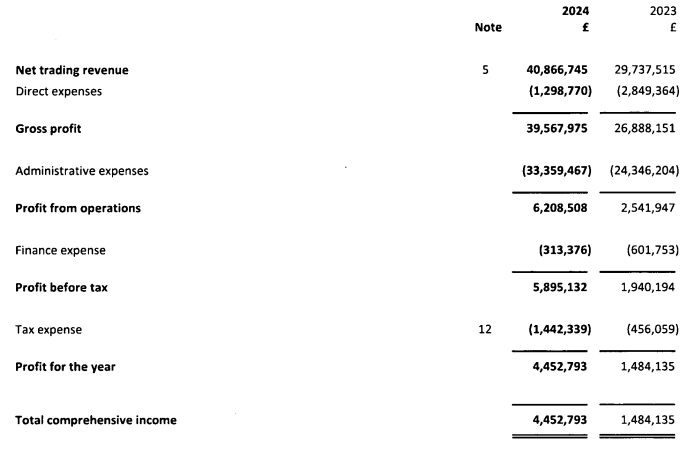

The UK unit of Capital.com ended 2024 with a net trading revenue of about £40.9 million, up from the previous year’s £29.7 million. With the 37.7 per cent revenue rise, the company also netted £4.45 million in profit.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Solid Growth in Revenue

“The company's revenue is derived from rebates received from its parent company through acting as a matched principal broker in the CFD and spread betting markets,” the Companies House filing by Capital.com UK noted. “Revenue comprises a monthly service charge receivable from the company's parent.”

The company generated £42.4 million as income from rebates but also paid over £306k to customers as rebates. It generated £783k from interest and £209k from other services, but reported £2.2 million as payable revenue share.

The Financial Conduct Authority (FCA)-regulated company lowered its direct expenses, but its administrative expenses jumped to £33.4 million from £24.3 million. Staff costs were the primary reason behind the high administrative expense.

The company had 116 staff at the end of 2024, up from 105 in 2023. They worked across departments, including infrastructure, management, marketing, product, and sales.

Interestingly, the company slashed its marketing and promotional expenses to about £70,000 from the previous year’s £966,399, a decline of about 92.7 per cent.

The pre-tax profit of the company came in at £5.9 million, which was 210 per cent higher than the previous year. The net profit also jumped by 215 per cent.

Capital.com Expands

Apart from the UK, Capital.com also operates with authorisation from regulators in Australia, Cyprus, the UAE, and the Bahamas. However, the numbers posted with Companies House only represent the state of its UK business.

FinanceMagnates.com earlier reported that the brand is now seeking licences in Japan and Turkey, along with some other countries.

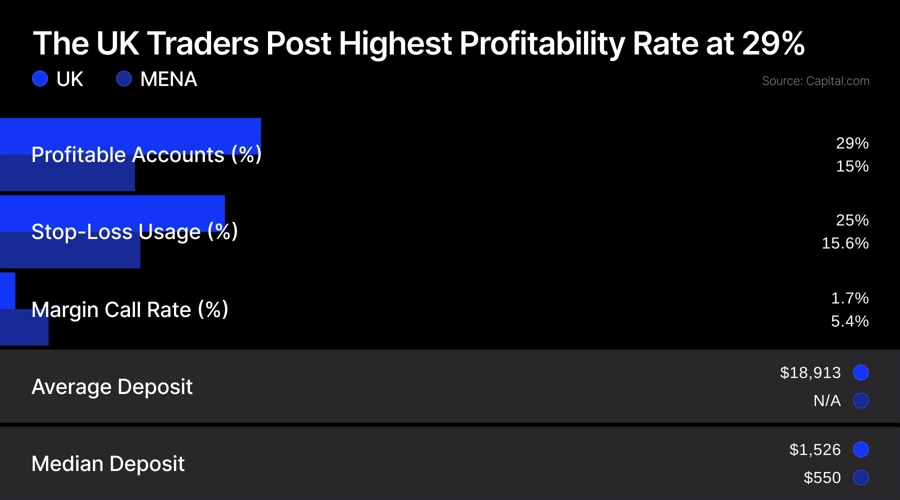

Recently, Capital.com also revealed that its British clients are the most profitable. The average UK deposit stands at $18,913, with a median of $1,526, nearly triple the amount in Europe and the MENA.

In H1 2025, the broker handled £1.5 trillion in trading volume globally. Out of that, 52.2 per cent was generated by traders in the MENA region. UAE traders turned out to be the most lucrative, as 71.7 per cent of the MENA trading volume came from them.

Read more about Capital.com: