Finalto Group has consolidated its business structure in the United Kingdom. At the end of 2024, it completed the migration of Finalto Trading’s (previously Tradetech Alpha) clients to Finalto Financial Services (formerly CFH Clearing), which had a notable impact on the financials of both units.

Revenue Shifted from One Entity to the Other

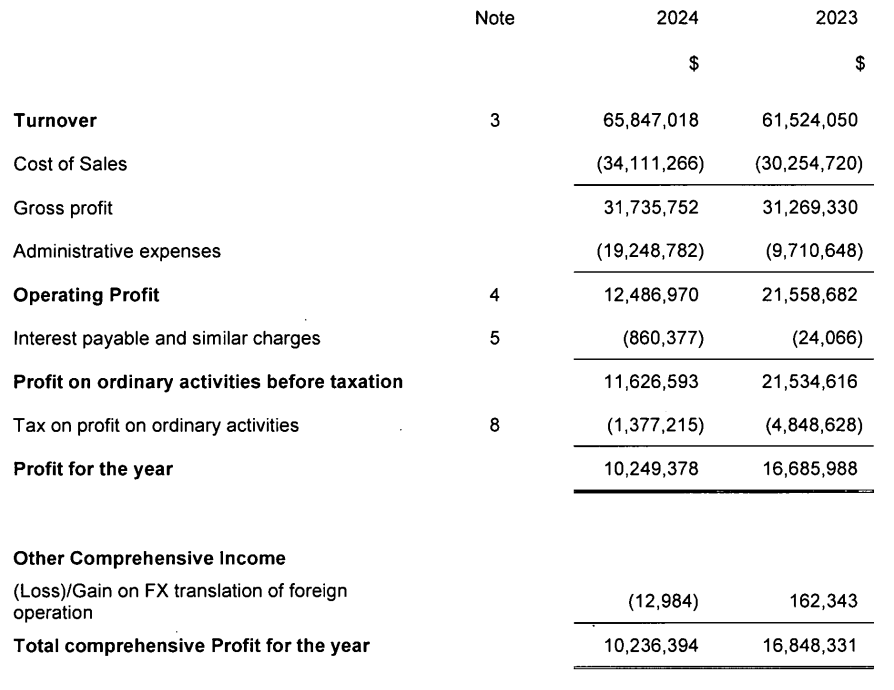

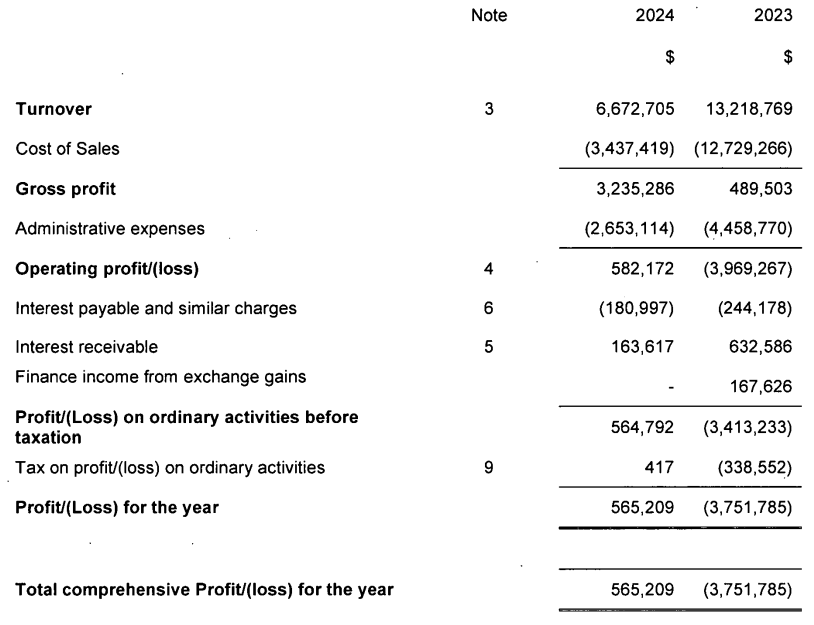

The revenue of Finalto Financial Services for 2024 rose to more than $65.8 million, a yearly increase of almost 7 per cent. Meanwhile, Finalto Trading’s revenue almost halved to $6.6 million due to the client migration.

The migration of clients began in 2023.

According to the latest Companies House filings, the pre-tax profits of Finalto Financial Services, which will now remain the sole UK entity, came in at $11.6 million, down from $21.5 million. The company explained that “increased revenue from former Finalto Trading clients was offset by higher costs from services provided by other group companies and costs taken on from Finalto Trading.”

Some big moves at Finalto: Finalto's Group CEO Matthew Maloney Steps Down; Markets.com CEO Stavros Anastasiou Departs

Trading Volume Took a Hit

The unit also revealed that trading volume on its platform fell to $1.3 trillion from $1.4 trillion in the previous year, “due to certain clients onboarding with other entities in the Finalto group.”

“The Company continued to onboard a geographically diverse client base throughout the year, giving the Company a strong pipeline heading into 2025,” it noted, adding that it continues to invest in technology development.

Meanwhile, Finalto Trading wound down most of its activities at the end of 2024. It also highlighted that it had sufficient cash on hand to meet its liquidity obligations. Its post-tax profits for 2024 came in at $565,209 compared with a loss of more than $3.7 million in the prior year, which was “primarily driven by performance in the first quarter of the year, when the company was more active.”

Hong Kong-based Gopher took control of both UK companies in 2022 through the $250 million acquisition of the Finalto Group.