StriveFX, a global forex and CFD broker, has added cTrader, a multi-asset trading platform developed by Spotware, to its platform offerings. The integration provides StriveFX clients with an additional trading option suitable for different levels of experience.

Meanwhile, Brokerpilot has integrated its risk management software with cTrader, enabling brokers to monitor trades, assess risk, and analyze data in real time. The platform targets retail forex, cryptocurrency, and commodity brokers, providing centralized tools to oversee trading activity, detect potential fraud, and manage operations from a single dashboard.

StriveFX Expands with cTrader Integration

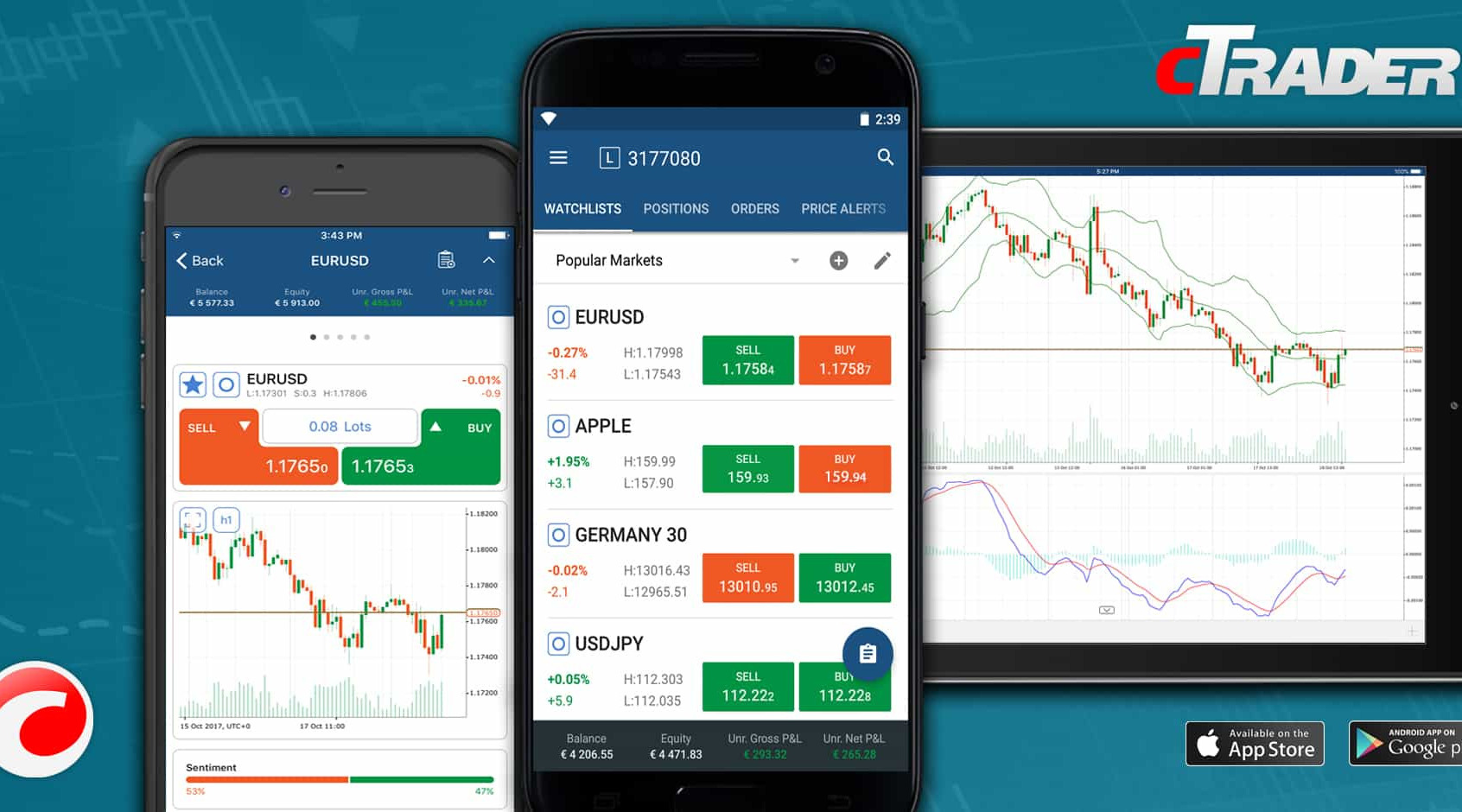

The platform is available across iOS, Android, web, desktop, and Mac. It supports 23 languages and aims to deliver a consistent trading experience across devices. StriveFX clients can use cTrader’s copy trading features and access a community of over 8 million users.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

- Interactive Brokers’ Tax Planner Offers Investors Full-Year Tax and Portfolio Insights

- IG Sees Departure of Marketing and Product Leader Michael Logue After 13 Years

Platform Adds Algorithmic and Referral Features

cTrader also supports algorithmic trading through cBots and custom indicators with cloud execution . The cTrader Store provides access to prebuilt bots, indicators, and plugins. Alerts and notifications are available for price movements, order updates, and broker messages.

The platform includes plugin and API integrations, with over 100 third-party tools for analytics , reporting, payments, and other workflows. A referral system, cTrader Invite, allows introducing brokers and partners to share links and track client referrals within the platform.

cTrader Integrates MAP FinTech Compliance Tools

MAP FinTech has partnered with Spotware to integrate regulatory reporting capabilities into the cTrader platform. The integration allows brokers to manage transaction reporting, trade surveillance, and best execution monitoring for regulations such as EMIR, MiFIR, and SFTR without switching between systems.

The approach aims to reduce administrative burden while maintaining compliance across multiple jurisdictions. MAP FinTech processes reporting for over 200 clients globally.