Gildencrest Capital (formerly TeraFX), a retail brokerage, closed 2023 with an annual turnover of more than £7.5 million, a 53 percent jump from the previous year. The significant increase in revenue was fuelled by a more aggressive rise in the trading volume of CFDs offered by the platform, which generated £4.7 million in income.

A Solid Jump in Trading Volume

According to the latest Companies House filing, the trading volume in the forex and CFDs business of the platform increased by 94 percent last year to £37.6 billion. The trading volume with the instruments of the Capital Market Securities business also recorded an increase of 83 percent to £1 billion. The equities trading services of the broker generated an annual income of £2.13 million.

“In 2023, the company shifted focus from the forex business on the global marketplace to focus more of its efforts on other capital market instruments, to broaden its product offering and brokerage activities,” the company noted in the filing, adding that it has “shifted away from retail to focus on smaller institutional professional clients.”

Another Boost to CFDs

The company further highlighted that it is exploring avenues like joint ventures to further boost its CFDs revenue. However, it neither provided any details on establishing such joint ventures nor indicated any potential partnerships.

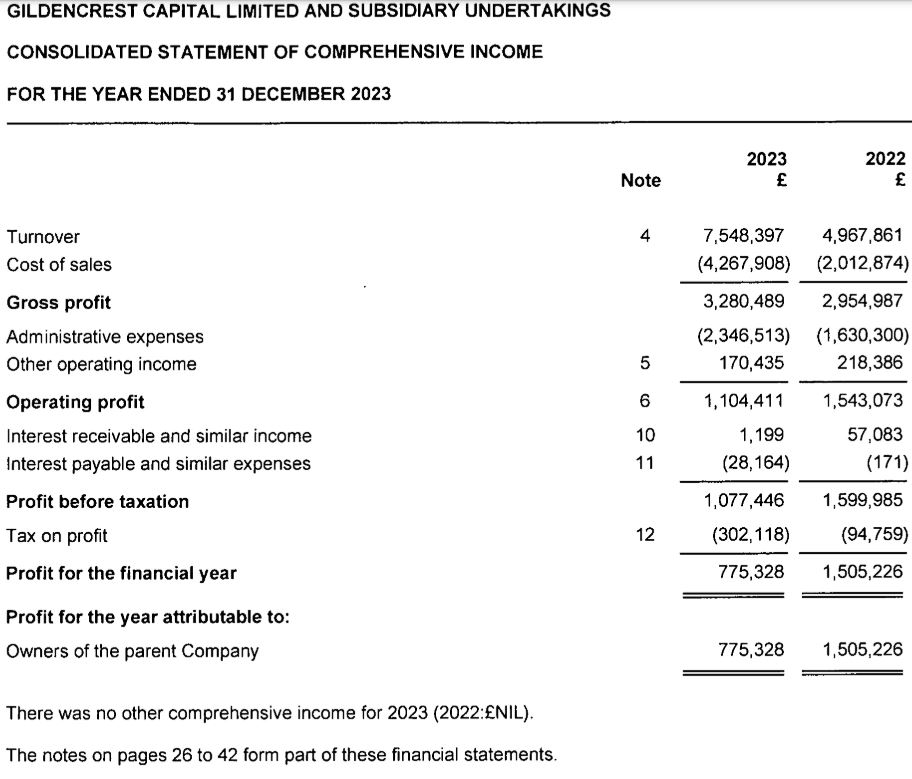

The income statement further revealed that the broker ended the year with a gross profit of £3.2 million, higher than the previous year’s £2.9 million. However, its administrative expenses increased to £2.3 million from £1.6 million. After considering all incomes and expenses, the broker made about £1.08 million in pre-tax profits, lower than about £1.6 million in 2022. The net profit came in at £775,328, 94 percent lower than the previous year.

After achieving these results, the company changed its name from TeraFX to Gildencrest Capital, which was a major branding overhaul for the broker. It also closed its Polish branch and is now seeking a licence in Latvia and has plans of opening a branch in Riga later this year.