RoboMarkets, which exited the retail CFDs market in Europe, now appears to be targeting the Middle East, having obtained a Category 1 licence from Dubai’s Securities and Commodities Authority (SCA), FinanceMagnates.com has learned.

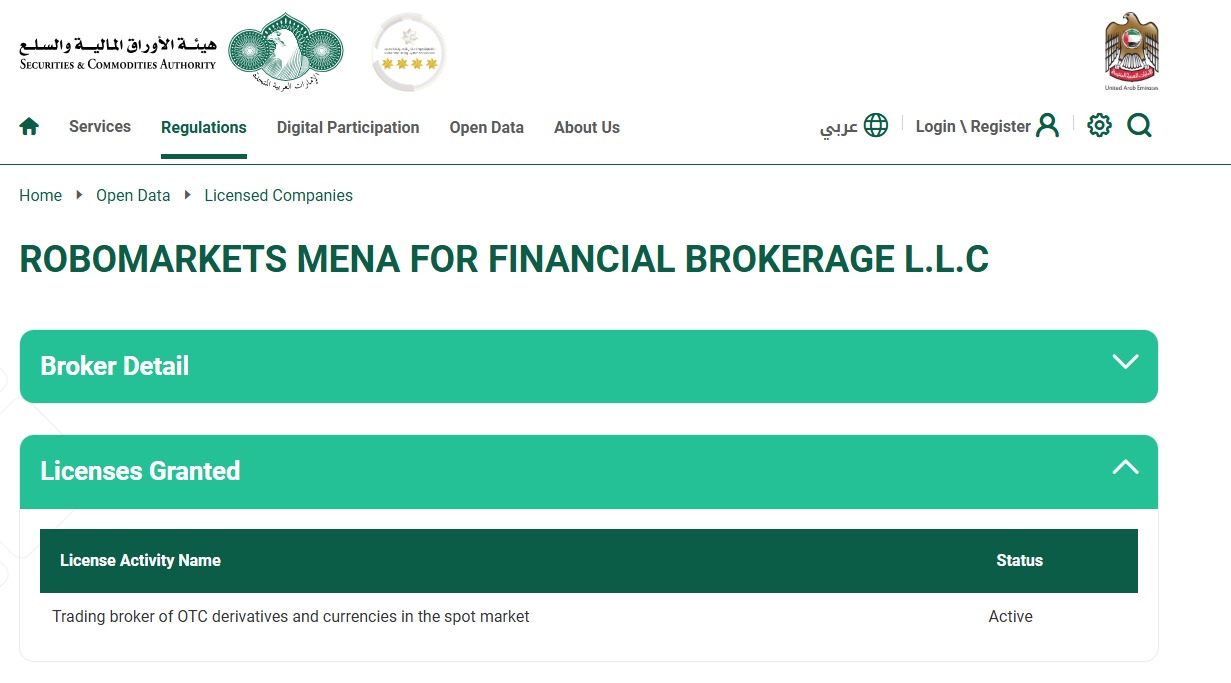

According to the regulatory register, the licence has been awarded to the local entity, Robomarkets MENA for Financial Brokerage, which was established in July last year.

Brokers Are Flocking to Dubai

Category 1 under the SCA is the “Dealing in Securities” licence. It authorises firms to operate as trading and clearing brokers, trading brokers in global markets, brokers for non-exchange-traded derivatives and spot FX, trading brokers (on-market), and securities dealers.

Read more: What Do Exness, IronFX, FXTM, and RoboMarkets Have in Common?

Although many other CFD brokers have obtained licences from the Dubai regulator, most have secured Category 5, which allows them to operate in a similar way to introducing brokers (IBs). Exinity, VT Markets, Eightcap, EC Markets and Taurex are among those with a Category 5 licence.

Meanwhile, Plus500 and XTB are two established brands that have obtained the SCA’s Category 1 licence.

IC Markets is another notable broker working towards obtaining a UAE licence to strengthen its Middle East presence, though it has not announced any details about the licence category.

New MENA CEO Onboard

The Dubai regulator’s register also shows that RoboMarkets’ Dubai unit appointed Karine Ugarte as one of its local executives. Her LinkedIn profile indicates that she became CEO of RoboMarkets MENA last May.

FinanceMagnates.com reached out to RoboMarkets but has not received a response.

The Cyprus-regulated entity of RoboMarkets, rebranded from RoboForex, dropped its retail CFDs business earlier this year and moved to serve only institutional clients. The change in business model made the Frankfurt-based entity the centre for serving European retail clients, offering only stocks, bonds and ETFs.

Meanwhile, the Belize-regulated RoboForex brand continues to operate offshore and provide CFDs to retail clients.