BUX, the Dutch neobroker now fully owned by ABN AMRO, has quietly closed down its contracts for differences (CFDs) platform, Stryk, as it focuses “more on mid and long-term investing via the BUX app.” It has also allowed customers to migrate their accounts to AvaTrade, another CFDs broker.

Stryk Decommissioned

“We are reevaluating the position of speculative trading products within our group’s overall offering,” the FAQ section of the now-closed platform noted. “As part of this change in strategy, we are decommissioning Stryk, our CFD trading app.”

Elaborating on the decision to close the platform, BUX highlighted that it has been increasing its focus on “long-term wealth creation” and the “decommissioning of Stryk completes the strategic pivot.” It will also allow the company to “streamline [its] operations and allocate resources more efficiently.”

Further, the regulatory environment also played a role. “The landscape for CFDs has changed significantly since we entered the CFD market,” the website of the closed platform added. “In this environment, we believe that our resources are better directed towards the BUX mobile app, which focuses on mid and long-term investing and is poised for healthy growth in the coming years.”

Rebranding to the Strategic Path

BUX initially launched its CFDs offerings under the brand BUX X but rebranded it to Stryk in July 2022 to differentiate it from the company’s zero-fee trading app, which was also rebranded to BUX from BUX Zero in mid-2023.

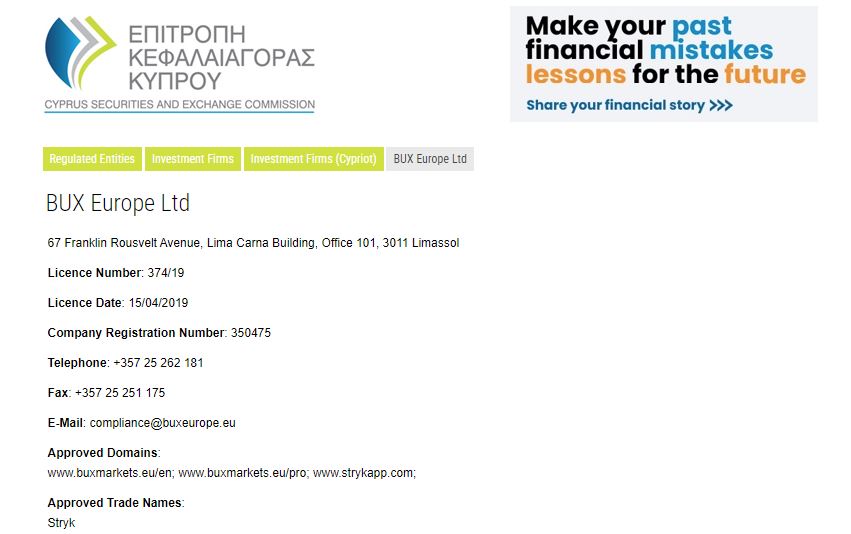

Also, the group operated the CFDs business under its UK-regulated entity. However, it shifted the CFDs business under the Cyprus-regulated BUX Europe to expand the services in the European markets. Although the Stryk brand has been decommissioned, according to the regulatory registry, BUX Europe still holds the Cyprus Investment Firm licence.

While it is unclear when exactly Stryk was closed down, Wayback Machine shows that the step was taken at the beginning of this year.

Meanwhile, the acquisition of the Netherlands-based BUX was recently completed by the local lending giant ABN AMRO, which will now mark its presence in the retail investment markets. However, the financials of the deal remain unknown.