TipRanks, a market research aggregator, has brought artificial intelligence (AI) closer to investors with the launch of Spark, its most comprehensive AI stock analyst, Finance Magnates has learned.

Addressing the Demand for AI in Financial Services

“We are exceptionally proud to unveil the AI Stock Analyst – the world’s first and most comprehensive AI analyst,” said Uri Gruenbaum, Founder and CEO of TipRanks, which was acquired by Prytek last year for $200 million.

“TipRanks always aims to be at the cutting edge of financial innovation, helping investors make informed, data-driven decisions. This is yet another area of investment research where TipRanks is leading the way.”

The launch of the AI Stock Analyst comes at a time when multiple brokers are integrating AI-powered chatbots and assistant tools into their platforms. Earlier, eToro introduced Copilot and Einstein GPT. More recently, Tiger Brokers added DeepSeek AI.

Analysing Penny Stocks

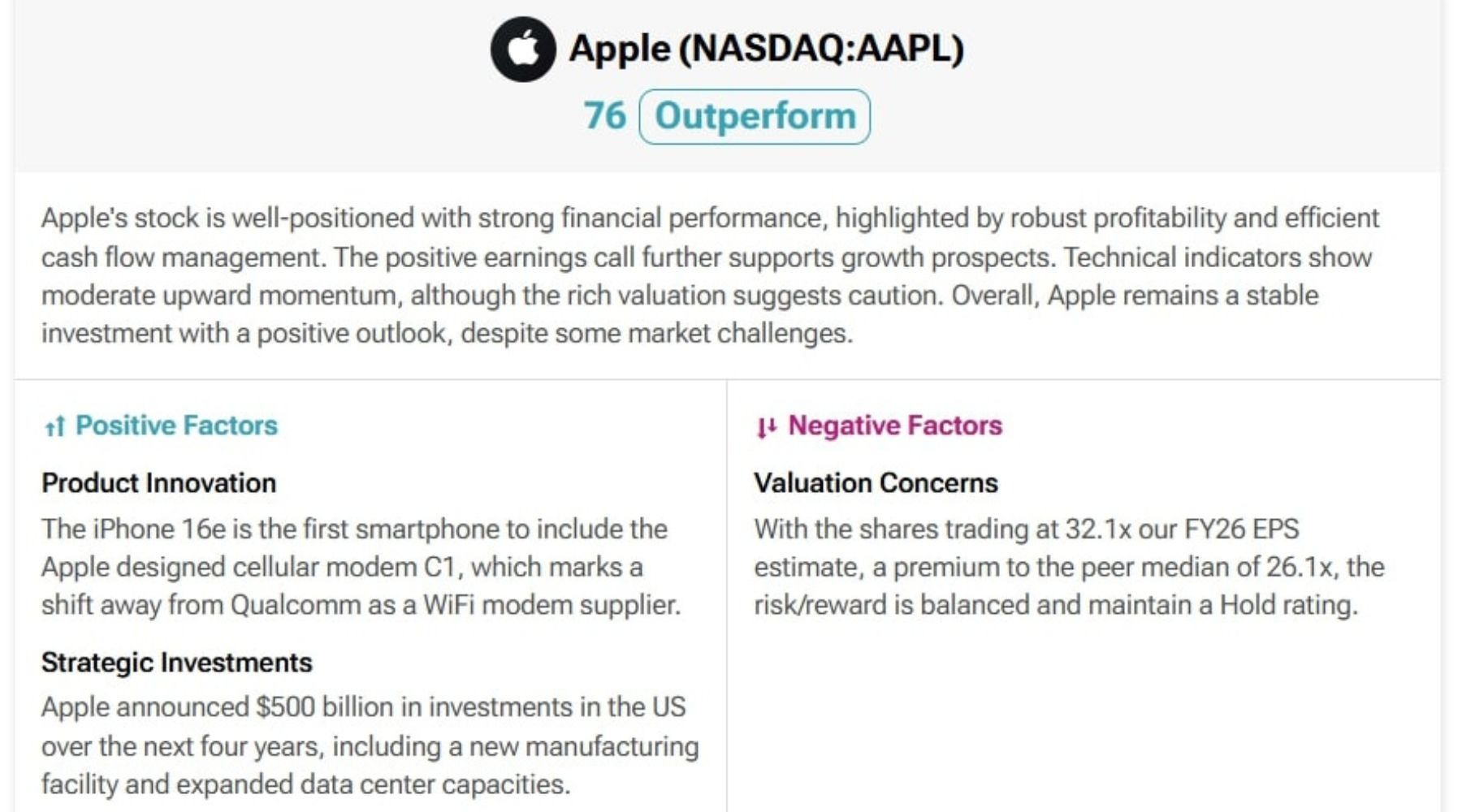

According to the Israeli company, the AI-based analyst helps retail investors and traders conduct “fast and easy” stock assessments and generate data-driven insights. The AI model evaluates stocks based on fundamental, technical, and sentiment-based indicators.

Beyond assessing positive and negative factors and company financials, the AI-based analyst also provides short- and long-term momentum signals. Additionally, it offers a summary and sentiment analysis.

TipRanks further highlighted that Spark has access to micro-cap penny stocks—an area where analysis is typically scarce for retail investors. By introducing this feature, TipRanks is filling a significant gap in market research.

The company’s new AI analyst sources information from its existing financial database.

Founded in 2012, TipRanks is a stock research platform that provides alternative datasets to retail traders. It uses natural language processing to analyse the performance of professional analysts.

Its services are accessible through its platform and via brokers that partner with TipRanks to offer additional stock analysis features. Last December, Finance Magnates reported that the Australian division of CMC Invest, the stock trading platform of CMC Markets, had integrated TipRanks’ services for its customers.

The Israeli company even offers a MetaTrader 5 plugin, enabling traders to access its services without leaving the popular trading platform.