Retail CFD brokers are adjusting offerings and risk management measures as investors turn to gold and silver amid economic uncertainty, rising inflation, and geopolitical tensions. Sharp price movements in the precious metals market have prompted these changes.

CFD Brokers Respond to Rising Gold, Silver Prices

FXPrimus has increased leverage on gold pairs, allowing clients to trade with up to 1:2000 leverage. According to the broker, it will provide “more flexibility” amid rising prices.

In contrast, OANDA Japan has issued formal warnings to traders about extreme market swings in silver and other precious metals. The broker highlighted wider spreads, lower liquidity, and fluctuating funding rates. It also cautioned that trading could be temporarily suspended to protect clients.

Join IG, CMC, and Robinhood at London’s leading trading industry event!

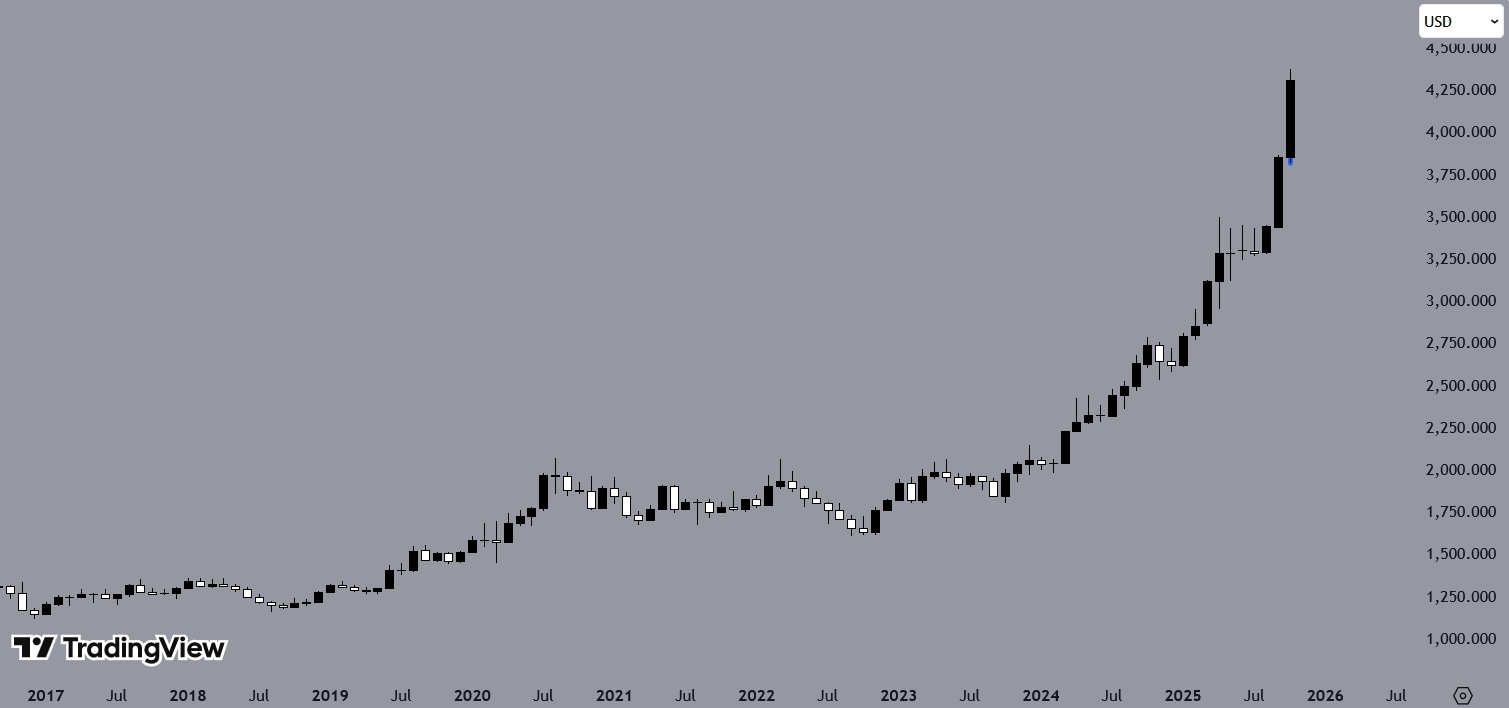

Gold Prices Surge Rapidly This Year

Gold prices have seen substantial gains this year. In early January, gold traded between roughly $2,624 and $2,798 per ounce. As of Friday, spot gold reached a record $4,378.69 per ounce, marking an increase of about 62% year-to-date.

- OneRoyal Promotes Dominic Poynter from Head of Marketing to Chief Commercial Officer

- When Giorgia Meloni Sold Crypto—Without Knowing It: Consob Steps In

- Brokers Can Connect Directly to Exinity Connect via MT5 for Liquidity

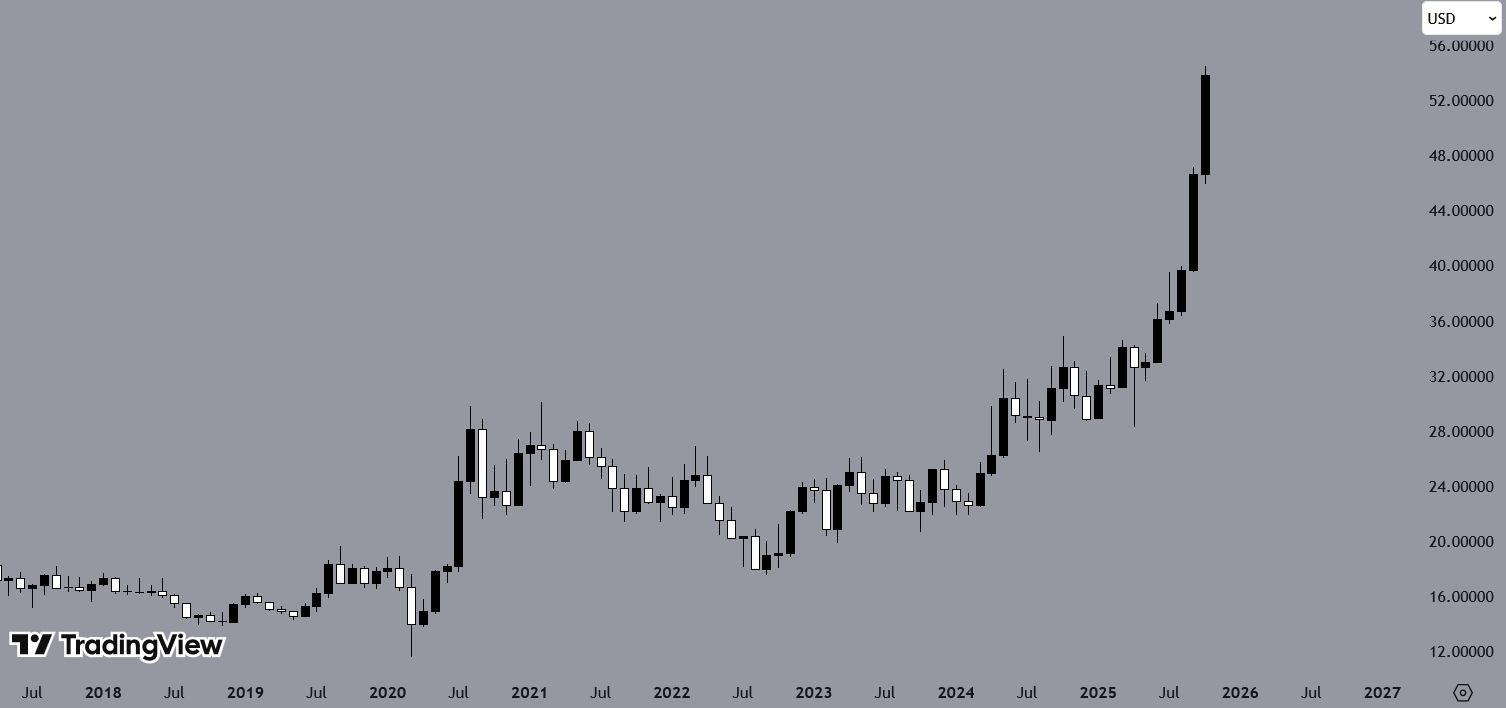

Spot Silver Reaches New Record Levels

Silver has risen even more sharply. On January 1, 2025, it was priced around $28.92 per ounce. Today, it climbed to approximately $54.07 per ounce, an increase of about 87% year-to-date.

US-China Trade Tensions Drive Market Volatility

Earlier, President Donald Trump had threatened a “massive increase” in tariffs on Chinese goods and suggested he might cancel a planned meeting with President Xi Jinping. The comments followed China’s announcement of export controls on certain goods and software.

Afterwards, Trump indicated a potential easing of trade tensions while also signaling that further tariff measures could be implemented. Financial markets reacted, with US stocks falling and cryptocurrencies experiencing sharp swings.

Bitcoin dropped about 9%, and some altcoins fell over 50%, while institutional investors remained largely steady, reflecting a measured response to ongoing geopolitical and trade uncertainty.