FundingTicks, a prop trading platform, has announced it will wind down its operations. The company said the decision is part of a "strategic plan" to focus resources on areas that deliver long-term value to clients and partners.

The move comes after backlash in December 2025, when the platform introduced new trading rules. Changes included a one-minute minimum trade hold for scalpers, higher daily profit requirements, and reduced profit splits.

- "Gamified Features in the Evaluation Stages": Arizet Launches Trading Platform for Prop Firms

- Inside Prop Trading’s iGaming Psychology Engine

- Prop Traders Want to Hear About Others’ Experience: Is That Why They Trust YouTube?

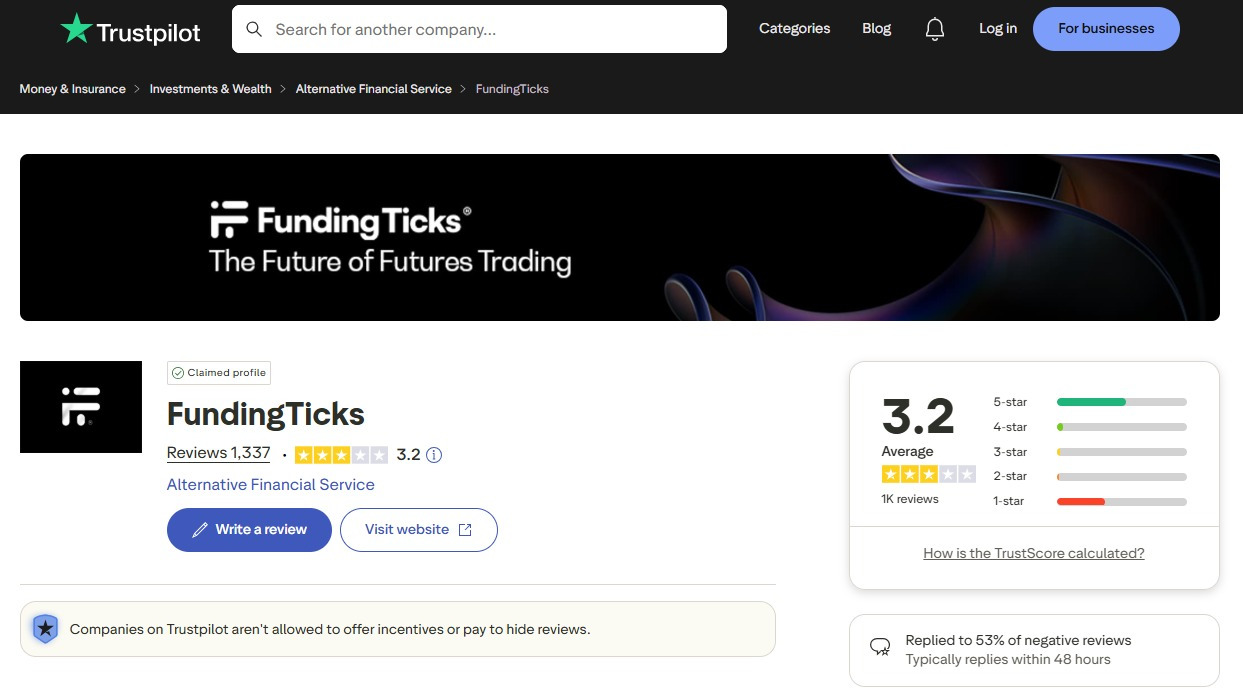

Traders reported that previously valid trades and profits were reduced or invalidated. FundingTicks’ Trustpilot rating fell from 4.1 in October 2025 to 3.2. CEO Khaled defended the platform, stating he had “paid out more than US$220M” and prioritized traders.

Live, Evals, Master Accounts To Refund

FundingTicks said the wind-down will be handled with “security, fairness, clarity and transparency.” The company outlined how it will manage accounts and rewards during the process.

All active Evals and Master accounts will be refunded in full, regardless of profit or drawdown. Master accounts that reached profit targets and met trading objectives will receive an 80% reward split, while those that did not meet objectives will receive a 20% split.

For live accounts, those in profit will receive a refund, 90% of realized profit, and 20% of the initial balance. Accounts at the initial balance will receive a refund and 20% of the initial balance. Accounts in loss will receive a refund only. Pending live transition accounts will also be refunded and receive 20% of the initial balance.

Traders Advised to Check Dashboards

The company said refunds and account handling are already underway and advised traders to check their dashboards for details. FundingTicks’ support team will remain available until January 31 to respond to questions.

The company concluded by thanking traders and stating that its focus will remain on execution and other areas going forward.

Hundreds of Prop Firms Closed 2024

Finance Magnates reported earlier that the prop trading industry experienced significant disruption in 2024. Estimates suggest that 80 to 100 prop trading firms closed, challenge pass rates fell, and average trader investments dropped by around 50%. The shift followed MetaQuotes’ decision to reduce support for prop firms, prompting consolidation and changes in trader behavior.