MetaTrader 5 has unveiled integrated payments service, marking a shift in their strategic direction towards seamless customer onboarding. The new feature not only enhances platform convenience but also streamlines the entire cycle of interaction with new users, a crucial element in the fiercely competitive world of brokerage.

Integrated Tracking, Analysis, and Automated Account Opening

The key strategy focuses on guiding users effortlessly from the initial click on promotional banners to their first trade. MetaTrader 5 achieves this by incorporating features like confirmation of contact details, allowing the opening of demo and preliminary real accounts directly within the trading platform. Users can now confirm phone numbers and emails from the terminal, ensuring accurate client information and establishing valid communication channels.

To enhance user tracking and optimize advertising strategies, deep links with tracking tags have been incorporated. This allows precise tracking of installation sources, even for users coming from external platforms like the App Store or Google Play. The detailed analytics provided by these links empower brokerage companies to identify the most effective advertising channels and advertisement types.

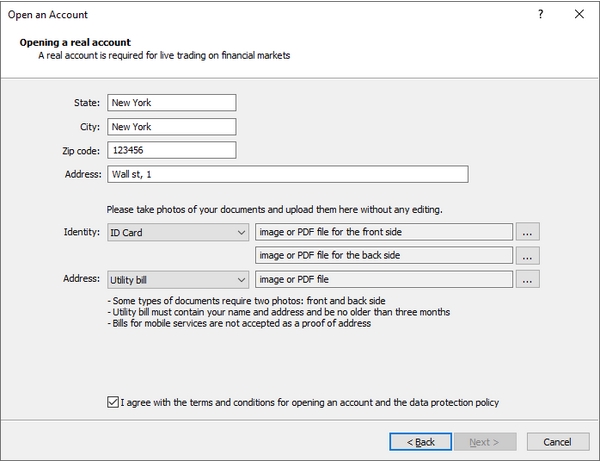

A significant leap in user experience is the automated opening of demo and real accounts. Users are greeted with a wizard guiding them through the account-opening process, eliminating the need to search for available options.

User Verification, Automation, Accelerated Deposits and Trading

Security concerns are addressed through built-in platform tools that automate up to 95% of data processing. This guarantees an error-free, attentive, and swift experience for clients during every stage. The platform's capabilities extend to processing 2,500 types of documents from 150 countries, ensuring compliance with international regulations and data protection standards.

The newly introduced Automations service emerges as an irreplaceable tool in the context of onboarding. From welcome emails to reminders of the next steps, technical notifications, and stimulating messages, this service efficiently guides clients through the sales funnel. It ensures clients stay well-informed and on track to complete all necessary steps, contributing to a seamless onboarding experience.

Traders can now replenish their accounts through bank transfers, cards, or online payment systems directly within the MetaTrader 5 platform. This eliminates the need for additional registrations on external sites, allowing users to swiftly proceed to trading using integrated solutions. The minimized actions required from clients result in accelerated onboarding, increased conversion rates, and overall success.

To evaluate the effectiveness of these onboarding changes, MetaTrader 5 recommends the use of Finteza, a comprehensive end-to-end analytics tool. Developed by MetaQuotes, Finteza seamlessly monitors traders' actions across websites and the trading platform. E-commerce reports provide valuable insights into financial flows, enabling brokers to assess advertising channel effectiveness, understand customer behavior, and link it to conversion actions on their servers.