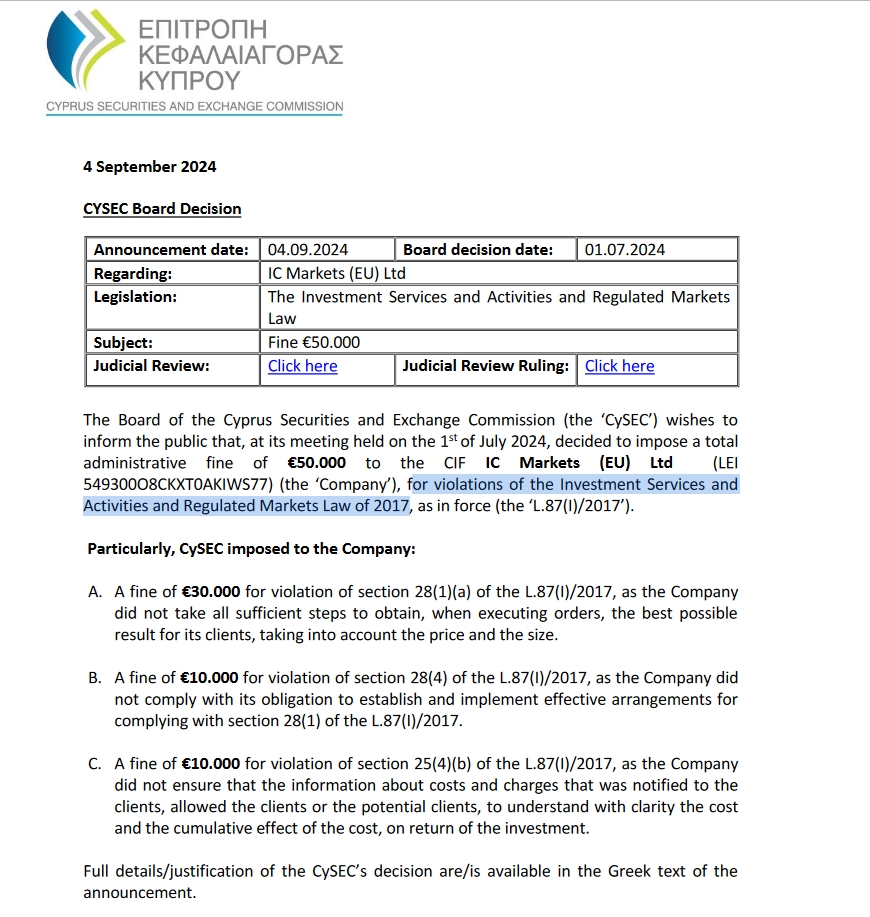

The Cyprus Securities and Exchange Commission (CySEC) has imposed a €50,000 fine on IC Markets (EU) Ltd for violations of the Investment Services and Activities and Regulated Markets Law. The decision was made during a board meeting on July 1, 2024. This fine pertains to breaches of the Investment Services and Activities and Regulated Markets Law.

CySEC Hits IC Markets

The company has been fined €30,000 for failing to ensure the best possible outcomes for its clients when executing orders. According to the regulator, IC Markets (EU) Ltd did not adequately consider factors such as price and size in its execution process.

Additionally, the company faces a €10,000 fine for not establishing and implementing effective measures to comply with its obligations regarding client order execution.

Another €10,000 fine was imposed for not providing clear and comprehensive information about costs and charges. This failure hindered clients' ability to fully understand the cost implications and their effect on investment returns.

'“IC Markets (EU) Ltd strongly refutes the decision made by the Cyprus Securities and Exchange Commission (CySEC). The fines are, in our view, unjustified and fail to reflect the true operational standards of our Company,” IC Markets responded.

“We firmly disagree with CySEC’s conclusions, particularly the assertion that we did not take sufficient steps to achieve the best possible execution results for our clients,” the company continued. “IC Markets has always maintained robust internal systems, including comprehensive ex-ante checks on pricing, and has consistently taken prompt corrective actions where necessary.”

Regulator’s Earlier IC Markets Fine

Earlier, IC Markets (EU) was fined €200,000 by the CySEC for breaching leverage rules, as reported by Finance Magnates. The penalty follows allegations that the broker offered leverage up to 1000:1 by using an offshore entity, while EU regulations limit leverage to 30:1 for FX and CFD brokers.

IC Markets disputes the decision, claiming that CySEC relied on biased testimony from a former employee and ignored audited evidence. The company plans to appeal, criticizing the regulatory process for lacking impartiality and transparency.