The U.S. Commodity Futures Trading Commission (CFTC), the main financial watchdog that supervises FX derivatives in the US has given the concept of free-market a new meaning. In a notification issued today, the regulator announced that it has received a legal mandate from the courts which prohibits an Australian based financial services firm from soliciting US residents for investment purposes.

The United States exercised its might in the world of financial markets through its directive against Halifax Investment Services. The Sydney head-quartered firm, which offers traders a number of trading platforms and products was found guilty by the regulator for promoting its services to US residents, despite the firm not holding the correct regulatory status in the US.

James B. Zagel of the U.S. District Court for the Northern District of Illinois issued a Consent Order of Permanent Injunction that bars Australian firm Halifax Investment Services, Ltd. from soliciting orders to trade foreign currency (Forex ) from United States residents who do not qualify as eligible contract participants (ECPs). Details in the Order state; “that between October 18, 2010 and February 5, 2013, Halifax maintained a website that permitted United States residents who were not eligible contract participants to potentially apply to open leveraged Forex Trading accounts by submitting information online to Halifax’s website.”

Since 2008, FX traders in the USA have witnessed a number of significant changes that alter the way they deal with global FX brokers. New rulings deployed by the financial watchdog have prohibited foreign based brokers to solicit and promote products to US residents. Only firms registered in the US as a Retail Foreign Exchange Dealer (RFED) or Futures Commission Merchants (FCMs) are allowed to offer their products to residents.

The latest directive (Order) comes one year and two months after the CFTC filed a complaint against the broker. According to the CFTC complaint, Halifax acts as an RFED and knowingly solicits or accepts orders from non-eligible contract participants (non-ECPs) located in the U.S. without being registered with the CFTC as an RFED. Among other things, the complaint states that Halifax operates a website that permits U.S. customers to open trading accounts by submitting online account applications, and that nothing in Halifax’s online account application states that Halifax does not accept U.S. customers or precludes non-ECPs from opening forex accounts with Halifax. Apart from the permanent injunction, details in the complaint state that the CFTC; “also seeks civil monetary penalties, trading and registration bans, disgorgement and rescission.”

Australian providers are all too familiar with regulatory dealings with the US. In 2011, the CFTC reported that a number of global providers were soliciting US clients without the necessary paperwork. Vantage FX was caught-out along with ten other providers. The internationalisation of business and commerce has created a uniform code of conduct; this was reinforced during the 2009 G20 Summit which looked at OTC products and the role they played in the 2008 global recession. The US and Japanese regulators were the first major bodies to implement new leverage restrictions post the discussions, a concept that is expected to roll out in Singapore and other jurisdictions in the coming months.

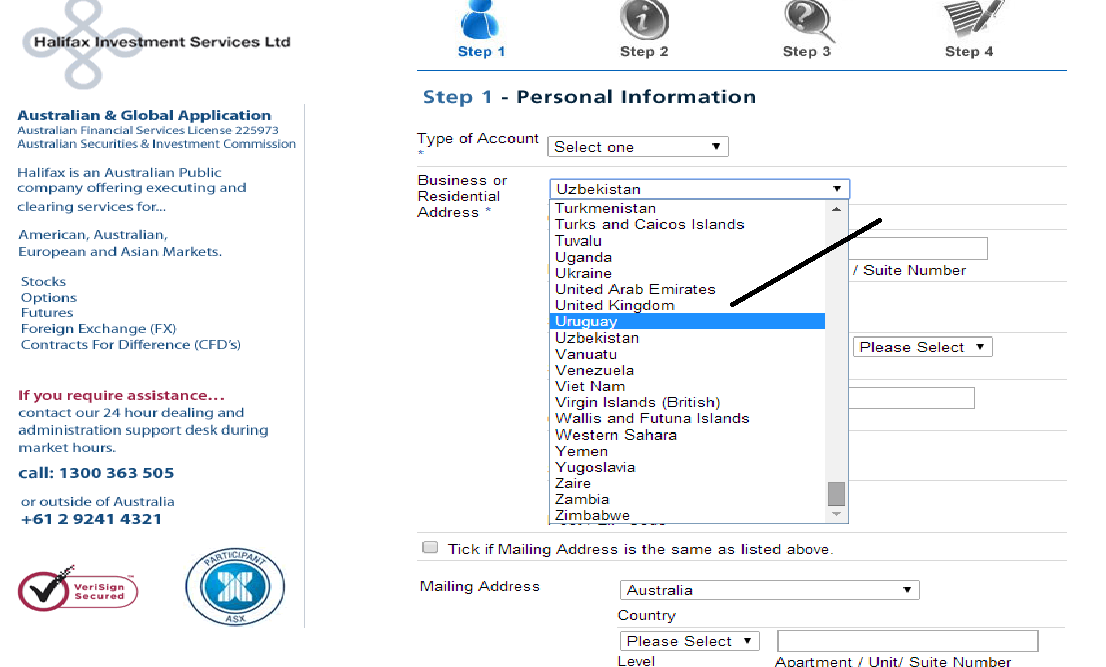

Halifax no longer allowing US residents to open an account

Halifax Investment Services offers a wide range of asset classes. According to its website it also offers traders a choice of platforms including; MT4, GFT’s Deal Book and the Saxo Trader.

Surprisingly, the firm has not placed a standard disclaimer that is common on several non-US brokers website, the fact that they do not deal with US residents. Several competitors including Think Forex has the necessary data on its website which states: “Please note: We do not service United States entities or residents.” Brokers have questioned the role of regulators when trying to impose rules against firms authorised under another authority, the US has been prominent in its targeting of misbehaving firms however the implications of non-compliance are unclear. The key question is what powers the regulator has in enforcing its rules!