Capital Index (UK) Limited, a provider of contracts for difference and spread betting, has reduced its annual losses for 2024, according to its recently filed statement of comprehensive income.

The company, however, continues to face challenges in achieving sustainable profitability within a competitive retail trading market.

Pre-Tax Profit Improves, Net Loss Persists

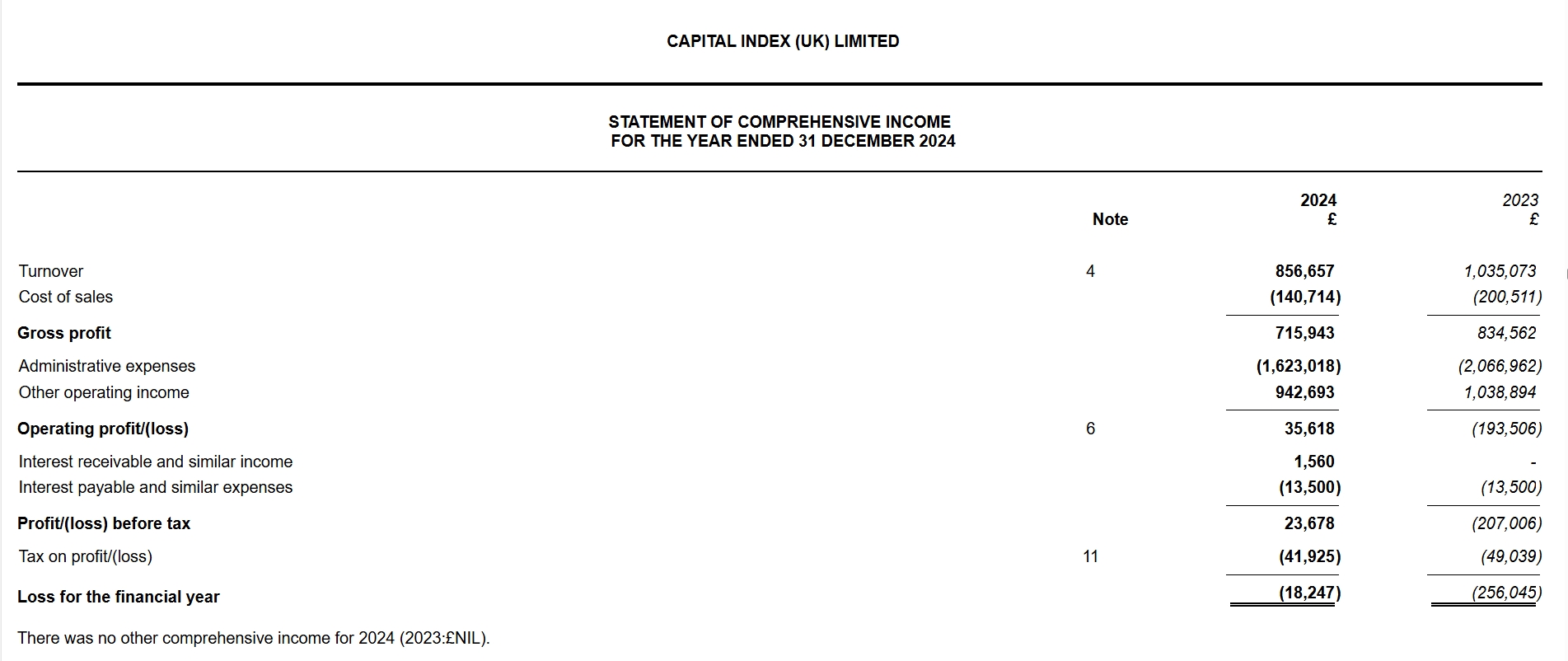

For the year ended 31 December 2024, Capital Index reported a pre-tax profit of £23,678. This marks a notable improvement from a pre-tax loss of £207,006 in 2023.

You may find it interesting at FinanceMagnates.com: Capital Index (UK) Sinks into Loss in 2021 as Market Volatility Vanishes.

Despite this return to a pre-tax profit position, the company recorded a loss after tax of £18,247. While substantially lower than the £256,045 loss in the previous year, this represents the second consecutive year without a net profit.

Turnover and Other Income

Turnover fell by more than 17%, declining to £856,657 from £1,035,073 in 2023. Other operating income, which often includes client trading losses or gains from the company’s own trading book, totalled £942,693, exceeding the turnover figure. This suggests that client performance and market conditions were major contributors to the company’s overall financial result.

Operating Expenses Remain High

Operating expenses continue to weigh on the business. Administrative costs decreased to £1.62 million from £2.06 million, but remained significantly higher than the gross profit of £715,943. Interest expenses were reported at £13,500, unchanged from the previous year, alongside minor interest income of £1,560.

The directors linked the challenges in their core UK market to broader economic pressures. In their report, they stated:

“The UK business continued to suffer due to the cost of living crisis, both in terms of client numbers and trades. However, the Directors are hopeful that revenues will increase in 2025 and together with a reduction in overhead costs a return to profit will be possible.”