After a delay of about eight months, iFOREX has set a possible listing date of 25 February 2025. The move appears to be strategic, as the contracts for differences broker ended Q4 2025 with revenue of $13.5 million and EBITDA of about $2 million. The figures recovered from the previous quarter, when they were $7.7 million and negative $3.1 million, respectively.

Flat Revenue, but Lower Profit

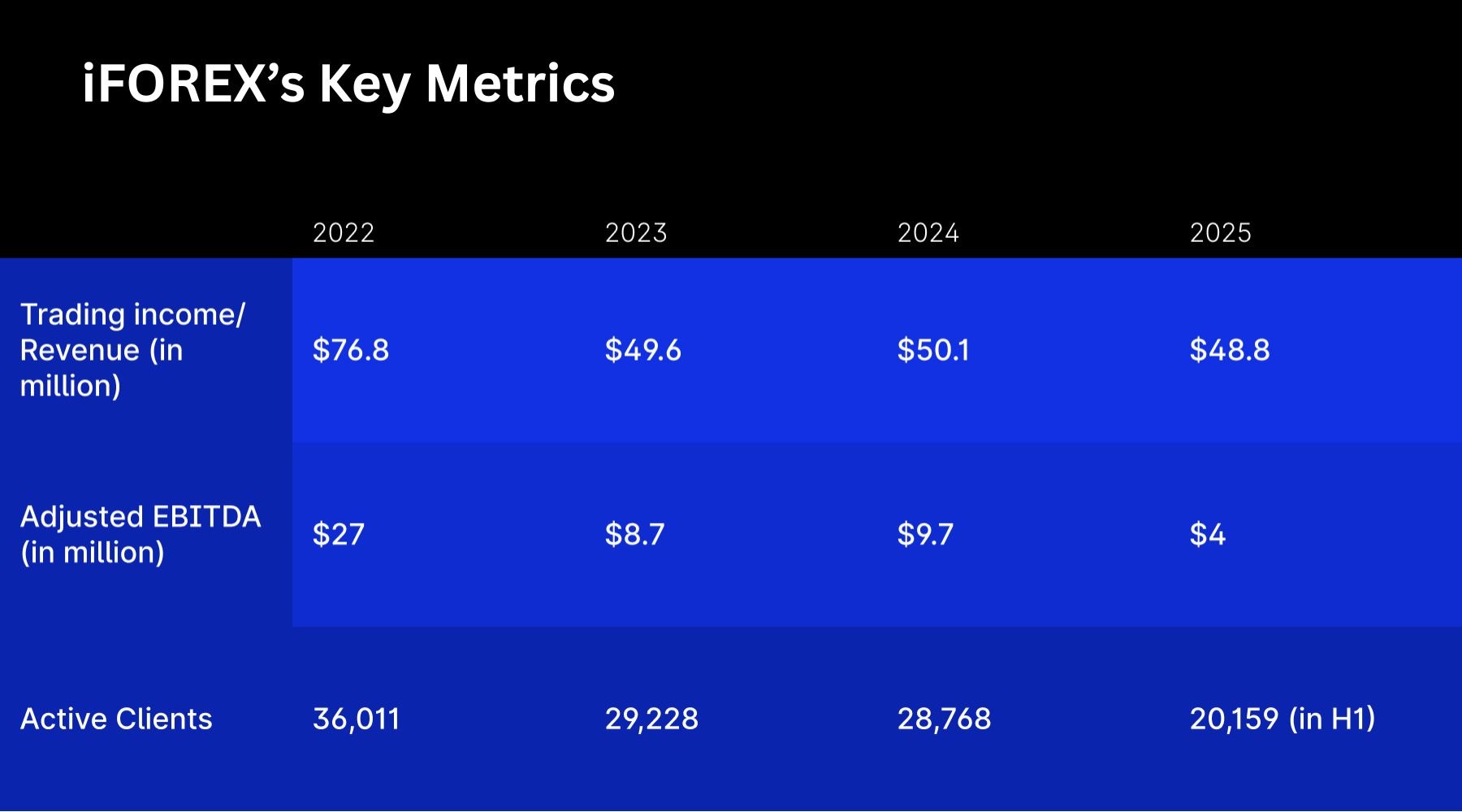

The initial public offering (IPO) prospectus published yesterday (Thursday) also noted that the group generated $27.6 million in H1 2025, bringing annual revenue to $48.8 million, which is still below the $50.1 million recorded in 2024.

Adjusted EBITDA for last year is expected to be about $4 million, down from $9.7 million the year before.

This shows that the company has kept its IPO valuation at 1.1x of its revenue.

Net profit for the first six months of 2025 came in at over $1.2 million, down 63.5 per cent year over year. Annual net profit in 2024 was $5.1 million, compared with $26.1 million in 2022 and $6.7 million in 2023.

“The Group has positive momentum into FY26,” the prospectus noted.

- iFOREX Prices London IPO at £43.3M After Eight-Month Delay

- iFOREX Europe Signs Deal with with Hungarian Football Champions

- iFOREX Strengthens Sports Presence as IPO Awaits: Sponsors Polish Football Club

iFOREX, which operates with licences in Cyprus and the British Virgin Islands, is aiming to raise £8.75 million at a valuation of about £43.3 million. It is expected to receive about $6.07 million after commissions and deductions.

The contracts for differences (CFDs) broker will use the majority of the proceeds, $1.5 million, to automate its customer onboarding and growth processes. It will also allocate another $1 million to investment in further automation software and products for its onboarding and AI risk management systems.

Read more: AI Takes Center Stage in Brokers’ Layoff Narratives

It will also use about $500,000 to enter new markets and accelerate growth in existing ones, and a similar amount to improve its human resources.

Its decision to go public is supported by the belief that the move would raise its profile and help it access new markets, regulatory authorisations, and pursue strategic M&A opportunities.

Founded by Eyal Carmon, iFOREX traces its origins to 1996 under different brands. It received its Cyprus licence in 2011 and its BVI licence in 2013. Over 95 per cent of its revenue came from the offshore entity, while the rest was generated by the Cyprus-registered one.

The majority of transactions on the platform, 37 per cent, are in currency pairs, followed by 33 per cent in commodities, 19 per cent in indices, and 8 per cent in cryptocurrencies. The remaining 3 per cent came from stocks and ETFs in 2024.

Carmon, who is now the sole shareholder of the CFD broker, will not sell any of his stake. However, even after the IPO, he will continue to be the largest shareholder with 58.91 per cent of the stake.

The broker is currently led by Itai Sadeh as its CEO.

Recovery after a Drop

iFOREX’s 2025 revenue clearly took a hit due to weak Q3 results. It attributed the weaker quarter to low market volatility and the impact of its IPO delay. It further noted that due to low market volatility, it “implemented a short-term revenue initiative which was ineffective and it was promptly reversed.”

Notably, 70 per cent of its revenue is generated from dealing spreads.

The majority of iFOREX’s client base is in East Asia, India, and the Middle East. It had 20,159 active clients in the first six months of 2025, broadly similar to a year earlier.

Asia, predominantly Japan, remained its top revenue generator, bringing in over $10.6 million between January and June 2025. Revenue from MENA and South Asia, driven by India, was about $8 million and $5 million, respectively.

Read more: iForex IPO Aims to Enter New Markets and Reverse Revenue Dependence on Asia

However, the figures remain significantly lower than the 2022 peak, which, according to iFOREX, was due to “a significant drop in spread revenues and trading P&L revenues.”

Notably, the broker does not have a licence in any of its key markets — Japan, India, or MENA. In practice, it can only reverse solicit traders from those jurisdictions.

iFOREX was also placed on warning lists by regulators in its key markets.

Related: India Hikes Trading Tax, Will It Push Traders to ‘Unregulated’ CFDs?

It intends to use the funds to secure regulatory licenses in Australia, Malaysia, the UAE, Chile, and the UK.

Interestingly, iFOREX’s marketing budget also increased in the first six months of 2025: it spent $21.3 million on selling and marketing, up from $15.6 million a year earlier. Its total marketing spend in 2024 was $35.9 million, down from $46.7 million in 2022.

The broker, which is B-book heavy, also appears to have reduced risks from the one-sided rally in gold, especially in January. As at 17 February 2026, its residual net exposure was $30.7 million, representing 21.5 per cent of all outstanding positions.

iFOREX also remains debt-free, with a net cash balance of $6.7 million at the end of 2025.