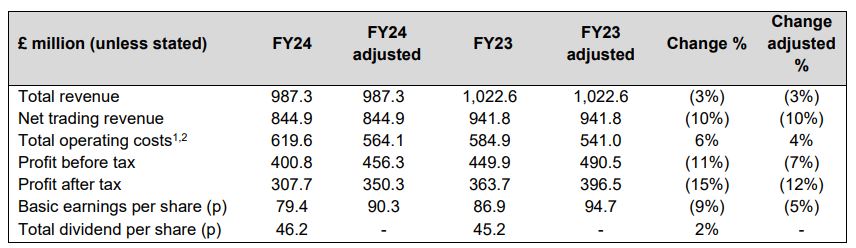

IG Group Holdings (LON: IGG) ended the fiscal year 2024, which concluded on May 31, with a pre-tax profit of £400.8 million, an 11 percent year-over-year drop, while the adjusted figure declined 7 percent to £456.3 million. After considering taxes, the company netted £307.7 million in profits, a 15 percent decline, while the adjusted figure dropped 12 percent to £350.3 million.

Interestingly, IG expanded its share buyback program, allocating an additional £150 million to it, which is expected to be completed by January 31, 2025.

“I’ve... identified areas requiring change,” said Breon Corcoran, . “We have lots of work to do to take IG to the next level and address the challenges we face.”

Declining Revenue

The London-headquartered company had total annual revenue of £987.3 million, a 3 percent decrease year over year. The broker's annual net trading revenue also plummeted by 10 percent to £844.9 million due to reduced trading activities. It highlighted that the total active clients on the platform dropped to 346,200 from 358,300 because of the less volatile markets. It also added 69,900 new traders, which was down 4 percent.

On the positive side, like most companies in the sector, IG also benefited from higher interest rates. The net interest income of the company jumped to £142.4 million compared to the previous year’s £80.8 million, an increase of 76.2 percent.

Meanwhile, tastytrade's revenue jumped 23 percent to a record $251.8 million (£200.6 million). This US unit's trading revenue increased by 10 percent to $160.1 million, while its gain from interest income also jumped by 53 percent to $91.7 million.

Maintains Guidance

The press release highlighted that the adjusted profits before tax margin was within the guidance range of mid-to-high 40s at 46.2 percent, down from the previous fiscal year’s 48 percent.

Basic earnings per share was 79.4 pence, 9 percent below the previous year's figure, while the adjusted figure declined by 5 percent to 90.3 pence. The company will also distribute a dividend of 46.2 pence per share, which is higher than the 45.2 pence dividend in FY23.

“We operate in a competitive industry landscape that is changing rapidly,” Corcoran added. “We must move at pace to get closer to our customers, give them the products they want more quickly, enhance efficiency, and add scale to win. My initial priorities are to increase client centricity, accelerate product velocity, and develop our culture to increase ownership and accountability.”