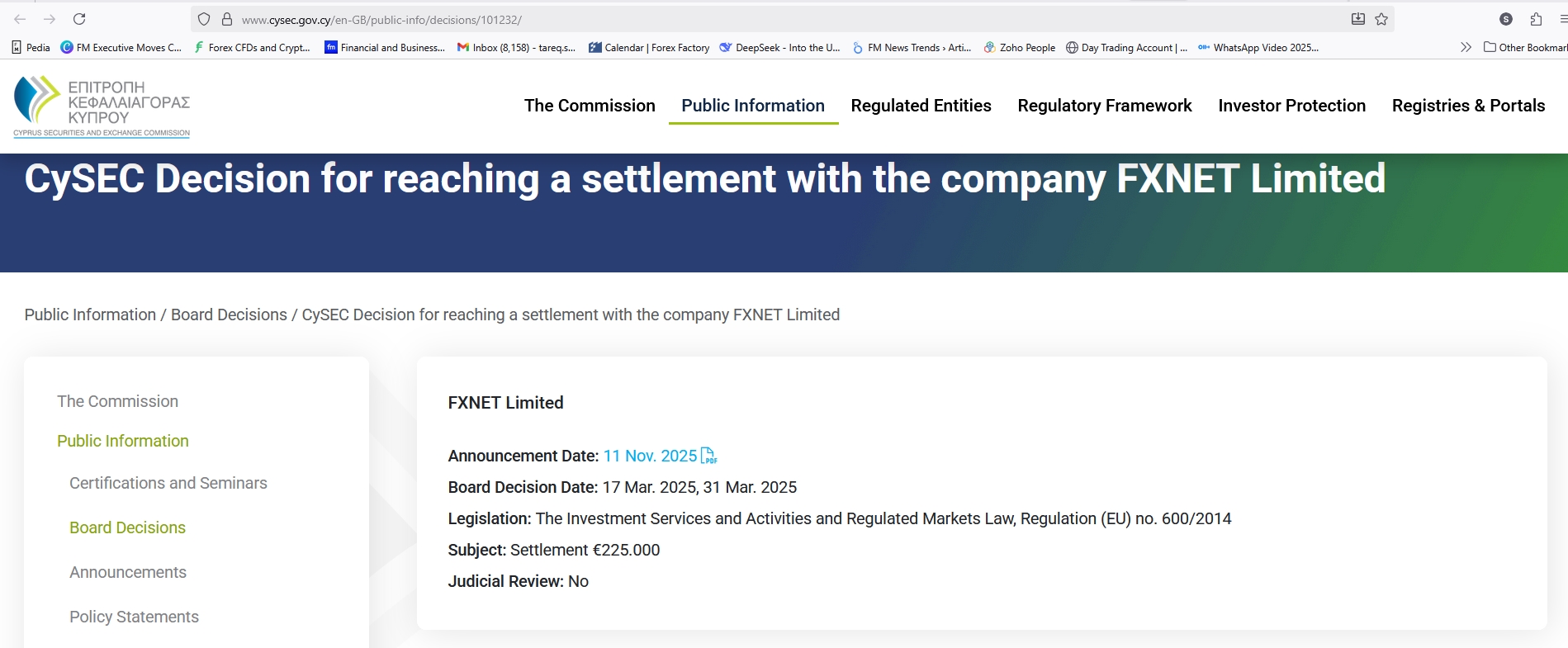

The Cyprus Securities and Exchange Commission has reached a settlement with FXNET Limited amounting to €225,000. The announcement was made today (Tuesday).

Join IG, CMC, and Robinhood in London’s leading trading industry event!

FXNET operates the brokerage brand EMS Brokers. The company agreed to the settlement following a review under the Investment Services and Activities and Regulated Markets Law.

CySEC Confirms FXNET Settlement Completion

CySEC said the Board took the decision in March this year after examining the company’s operations. The settlement resolves possible breaches identified during the review period. FXNET will pay the amount as part of the settlement. CySEC confirmed that no judicial review has been filed in relation to the case.

- The UK’s Investment Conundrum: Can Retail Save the Day?

- Admirals Cancels UAE License While Selling Australian Subsidiary

- Finfluencer Receives First Custodial Sentence in Hong Kong for Unlicensed Telegram Advice

Finance Magnates contacted the firm for comment. No response had been received at the time of writing.

FXNET Previously Fined by CySEC

This is not the first time FXNET has faced regulatory action. In 2019, CySEC announced a settlement with the firm, imposing a €60,000 fine for breaches of the Investment Services and Activities and Regulated Markets Law.

FXNET, a Cyprus Investment Firm regulated by CySEC since 2013, is required to comply with local regulations to maintain its trading license, which allows it to provide services across Europe.

CySEC Blocks Public Access to Certification Records

Meanwhile, the CySEC temporarily suspended public access to its Certification Registers. The regulator said the move followed reports that scammers were using personal details of certified professionals to mislead investors.

CySEC emphasized that certification remains a requirement for employment at supervised firms and urged the public to verify identities and companies before sharing personal or financial information. The suspension is intended to protect both investors and certified professionals.

CySEC invited individuals seeking clarification to contact its Certifications Department directly, highlighting ongoing concerns over impersonation and misuse of certification data in the capital market.