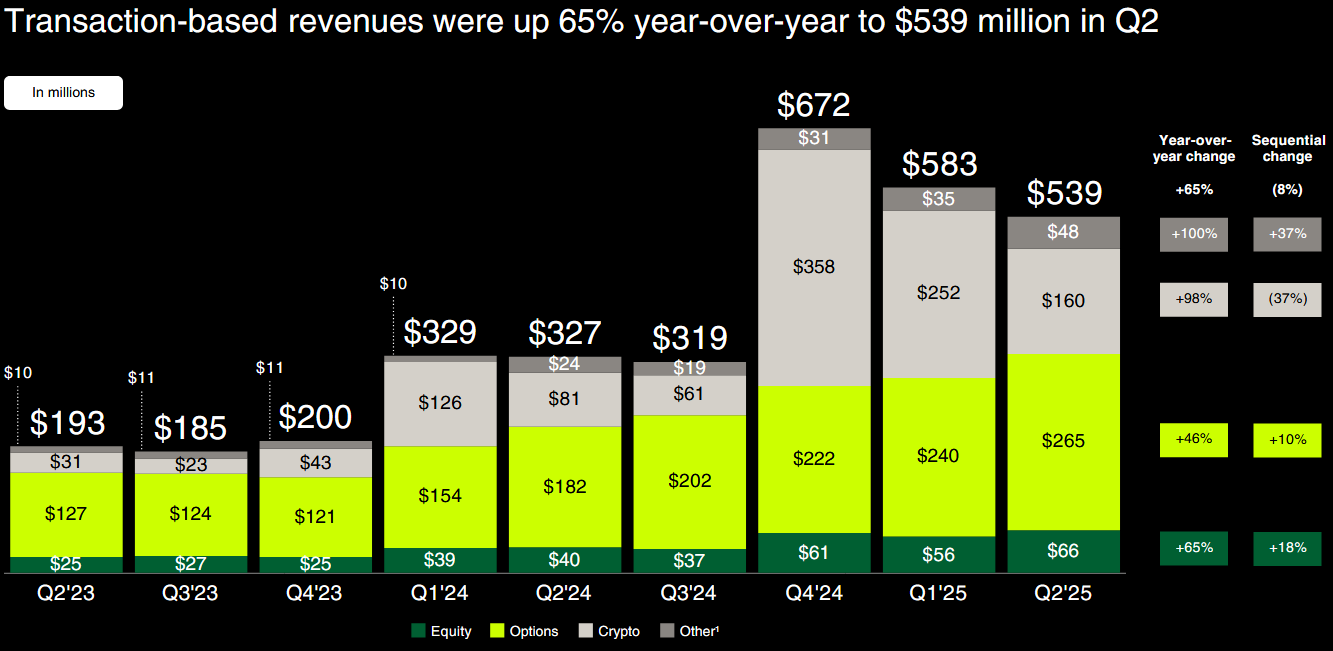

The crypto windfall for Robinhood (Nasdaq: HOOD) is disappearing, as Q2 2025 revenue from the asset class came in at $160 million – down from $252 million in the first three months of the year – a drop of 36.5 per cent. However, the company highlighted that its crypto revenue nearly doubled year-over-year.

Why Is Crypto Demand Dropping on Robinhood?

This marked Robinhood's second straight quarterly decline in crypto revenue. Revenue from digital assets peaked at $358 million in Q4 2024 but dropped 30 per cent in Q1 2025. CEO Vlad Tenev previously noted that the company is looking to diversify away from crypto, as trading volumes tend to go “up and down.”

Related: Robinhood Offers Crypto Trading “at the Lowest Cost,” but Is It False Advertising?

Despite the drop in crypto activity, the Nasdaq-listed broker’s total revenue rose to $989 million – up 45 per cent year-over-year and 6.6 per cent quarter-over-quarter. The figure also beat market expectations of $928.8 million.

Although transaction-based revenue reached $539 million (a 65 per cent rise year-over-year), it dropped 7.5 per cent compared to the previous quarter.

The rise in overall figures was driven by strong demand for options, which generated $265 million. In addition, revenue from net interest and subscriptions also increased.

Robinhood ended the quarter with a net income of $386 million and earnings per share of $0.42 – well above analysts’ forecasts of $0.31.

“We delivered strong business results in Q2 driven by relentless product velocity, and we launched tokenisation – which I believe is the biggest innovation our industry has seen in the past decade,” said Tenev.

Robinhood’s launch of tokenised stocks in European markets has contributed to its growing popularity. The company also expanded through acquisitions, including the closure of its Bitstamp deal.

Read more: Tokenised Stocks Are Here, but Do They Really Bring Added Value over CFDs?

ARPU Remains Strong

Beyond financial performance, several customer-related metrics improved. The number of funded accounts on the platform increased by 10 per cent year-over-year to 27.4 million. Assets on the platform also doubled to $279 billion.

Average revenue per user (ARPU) stood at $151 – up 34 per cent year-over-year and 4 per cent from the previous quarter. This remains just below the Q4 2024 peak of $164.

“And Q3 is off to a great start in July, as customers accelerated their net deposits to around $6 billion and leaned in with strong trading across categories,” said Jason Warnick, Chief Financial Officer of Robinhood.

Meanwhile, eToro—positioning itself as a competitor to Robinhood – is expanding rapidly following its public listing. The company still earns most of its revenue from crypto but has also embraced tokenised stocks and overnight trading.