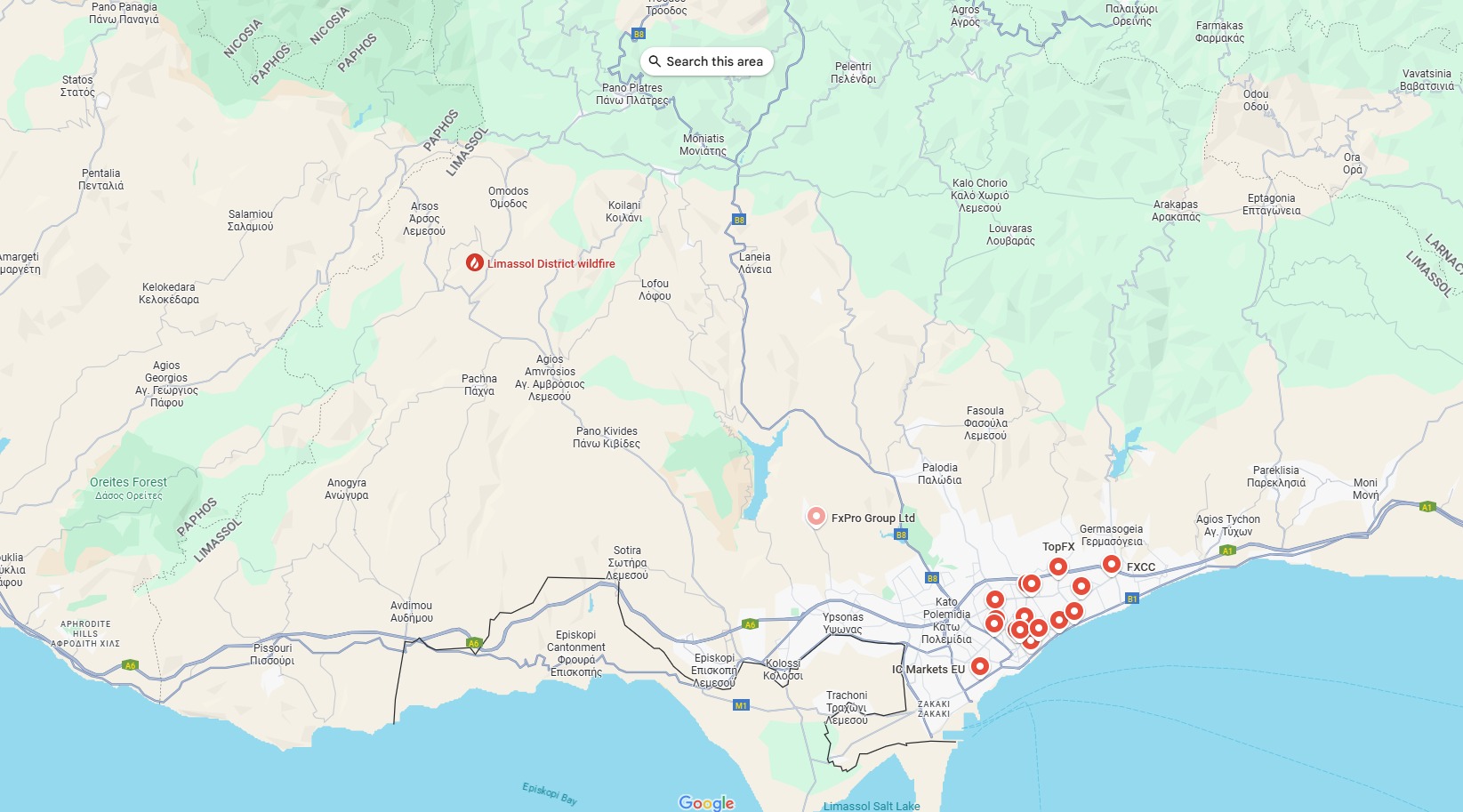

The wildfire in southern Cyprus has taken a serious turn, with two people killed and hundreds evacuated. However, the devastation remains far from the heart of Limassol, which is home to several contracts for differences (CFDs) brokers.

You may also like: What Do Exness, IronFX, FXTM, and RoboMarkets Have in Common?

Firefighting and Evacuation Efforts Are Ongoing

According to local reports, two fires are raging out of control in the Limassol and Paphos districts. Authorities have continued their efforts to evacuate residents from the village of Lofou, about 26 kilometres from Limassol city.

Homes were also burning in the Souni-Zanakia communities early Thursday.

“The situation is very difficult, and the fire front is huge. All forces have been mobilised,” Cypriot President Nikos Christodoulides told reporters from the scene yesterday (Wednesday).

Strong winds and high temperatures have also made it more difficult for firefighters to contain the blaze.

Authorities said 14 firefighting aircraft were deployed to tackle the fire yesterday (Wednesday). Although aerial operations were paused overnight due to darkness, aircraft were expected to resume at first light today (Thursday).

The country also requested assistance through the European Union's civil protection mechanism. Spain was expected to send two aircraft, and Jordan also pledged support.

Many CFD brokers operate from Cyprus, one of the country’s leading sectors for private employment. Although these brokers are spread across major cities, most are based in Limassol.

Read more: Exness Bought €75 Million Land from the Bank of Cyprus

Heatwaves and Wildfires

The wildfire erupted around midday yesterday (Wednesday) in mountainous terrain north of the southern city of Limassol. The cause of the wildfire is not yet known.

Temperatures on the Mediterranean island reached 43 degrees yesterday (Wednesday), prompting authorities to issue an amber weather warning. The ongoing heatwave is forecast to push temperatures to 44 degrees today (Thursday), which would make it the hottest day of the year.

Amid the scorching heat and dry conditions, the Cypriot forestry department issued an urgent appeal to the public to avoid using tools or generating sparks near forested areas.