Andrey Dashin’s brokerage brand ForexTime (FXTM) has renounced its Cyprus Investment Firm (CIF) license and “ceased all operations from 31st of December 2023” under the Cypriot entity.

FXTM Exits Europe?

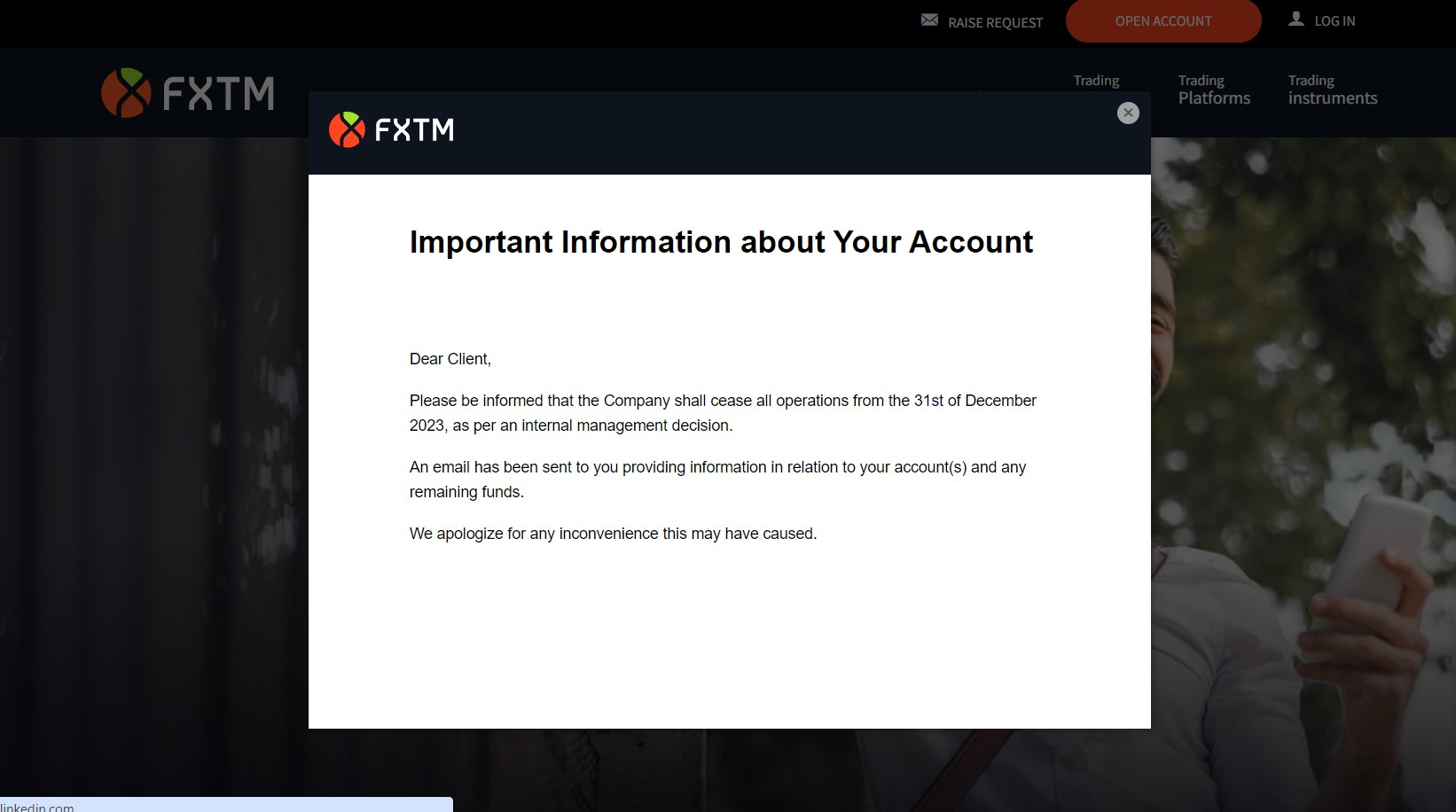

A notice displayed on the EU website of FXTM (forextime.com/eu) confirmed that the cessation of the services came “as per internal management decision.”

The company already terminated its services to retail clients in the EU in February 2021. In the earlier email to the retail customers, the company explained that it will provide its services in the EEA region exclusively for professional clients and institutional traders. However, the latest development indicates that the company has entirely pulled off its services from the EU.

The regulatory registry of the Cyprus Securities and Exchange Commission (CySEC) shows that the license offered to Forextime Ltd is currently “under examination for voluntary renunciation of the authorization.” The Cypriot obtained the license in December 2012.

Finance Magnates approached Exinity (the parent of FXTM) for the official take on the termination of services under the Cyprus license but did not receive anything as of press time.

Andrey Dashin’s Brokerage Empire

The ForexTime or FXTM brand is controlled by the broader Exinity Group, which offers retail trading services under the Alpari brand. The brands were consolidated under the Exinity Group in 2020. The Exinity website mentions that the “trading brands FXTM and Alpari currently serve over two million clients from multiple regulated entities, offering our services in 18 languages to clients in 150 countries.”

Dashin operates his trading industry empire with several legal entities and websites. The ForexTime (FXTM) brand is licensed in the United Kingdom and Mauritius. Exinity UK Ltd is the entity regulated by the UK’s Financial Conduct Authority while Exinity Limited is one licensed by Mauritius’ Financial Services Commission and operates Alpari International.

Another entity, Alpari (Comoros) Ltd, is noted to be regulated by the Mwali International Services Authority. Other regulated entities of Dashin’s empire are in Kenya, the UAE, and a few other jurisdictions.

Last year, the Exinity Group expanded beyond its retail offerings and entered the institutional business with liquidity solutions. Additionally, the group onboarded Matthew Wright as the Chief Operating Officer in September.

Meanwhile, the UK unit, which only offers services to professional and institutional traders, reported a revenue of about £1.68 million, a marginal year-over-year decline, while its pre-tax profits jumped 1,802 percent to £319,251. Over the years, the UK regulator flagged several clones of ForexTime (FXTM).