Hirose Financial, which offers forex and contracts for differences (CFDs) trading services, has suspended onboarding new retail traders under its United Kingdom and Labuan-regulated entities, FinanceMagnates.com has learned. However, the broker's Japanese operations appear to still be operating.

A “Permanent” or “Temporary” Suspension?

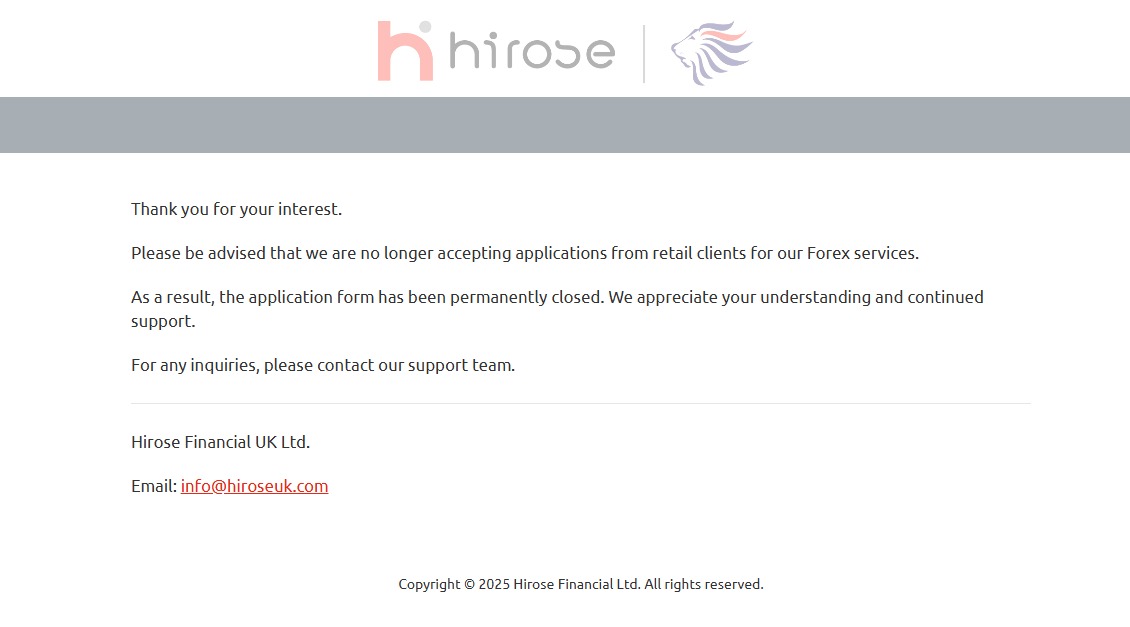

“Please be advised that we are no longer accepting applications from retail clients for our forex services,” the new client registration page of Hirose’s UK and Labuan entities now notes. “The application form has been permanently closed.”

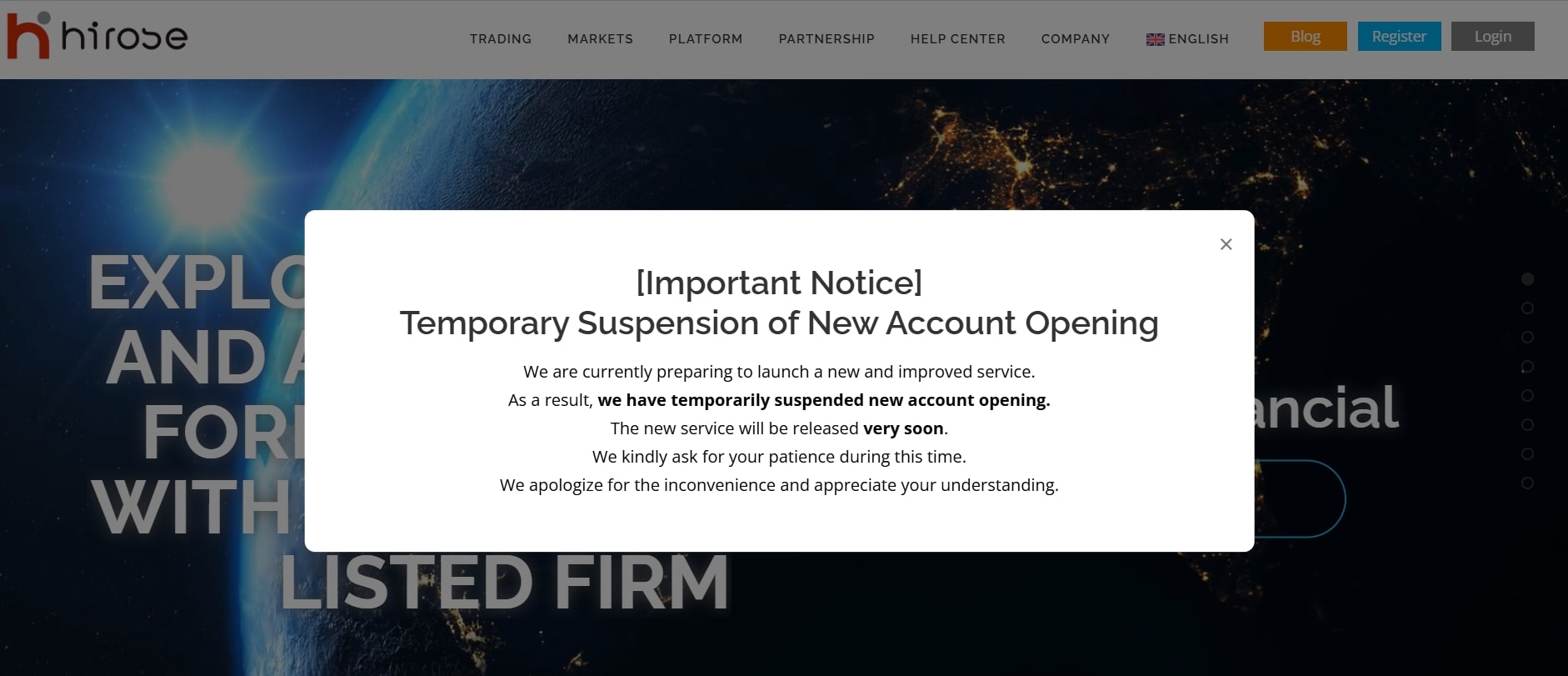

Interestingly, another notice on the homepage of another Hirose website, which redirects potential clients to Hirose’s offshore websites, states that the new account suspension is temporary.

“We are currently preparing to launch a new and improved service,” a notice on the website reads without any further information, adding: “The new service will be released very soon.”

According to a cached page on Web Archive, the services were suspended sometime in late July or early August.

Outside Japan, Hirose operates with licences from the UK’s Financial Conduct Authority and Labuan in Malaysia.

The broker also offers institutional services under its UK entity. However, it remains unclear if the suspension applies only to retail operations or also to services for institutions.

FinanceMagnates.com reached out to Hirose but has not received any response as of press time.

Read more: Brexit Forces Hirose UK to Shut EEA Business

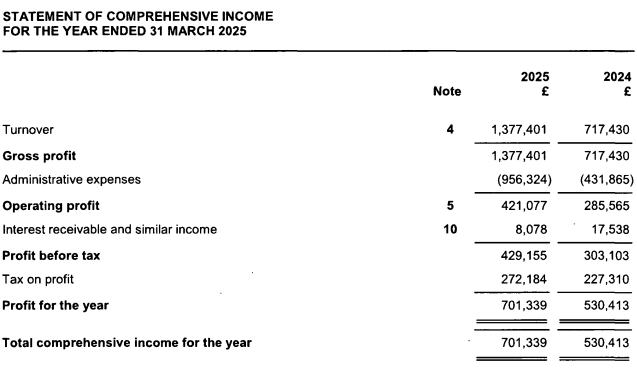

The UK Revenue Almost Doubled

Meanwhile, the UK-registered Hirose entity reported almost £1.38 million in annual turnover, a 92 per cent increase, for the financial year ending 31 March 2025. The revenue boost also impacted profitability, as the company netted over £701k, up from £530k.

The company's latest Companies House filings also mentioned that it will focus on “B2B market opportunities in order to increase the number of institutional traders.” However, they did not mention anything about plans for retail operations.

Recently, AETOS, another Australia-headquartered broker with links to China, shuttered its UK operations entirely after several other brokers left the country.

However, some still see opportunities in the UK, as Ultima Markets and Moneta Markets recently obtained an FCA licence.