parent, Compagnie, ended the first six months of 2025 with a consolidated revenue of CHF 632.1 million, a growth of 12.3 per cent.

While the interdealer broking (IDB) business’ revenue jumped by 11.2 per cent to CHF 607.6 million, its Japanese online retail forex trading business, under the brand Gaitame, brought in CHF 24.5 million, a yearly rise of 47.6 per cent.