The Cyprus Securities and Exchange Commission (CySEC) has published its latest report on the Collective Investments sector, covering the fourth quarter of 2024.

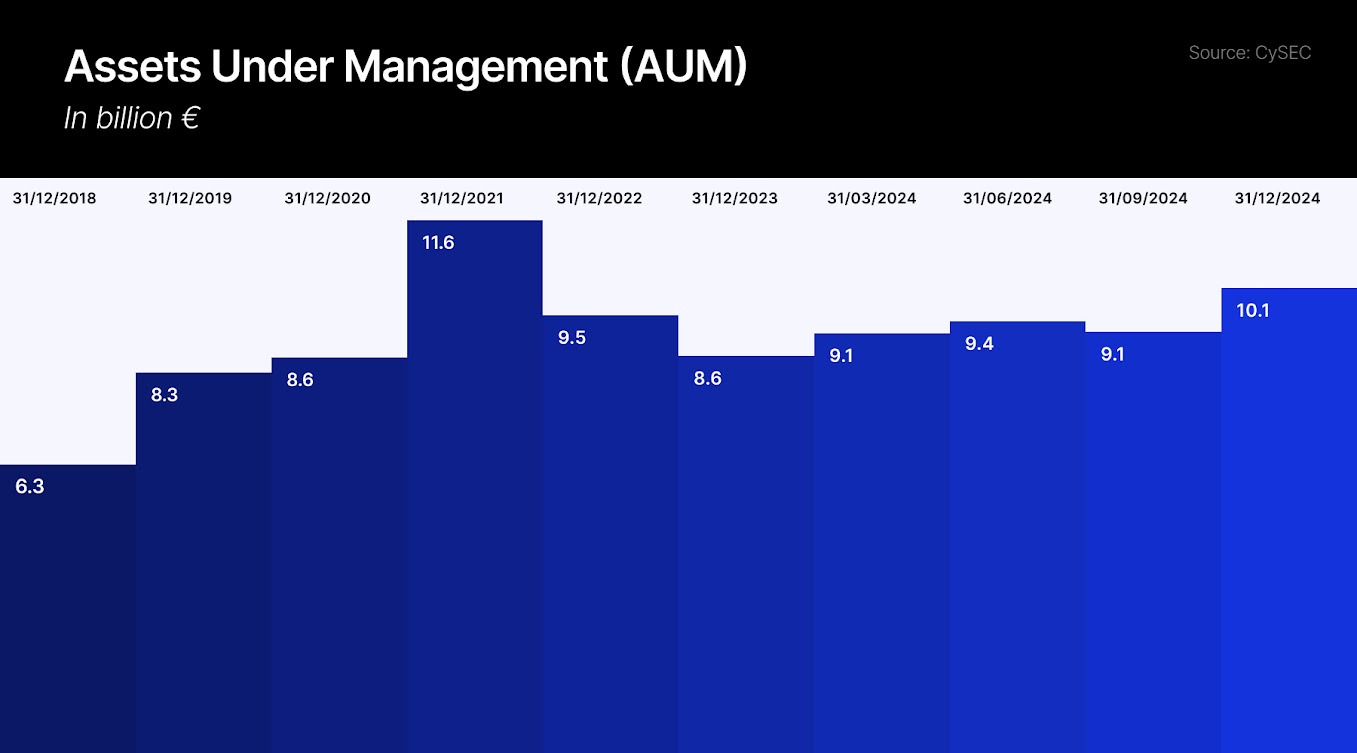

According to the report, total assets managed by investment funds in Cyprus rose to €10.1 billion. This marks a 10% increase from the previous quarter and a rise of nearly 18% compared to the same period in 2023. The growth is mainly due to new capital entering the market.

AIFMs Manage Majority of CySEC Funds

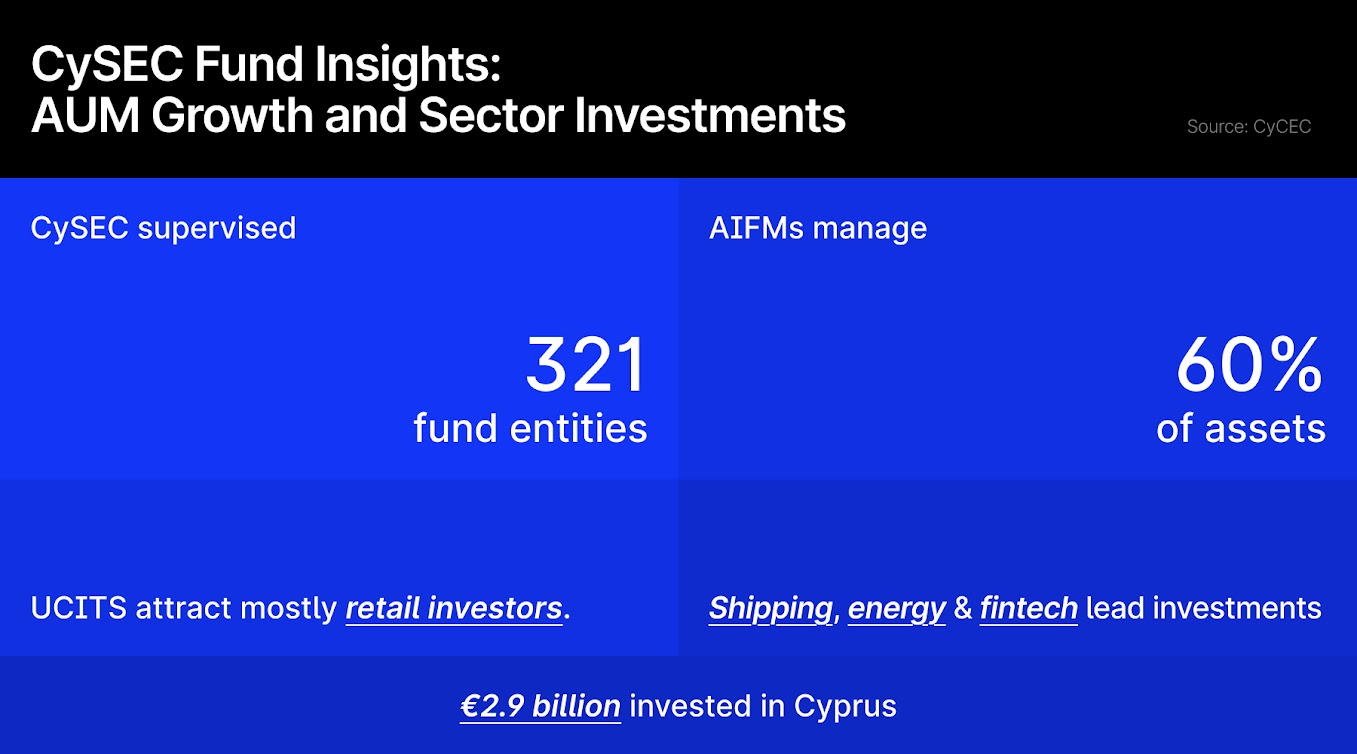

CySEC supervised 321 management companies and investment funds at the end of the quarter. This includes both externally and internally managed funds, along with licensed fund managers. The number was slightly lower than the 328 entities recorded a year earlier.

Most of the assets were managed by Alternative Investment Fund Managers (AIFMs), who held about 60% of the total. UCITS managers and other fund managers shared the rest. Overall, the Net Asset Value of the funds reached €9.6 billion.

You may find it interesting at FinanceMagnates.com: CySEC’s €17 Million 2025 Budget Focuses on Regulatory Oversight and Tech Enhancements.

Shipping, Energy, Fintech Lead Fund Investments

Around 75% of the total assets were held by 201 funds based in Cyprus. Of these, 166 funds invested partially or entirely in the local market. These Cyprus-focused investments reached €2.9 billion, or nearly 29% of total assets. Most of the domestic investments were in private equity and real estate.

The investor base differed depending on the fund type. Almost all investors in UCITS were retail clients. In contrast, alternative funds attracted mostly well-informed and professional investors.

In terms of sectors, the funds showed strong interest in areas like shipping, energy, and fintech . At the end of the quarter, €709 million was invested in shipping, €496 million in energy, and €258 million in fintech. Sustainable investments remained limited, accounting for less than 1% of the total.