For decades, 4pm on America’s eastern seaboard marked a civilised pause. The closing bell rang, screens dimmed and traders retreated to digest the day’s gyrations. Strategies were refined, notes updated, perhaps even families acknowledged.

That rhythm, though, is unravelling.

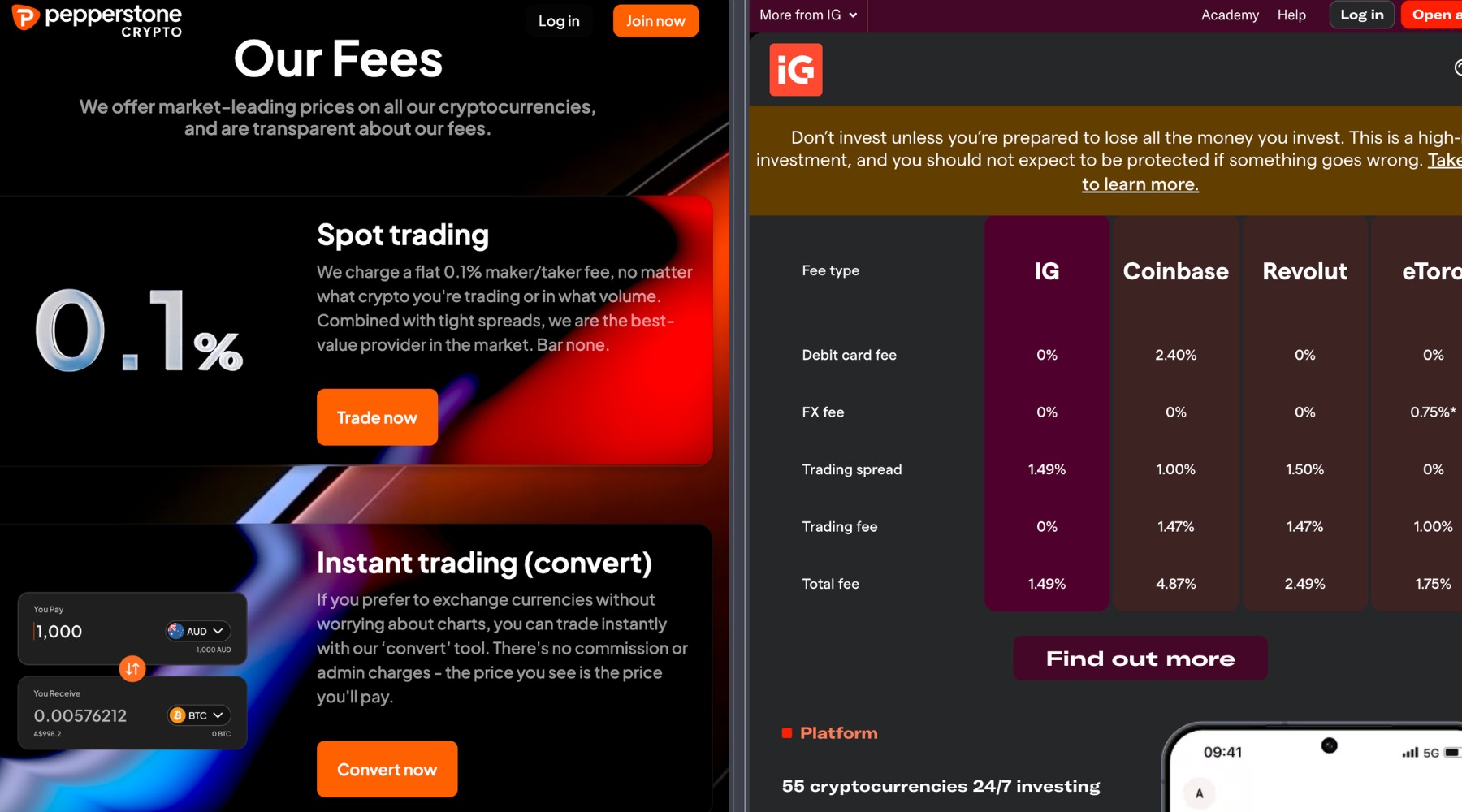

According to data shared exclusively with Finance Magantes, at Capital.com, between 25% and 40% of retail clients traded during pre-and post-market sessions over the past three months. Yet only 4% to 5% ventured into overnight trading. On eToro, where 24/5 trading access has been expanded to S&P 500 and Nasdaq 100 stocks, roughly one-third of stock trading in December 2025 took place during the after-hours session.

In June 2024, Vlad Tenev, Robinhood's CEO, announced on X that one year after launching its “24 Hour Market,” which offers trading 24 hours a day, five days a week, overnight activity had generated more than US$20 billion in total trading volume. The company did not publish a consolidated annual figure; however, based on reported peak activity, a reasonable estimate would place total trading volume above US$1 trillion, implying overnight flows still accounted for roughly 2% of the whole. Even so, Robinhood noted that on its busiest days, as much as 25% of daily trading occurred outside traditional market hours.

How Market Hours Have Extended

Traditionally, America’s equity market operated from 9:30am to 4pm Eastern Time, Monday to Friday. In 1991, the New York Stock Exchange (NYSE) became the first major exchange to introduce limited after-hours trading, initially extending activity until 5:15pm for institutional investors. At the time, fewer than a million computers were connected to the internet and the Soviet Union had just dissolved. Markets, like geopolitics, were just becoming more open.

Today, 24/5 trading offers four distinct trading windows: the traditional session; pre-market (4am-9:30am); post-market or after-hours (4pm-8pm); and overnight (8pm-4am). It should be noted that Robinhood defines “overnight” as between 8 pm and 7am, for Capital.com is 9pm to 2am, and for eToro is 8pm to 4am.

Stocks, ETFs and CFDs can now be traded throughout the working week. Yet access during extended hours remains constrained to selected instruments.

Retail Traders Are Extending Habits, Not Horizons

While retail traders appear to be testing extended hours, it does not necessarily change their appetite. According to eToro, there is little divergence between what clients trade during core hours and what they trade outside them.

On Capital.com, which primarily offers CFDs, activity clusters around technology names, including Meta, Tesla, Nvidia and Oracle, alongside ETFs and crypto-related firms.

What the Exchanges See

Exchange data tell a similar story. As of January 2025, extended-hours trading accounted for more than 11% of all US equity volume on the NYSE, with over 1.7 billion shares traded daily outside the core session, more than double the proportion recorded in early 2019. The exchange attributes much of this growth to retail participation.

- One-Third of eToro Trades Now Happen in 24/5 Extended Market Hours

- NYSE Turns to Tokenization to Extend Wall Street Beyond Market Hours

- 24/7 Trading "Not Inevitable Nor Universally Desirable," Says World Federation of Exchanges

Interestingly, the distribution leans heavily toward pre-market hours, which in the first quarter of 2025, represented more than 55% of all extended-hours volume, having expanded fifteen-fold since 2019. Post-market growth, by contrast, has been comparatively modest.

Why the Push, and the Problems It Brings

A 2025 analysis by the World Federation of Exchanges identified three forces driving the expansion of trading hours: investors conditioned by always-on digital services and cryptocurrency markets; rising demand from international retail traders, particularly in Asia; and seeking faster responses to market-moving news, which explains the pre-market growth.

But longer hours are not costless. Liquidity does not remain constant across a 24-hour cycle. Staffing exchanges continuously bring operational complications. And experience from foreign exchange and cryptocurrency markets suggests that activity continues to peak during traditional business hours. Overnight sessions tend to be thinner, spreads wider and volatility is less forgiving.

Retail traders are well aware. On Reddit forum r/Trading, users routinely warn of broader bid-ask spreads and lower volumes outside core hours. Add to that uneven access, as extended-hours trading is restricted to selected instruments. The market may be open; it is not entirely available.

Will Momentum Build for Longer Trading Hours?

Thomas Peterffy, Chairman of Interactive Brokers – the global brokerage offers 24/5 trading on alternative venues – speaking at a Piper Sandler conference in 2025, suggested that overnight trading, then just 2.2% of the firm’s volume, could exceed 30% by 2030.

In announcing its financial results for the fourth quarter and full year 2025, eToro said it would expand to 24/7 trading, citing the success of its 24/5 expansion. The initial rollout will cover a selection of popular assets, with plans to broaden access across asset classes over time.

At the same time, exchanges are also moving into the 24/7 territory. Both NYSE and Nasdaq are expected to allow nearly round-the-clock trading by the second half of 2026; the former is also preparing to launch a 24/7 trading platform for blockchain-based securities. Reflecting this trend, the LMAX Group added gold to its perpetual futures platform, enabling institutional clients to maintain XAU/USD exposure around the clock, including weekends when traditional markets are shut. The London-based cross-asset marketplace said that the move responds to a growing appetite for gold derivatives beyond standard hours.

However, for now, most investor behaviour remains traditional. The majority of activity still clusters around the core session, where liquidity is deepest and spreads tightest, and extended-hours trading tends to spike only at particular moments. On Capital.com, around 80% of total equity volume is still executed during normal US hours.

Markets may be open day and night, but whether the money will follow remains an open question.